Question

During the financial year ended 30th June 2019, Milk Park Ltd received rental revenue of 38,500 which relates to the following financial year. The related

During the financial year ended 30th June 2019, Milk Park Ltd received rental revenue of 38,500 which relates to the following financial year. The related revenue is taxable by the ATO when the amounts are received.

2. All administration and salaries expenses incurred have been paid except for $28,200 accrued wages and salaries as at year end. Wages and salaries expense are deductible for tax purposes when paid.

3. The warranty expenses incurred during the period remained unpaid as at year end. Warranty expenses are allowed for deduction when paid for tax purposes.

4. Out of $55,000 incurred as expense for long service leave, only $40,000 had been paid as at year end. This is allowed for deduction only when actually paid.

5. Only bad debts are allowed as deductibles for tax purposes.

6. Insurance expense charged for the period represents the portion of the total prepaid amount which had been used during the year. $31,700 of the prepaid amounts has not been used as at year end. Insurance expenses are deductible when paid.

7. The plant and machinery are depreciated over six (6) years for accounting purposes while its useful life is estimated to be four (4) years for tax purposes.

8. The applicable tax rate for Milk Park Ltd is 30%

9. Land had an initial cost price of $100,000 before it was revalued to its fair value at end year.

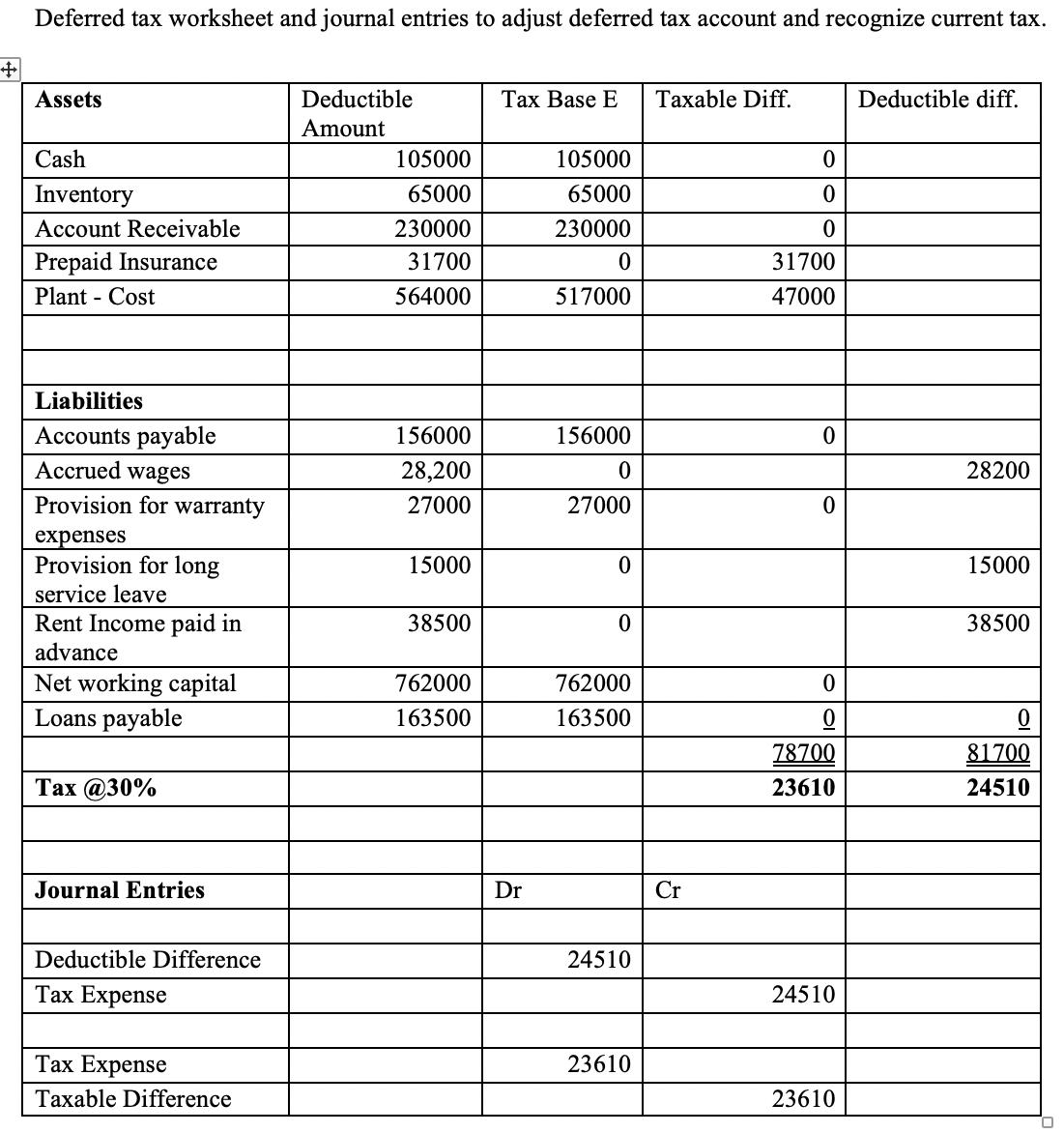

+ Deferred tax worksheet and journal entries to adjust deferred tax account and recognize current tax. Assets Cash Inventory Account Receivable Prepaid Insurance Plant - Cost Liabilities Accounts payable Accrued wages Provision for warranty expenses Provision for long service leave Rent Income paid in advance Net working capital Loans payable Tax @30% Journal Entries Deductible Difference Tax Expense Tax Expense Taxable Difference Deductible Amount 105000 65000 230000 31700 564000 156000 28,200 27000 15000 38500 762000 163500 Tax Base E Taxable Diff. Dr 105000 65000 230000 0 517000 156000 0 27000 0 0 762000 163500 24510 23610 Cr 0 0 0 31700 47000 0 0 0 0 78700 23610 24510 23610 Deductible diff. 28200 15000 38500 0 81700 24510 U

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Deferred Tax Worksheet Wages and salaries expense Accrued wages of 28200 Taxable Difference 0 alread...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started