Answered step by step

Verified Expert Solution

Question

1 Approved Answer

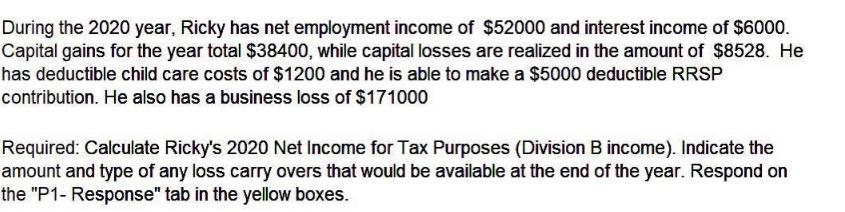

During the 2020 year, Ricky has net employment income of $52000 and interest income of $6000. Capital gains for the year total $38400, while

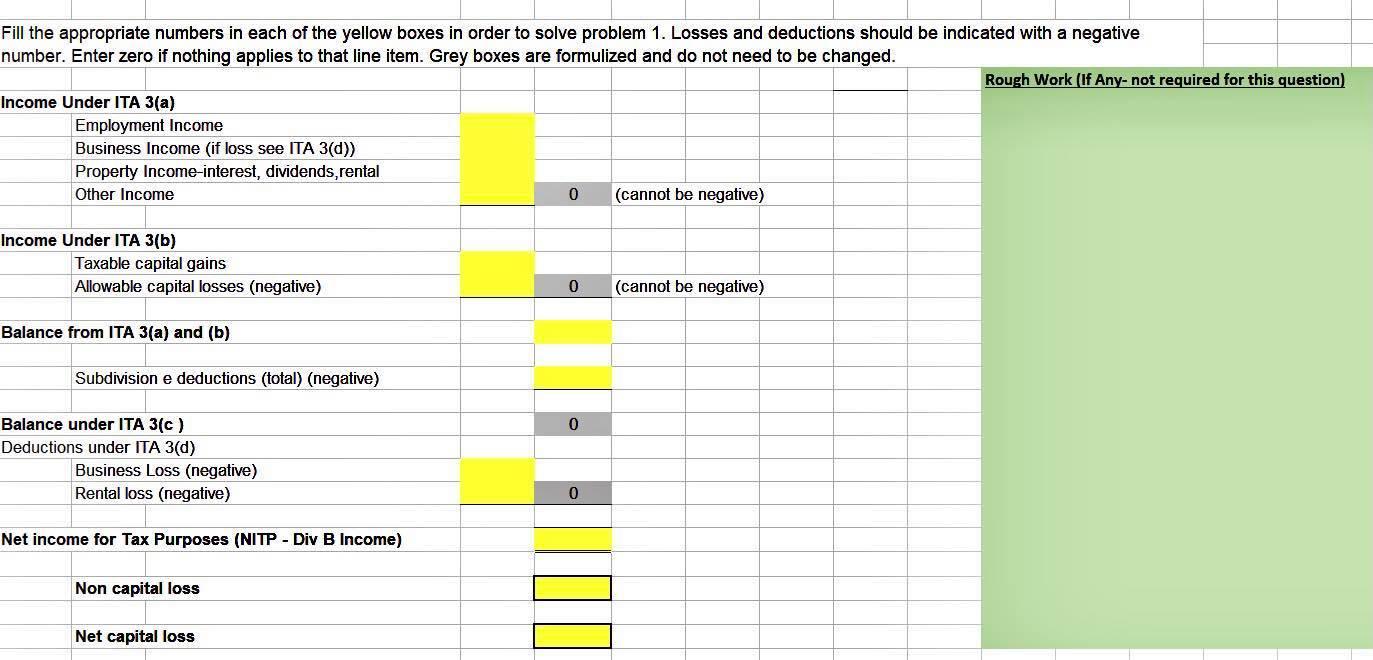

During the 2020 year, Ricky has net employment income of $52000 and interest income of $6000. Capital gains for the year total $38400, while capital losses are realized in the amount of $8528. He has deductible child care costs of $1200 and he is able to make a $5000 deductible RRSP contribution. He also has a business loss of $171000 Required: Calculate Ricky's 2020 Net Income for Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the year. Respond on the "P1- Response" tab in the yellow boxes. Fill the appropriate numbers in each of the yellow boxes in order to solve problem 1. Losses and deductions should be indicated with a negative number. Enter zero if nothing applies to that line item. Grey boxes are formulized and do not need to be changed. Income Under ITA 3(a) Employment Income Business Income (if loss see ITA 3(d)) Property Income-interest, dividends, rental Other Income Income Under ITA 3(b) Taxable capital gains Allowable capital losses (negative) Balance from ITA 3(a) and (b) Subdivision e deductions (total) (negative) Balance under ITA 3(c) Deductions under ITA 3(d) Business Loss (negative) Rental loss (negative) Net income for Tax Purposes (NITP - Div B Income) Non capital loss Net capital loss 0 0 0 0 (cannot be negative) (cannot be negative) Rough Work (If Any- not required for this question)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate Rickys 2020 Net Income for Tax Purposes Division B income and determine any lo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started