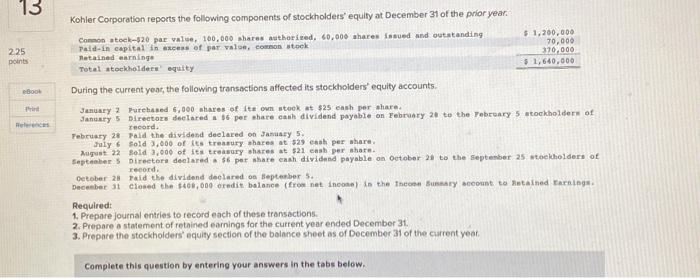

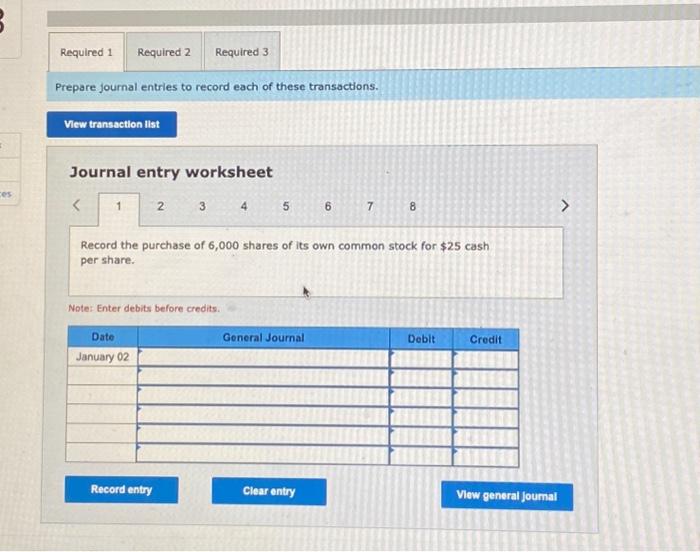

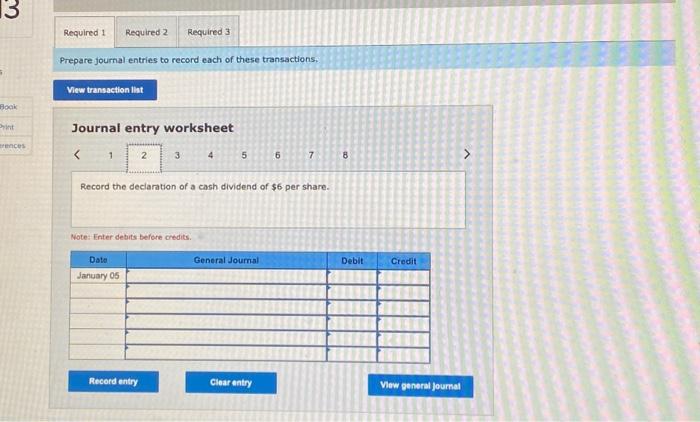

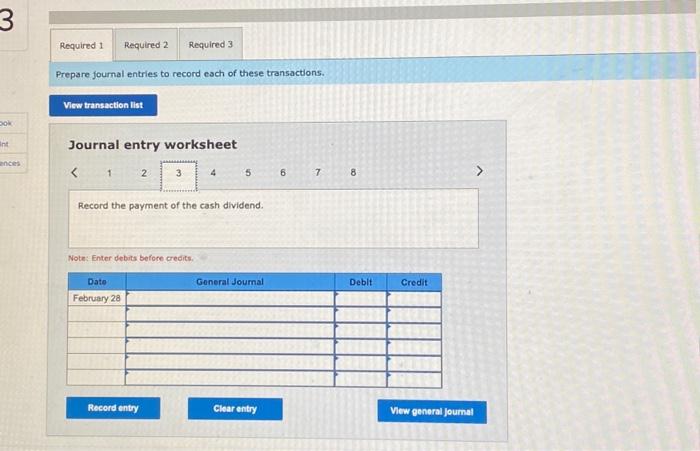

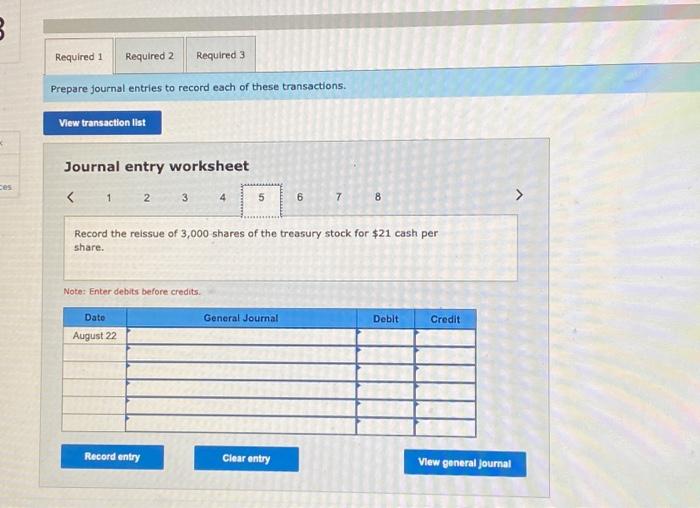

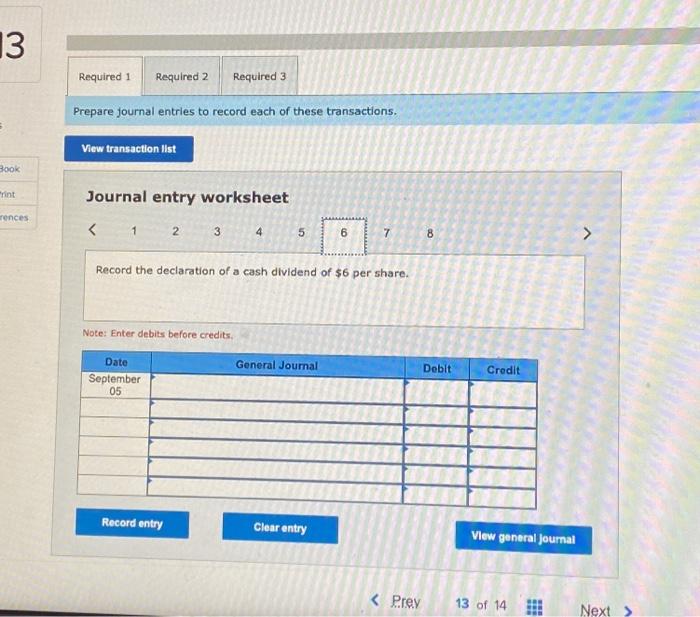

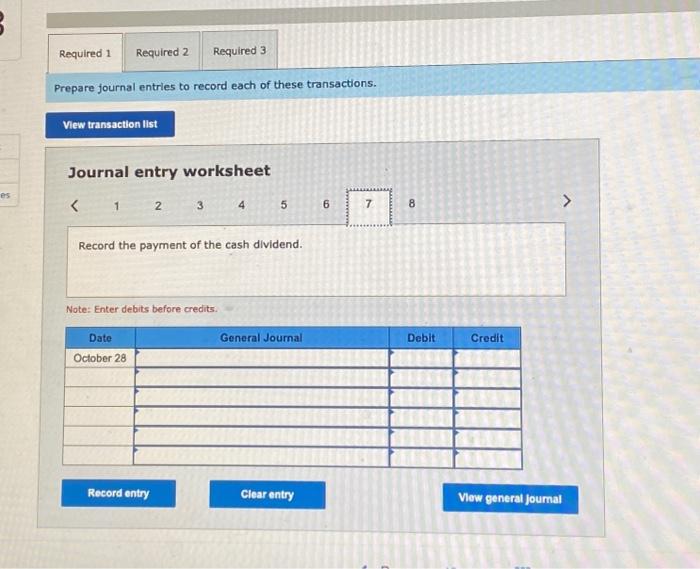

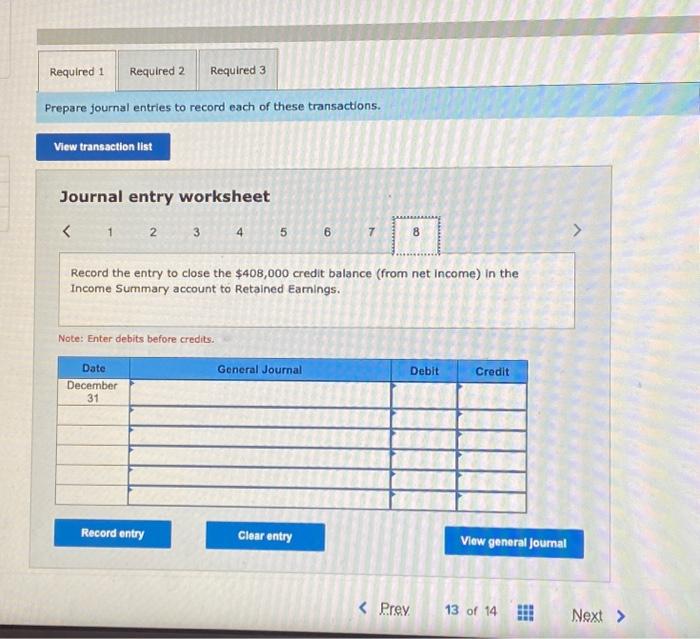

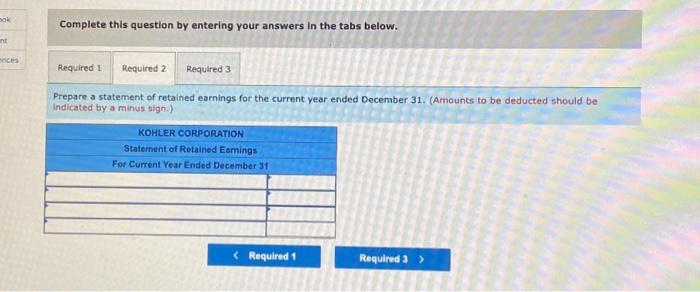

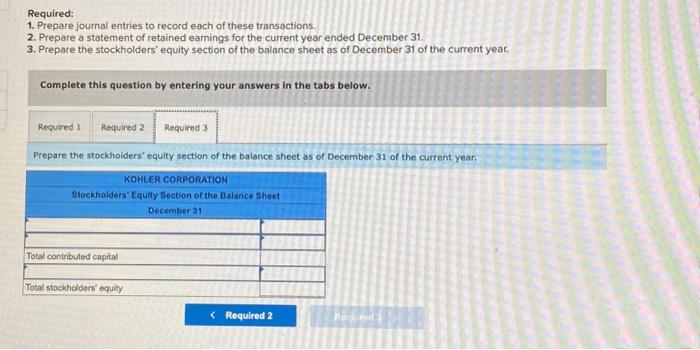

During the current yoar, the following transactions affected its stockhoiders equity accounts. January 2 Purehased 6,000 shares of ita own stook at 525 eash per share. January 5 pirectors deelared a if per share canh dividend payoble on Febranry 20 to the Fabreary 5 ntockholdern of record. February 28 Taid the dividend deelared on Jasuary 5. thaly 6 sold 3,000 of its treatury nhares at s29 enah per ahare. Muguat 22 sold 3,000 of ita treasury shares at 521 enat per athare. septanee.5 pireetora declared a 56 per nhare enah dividend payable on october 21 to the septenber 25 stoeldholdern of. record. Oecober 28 Paid tbe dividend deolared on Beptenber 5 . Requiredt 1. Prepare joumal entries to record each of these transactions. 2. Prepare a statement of retnined earnings for the current year ended December 31 , 3. Prepare the stockholders' equity section of the bolance sheet as of December 31 of the current yeat. Prepare journal entries to record each of these transactions. Journal entry worksheet 678 Record the purchase of 6,000 shares of its own common stock for $25 cash per share. Note: Enter debits before credits. Prepare journal entries to record each of these transactions. Journal entry worksheet 4567 Record the declaration of a cash dividend of $6 per share. Note: Enter debits before credits. Journal entry worksheet 4567 Record the payment of the cash dividend. Note: Enter debits before credits. Journal entry worksheet Record the reissue of 3,000 shares of the treasury stock for $29 cash per share. Note: Enter debits before credits. Prepare journal entries to record each of these transactions. Journal entry worksheet Record the reissue of 3,000 shares of the treasury stock for $21 cash per share. Note: Enter debits before credits. Prepare journal entries to record each of these transactions. Journal entry worksheet Record the declaration of a cash dividend of $6 per share. Note: Enter debits before credits. Prepare fournal entries to record each of these transactions. Journal entry worksheet Record the payment of the cash dividend. Note: Enter debits before credits. Prepare journal entries to record each of these transactions. Journal entry worksheet