Question

During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) Capital Asset

During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.)

| Capital Asset | Market Value | Tax Basis | Holding Period | ||

| L stock | $ | 54,400 | $ | 43,200 | > 1 year |

| M stock | 32,400 | 41,200 | > 1 year | ||

| N stock | 34,400 | 24,200 | |||

| O stock | 30,400 | 35,200 | |||

| Antiques | 11,400 | 6,200 | > 1 year | ||

| Rental home | 304,400* | 92,200 | > 1 year | ||

*$30,000 of the gain is 25 percent gain (from accumulated depreciation on the property).

Ignore the Net Investment Income Tax.

Ignore the Net Investment Income Tax.

a. Given that Ron and Anne have taxable income of only $24,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2018 assuming they file a joint return?

b. Given that Ron and Anne have taxable income of $404,400 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2018 assuming they file a joint return?

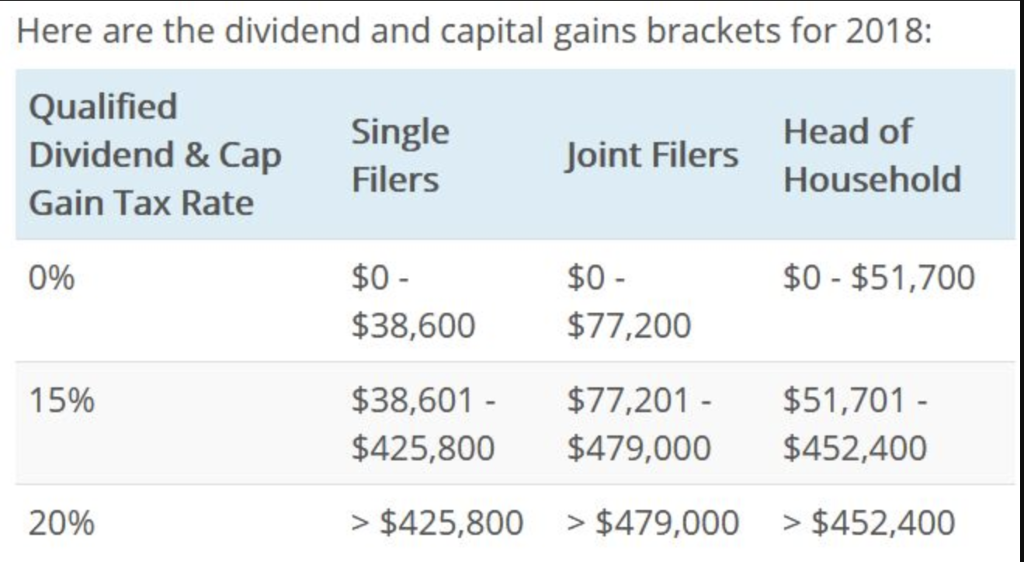

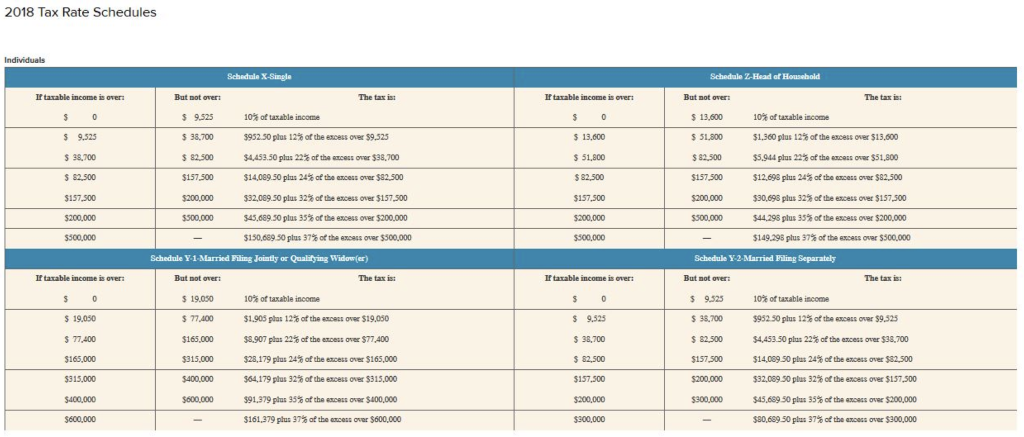

Here are the dividend and capital gains brackets for 2018: Qualified Dividend & Cap Gain Tax Rate Head of Single Filers Joint Filers Household 0% $0 $38,600 $0 $77,200 $0 $51,700 15% $38,601 $425,800 $479,000 $452,400 $77,201 $51,701 20% > $425,800 >$479,000 >$452,400 2018 Tax Rate Schedules Schedule X-Single Schedule Z-Head of Household If tarable income is over But not over The tax is If tatable income is over But not over The tax is $ 9.525 5 38,700 3 82,500 $157,500 $200,000 9.525 38,700 82.500 $157,500 10% of taxable income $952.50 plus 12% of the excess over $9,525 S4A53.50 plus 22% of th mess over $38,700 $14,009.50 plus 24% of the mess over S82500 $32,069.50 plus 32% of the excess over $157,500 $45.689.50 plus 35% of the excess over $200,000 $150,669 50 plus 37% of the excess over $500,000 13,600 51,800 82,500 $157,500 $200,000 13,600 51.800 $ 82.500 $157 500 $200,000 $500,000 10% of taxable income $1.360 plus 12% of the excess over $13,000 $5.944 plus 22% of the excess over $51,500 $12,696 plus 24% of the mass ovee$82,500 $30,698 plus 32% of the excess over $157,500 $44,298 plus 35% of the excess over S200.000 $149,296 plus 37% of the excess over $500,000 $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widor(er) Schedule Y-2-Married Filing Separately trable income ier: The tax is The tax is But not over S 19.050 77,400 $165,000 $315,000 If tatable income is over But not over 5 19.050 3 77,400 $165,000 $315,000 10% of taxable income $1,905 plus 12% of the eme" over $19,000 sa.907 plus 22% of the eme" over $77,400 $28,179 plus 24% of the excess over $165,000 S4.1 79 plus 32% of the excess over S315.000 $91,379 plus 35% of the emess over $400,000 $161,379 plus 37% of the coce" ouer S600,000 $ 9.525 38,700 82,500 $157,500 5200,000 300,000 $ 9.525 $ 38,700 S 82500 $157500 10% of taxable iscome $95250 plus 12% of the e ness over S9.525 $4,453.50 pa 22% ofthe ence" over $38,700 $14,009.50 plus 24% of the ence" over $62,500 $32.08 950 plus 32% of the ence" over $157,500 $45,689 50 plus35% of theme" over $200,000 sso,689.50 plus 37% of the "cess over $300,000 300,000 600,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started