Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mayweather Auto Inc. (Mayweather) sold a new limited-edition SUV to Frakes Ltd. (Frakes) on June 1, for $170,000. The SUV has a normal selling

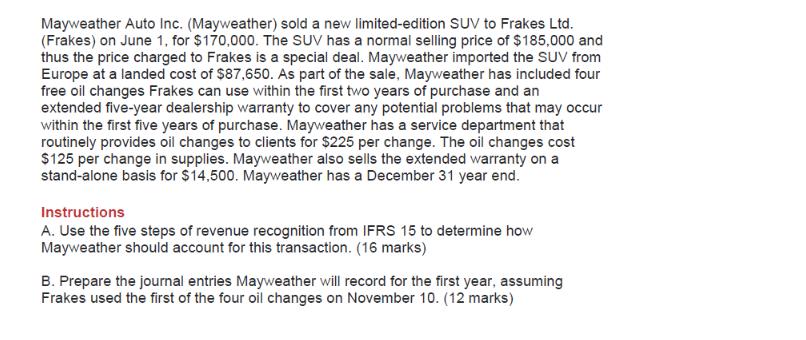

Mayweather Auto Inc. (Mayweather) sold a new limited-edition SUV to Frakes Ltd. (Frakes) on June 1, for $170,000. The SUV has a normal selling price of $185,000 and thus the price charged to Frakes is a special deal. Mayweather imported the SUV from Europe at a landed cost of $87,650. As part of the sale, Mayweather has included four free oil changes Frakes can use within the first two years of purchase and an extended five-year dealership warranty to cover any potential problems that may occur within the first five years of purchase. Mayweather has a service department that routinely provides oil changes to clients for $225 per change. The oil changes cost $125 per change in supplies. Mayweather also sells the extended warranty on a stand-alone basis for $14,500. Mayweather has a December 31 year end. Instructions A. Use the five steps of revenue recognition from IFRS 15 to determine how Mayweather should account for this transaction. (16 marks) B. Prepare the journal entries Mayweather will record for the first year, assuming Frakes used the first of the four oil changes on November 10. (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Revenue Recognition Steps from IFRS 15 for Mayweather Auto Inc and Frakes Ltd transaction 1 Identi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started