Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the end-of-period physical inventory count some of the inventory was not counted. This caused ending inventory to be understated (too low) by $18,000.

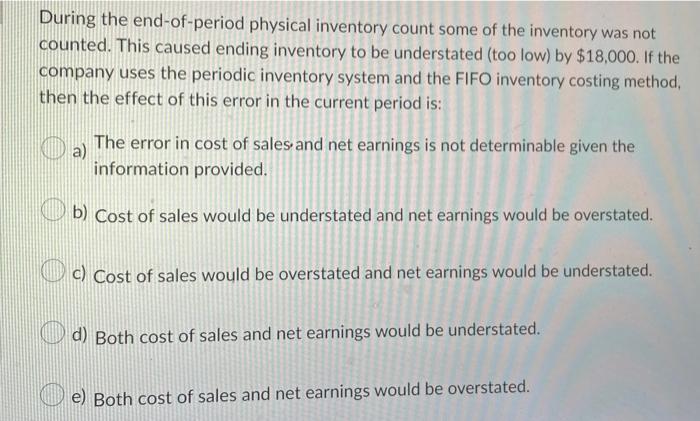

During the end-of-period physical inventory count some of the inventory was not counted. This caused ending inventory to be understated (too low) by $18,000. If the company uses the periodic inventory system and the FIFO inventory costing method, then the effect of this error in the current period is: a) The error in cost of sales and net earnings is not determinable given the information provided. b) Cost of sales would be understated and net earnings would be overstated. c) Cost of sales would be overstated and net earnings would be understated. d) Both cost of sales and net earnings would be understated. e) Both cost of sales and net earnings would be overstated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Option B Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started