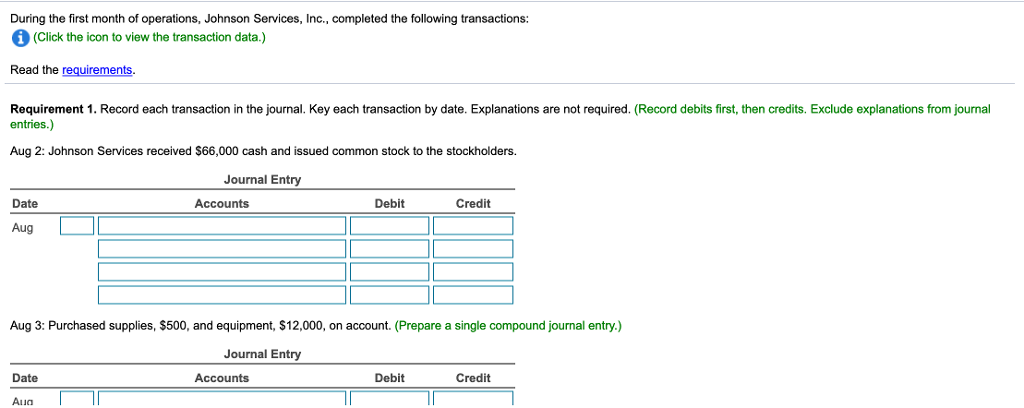

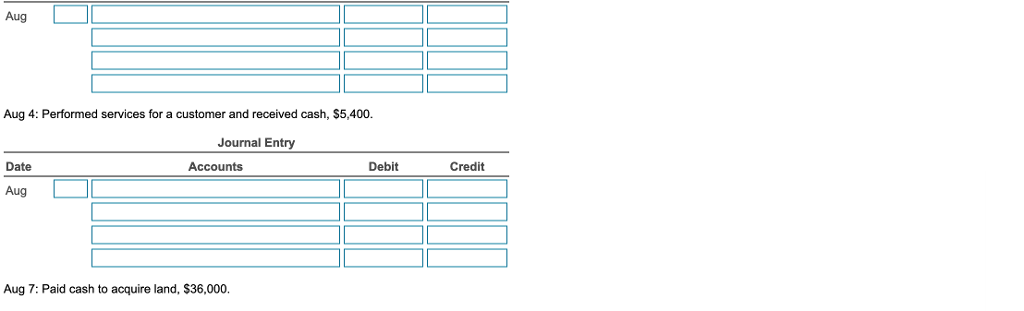

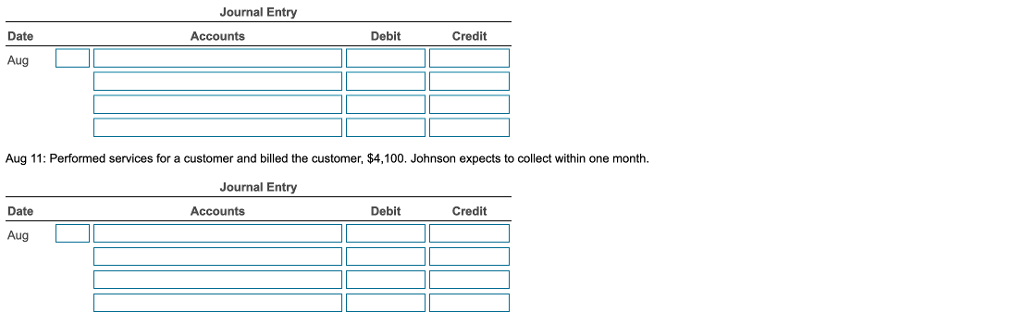

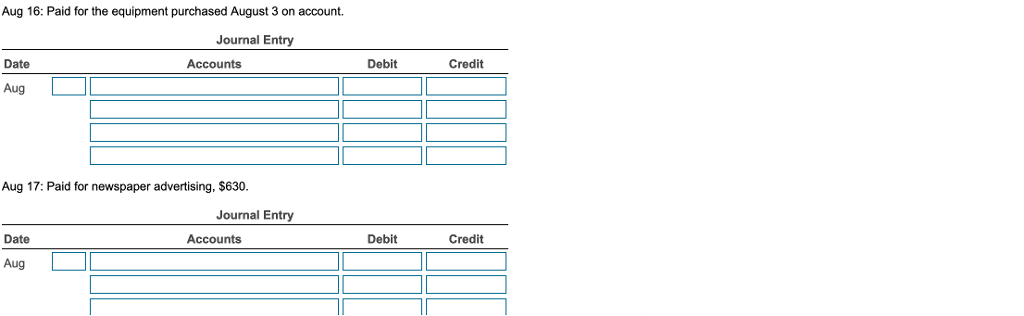

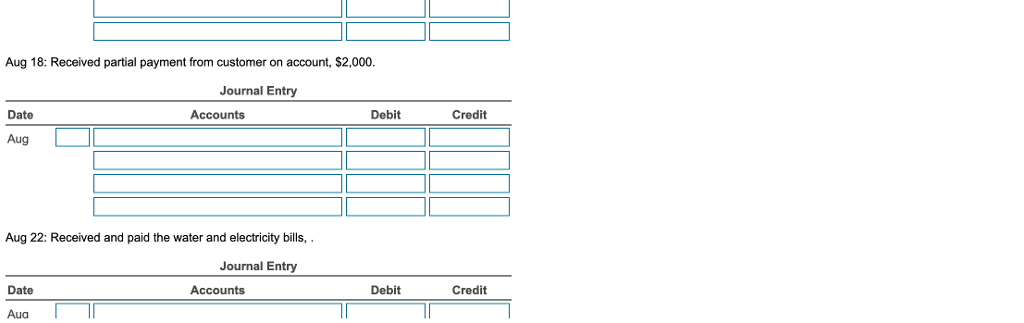

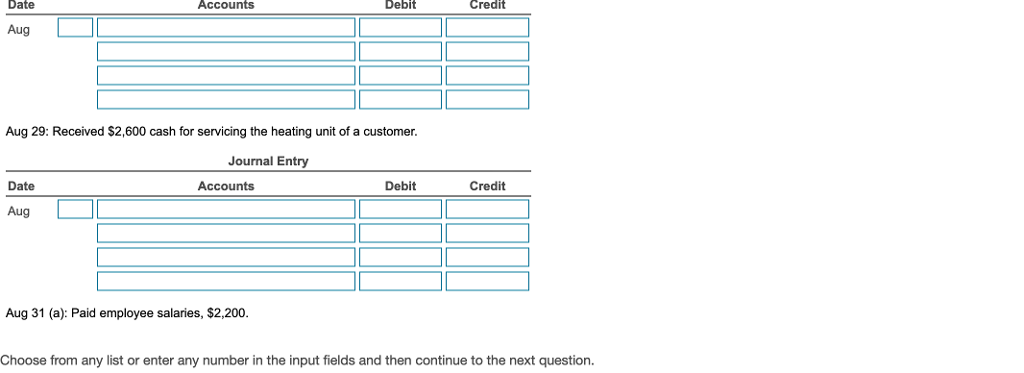

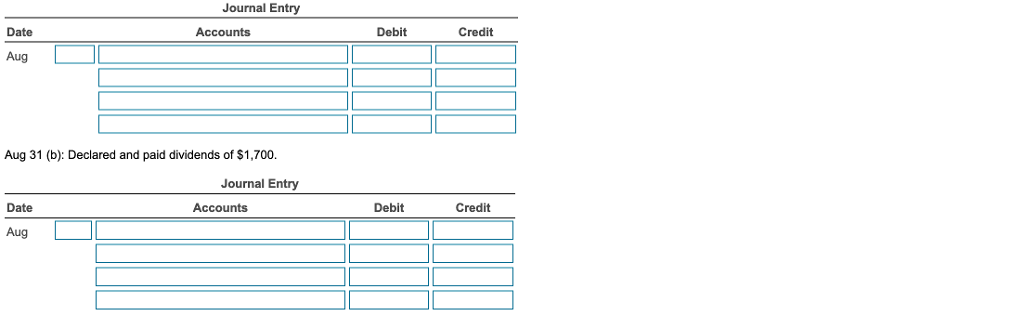

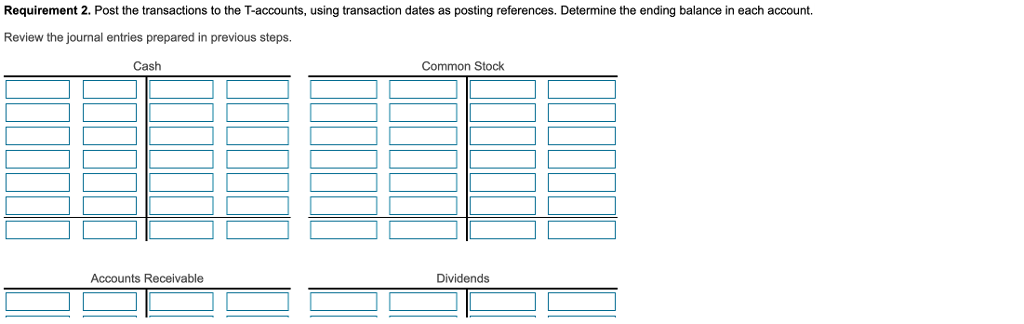

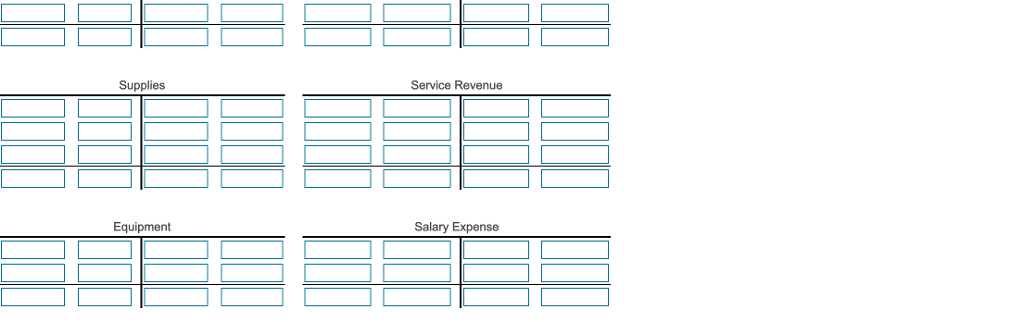

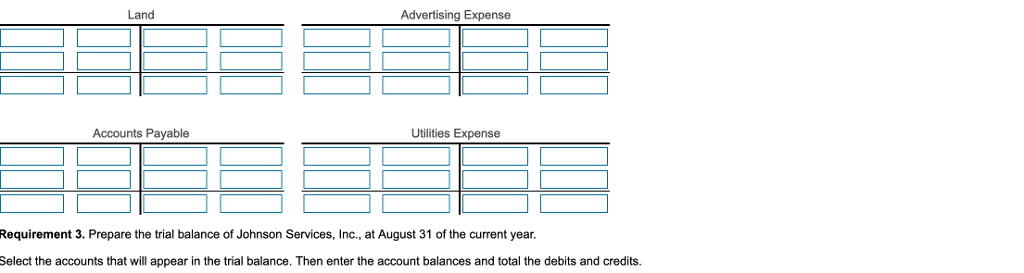

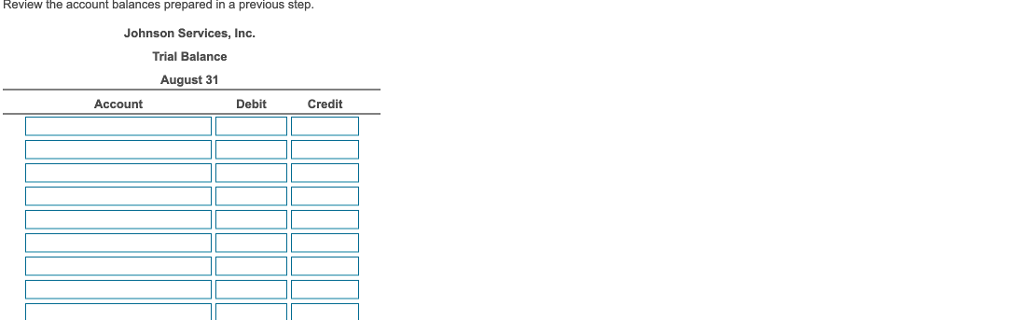

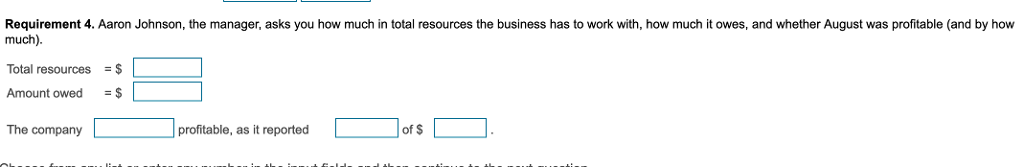

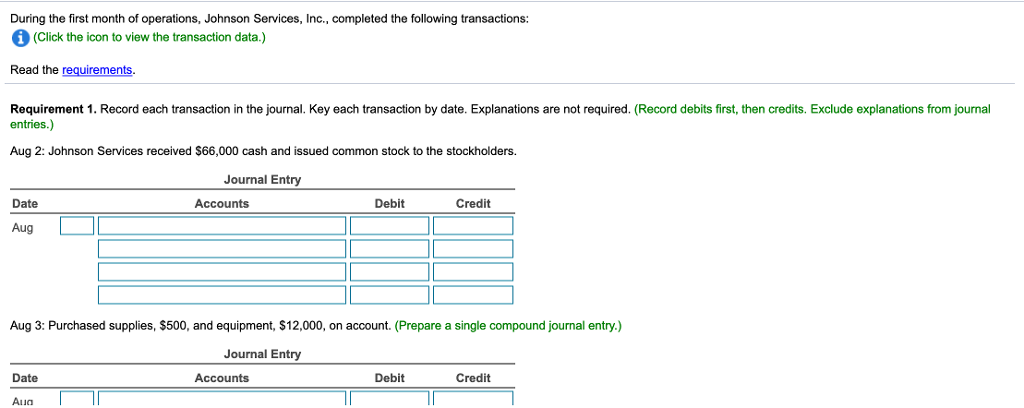

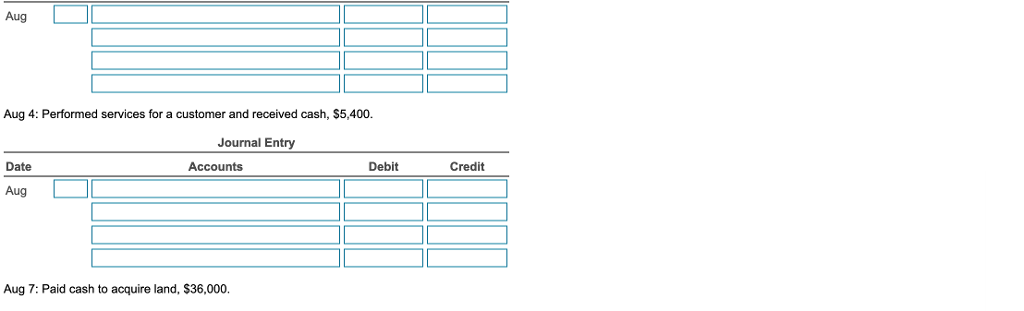

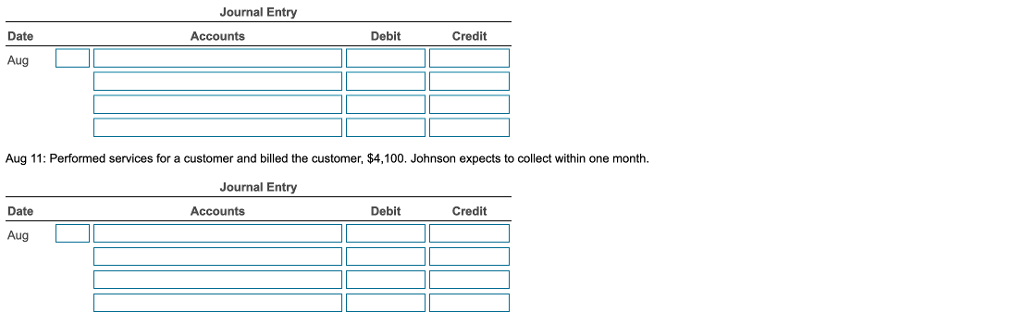

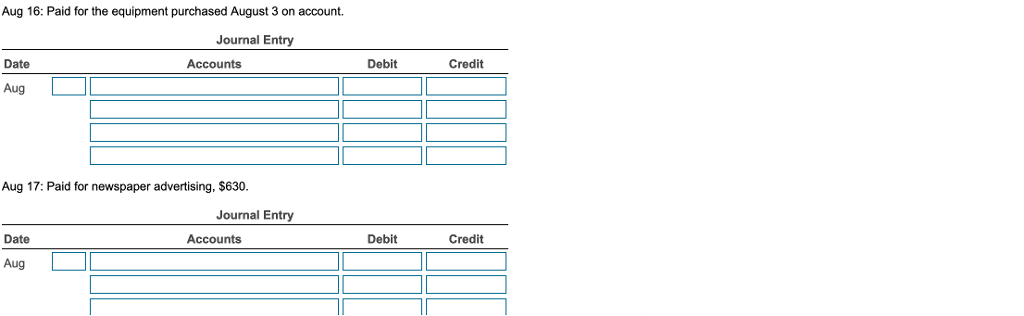

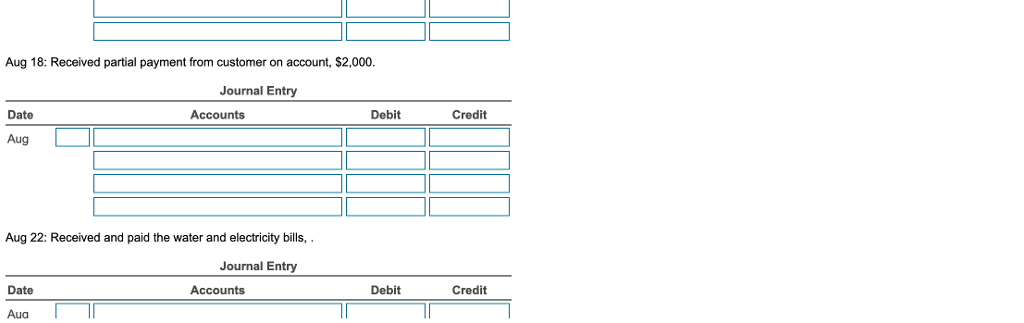

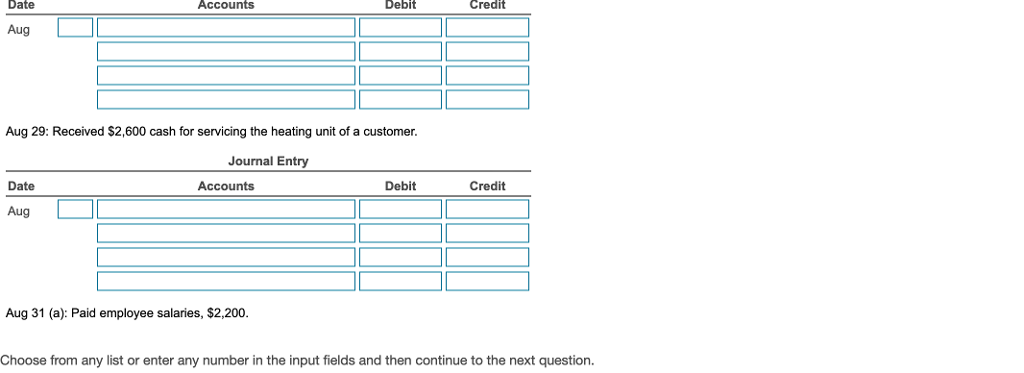

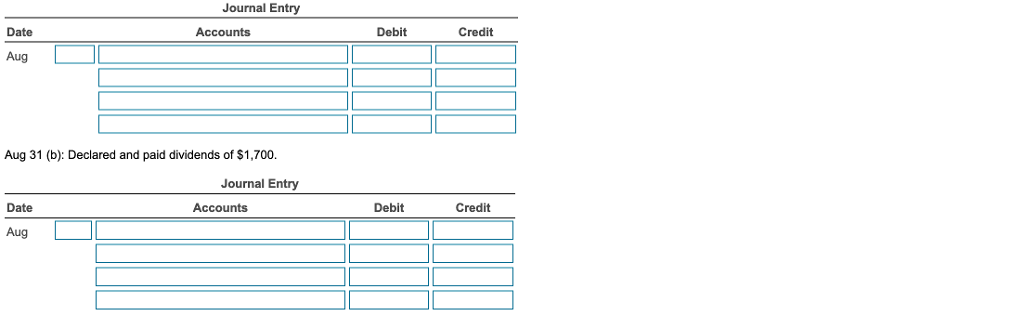

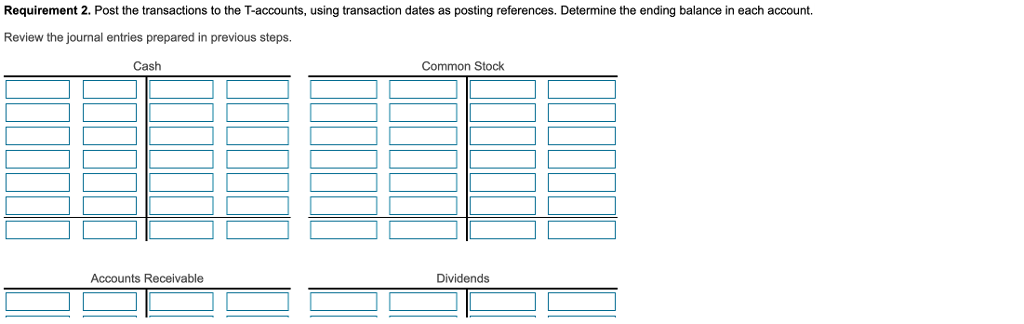

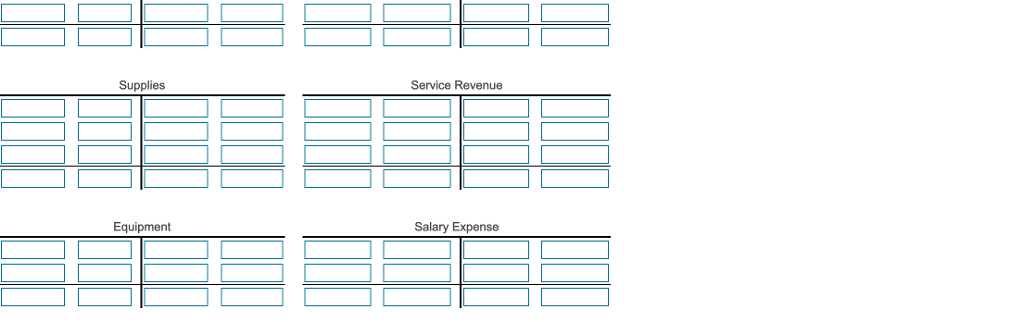

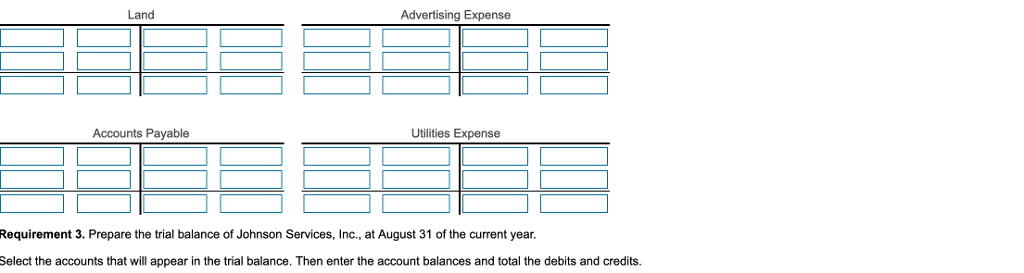

During the first month of operations, Johnson Services, Inc., completed the following transactions: (Click the icon to view the transaction data.) Read the requirements Requirement 1. Record each transaction in the journal. Key each transaction by date. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Aug 2: Johnson Services received $66,000 cash and issued common stock to the stockholders. Journal Entry Date Accounts Debit Credit Aug Aug 3: Purchased supplies, $500, and equipment, $12,000, on account. (Prepare a single compound journal entry.) Journal Entry Date Accounts Debit Credit Aua Aug Aug 4: Performed services for a customer and received cash, $5,400 Journal Entry Date Accounts Debit Credit Aug Aug 7: Paid cash to acquire land, $36,000. Journal Entry Date Accounts Debit Credit Aug Aug 11: Performed services for a customer and billed the customer, $4,100. Johnson expects to collect within one month Journal Entry Date Accounts Debit Credit Aug Aug 16: Paid for the equipment purchased August 3 on account. Journal Entry Date Accounts Debit Credit Aug Aug 17: Paid for newspaper advertising, $630. Journal Entry Date Accounts Debit Credit Aug Aug 18: Received partial payment from customer on account, $2,000 Journal Entry Date Accounts Debit Credit Aug Aug 22: Received and paid the water and electricity bills, Journal Entry Date Accounts Debit Credit Aua Date Accounts Debit Credit Aug Aug 29: Received $2,600 cash for servicing the heating unit of a customer Journal Entry Date Accounts Debit Credit Aug Aug 31 (a): Paid employee salaries, $2,200. Choose from any list or enter any number in the input fields and then continue to the next question Journal Entry Date Accounts Debit Credit Aug Aug 31 (b): Declared and paid dividends of $1,700 Journal Entry Date Accounts Debit Credit Aug Requirement 2. Post the transactions to the T-accounts, using transaction dates as posting references. Determine the ending balance in each account. Review the journal entries prepared in previous steps. Cash Common Stock Accounts Receivable Dividends Supplies Service Revenue Equipment Salary Expense Land Advertising Expense Accounts Payable Utilities Expense Requirement 3. Prepare the trial balance of Johnson Services, Inc., at August 31 of the current year. Select the accounts that will appear in the trial balance. Then enter the account balances and total the debits and credits Review the account balances prepared in a previous step Johnson Services, Inc. Trial Balance August 31 Account Debit Credit Total Requirement 4. Aaron Johnson, the manager asks you how much n to a resources much) e business has to work with how much it o ves, and whethe August as profitable and yhow Requirement 4. Aaron Johnson, the manager, asks you how much in total resources the business has to work with, how much it owes, and whether August was profitable (and by how much) Total resources$ Amount owed$ The company profitable, as it reported of S