Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the first month of operations, the following transactions occurred for Sheridan Inc.: Apr. 1 Invested cash of $8,000 and equipment of $6,500 in the

During the first month of operations, the following transactions occurred for Sheridan Inc.:

| Apr. | 1 | Invested cash of $8,000 and equipment of $6,500 in the company in exchange for common shares. | |

| 1 | Hired a secretary-receptionist at a monthly salary of $1,800. | ||

| 2 | Paid office rent for the month, $900. | ||

| 3 | Purchased architectural supplies on account from Halo Ltd., $1,800. | ||

| 10 | Completed blueprints on a carport and billed client $1,300. | ||

| 13 | Received $800 cash advance from a client for the design of a new home. | ||

| 20 | Received $2,000 for services performed for a client. | ||

| 21 | Received $600 from client in partial payment for work completed and billed on April 10. | ||

| 23 | Received Aprils telephone bill for $135; due May 15. (Hint: Use the Utilities Expense account for telephone services.) | ||

| 25 | Declared and paid $120 of dividends to shareholders. | ||

| 27 | Paid 50% ($900) of the amount owed to Halo Ltd. on account. (see April 3 transaction) | ||

| 30 | Paid secretary-receptionist for the month, $1,800. | ||

| 30 | Paid monthly income tax instalment, $100. |

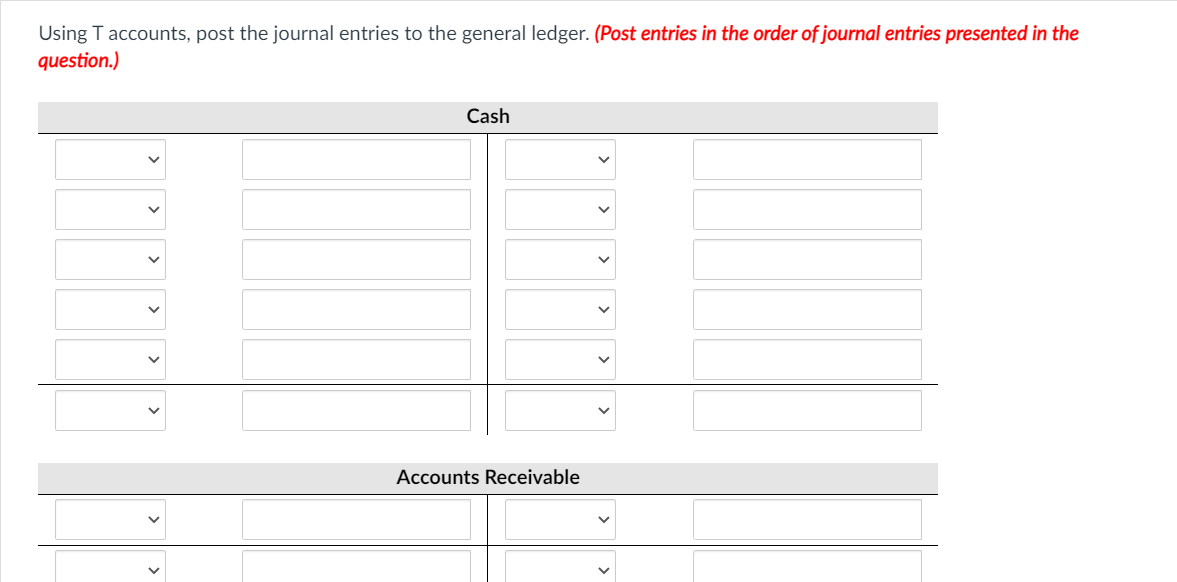

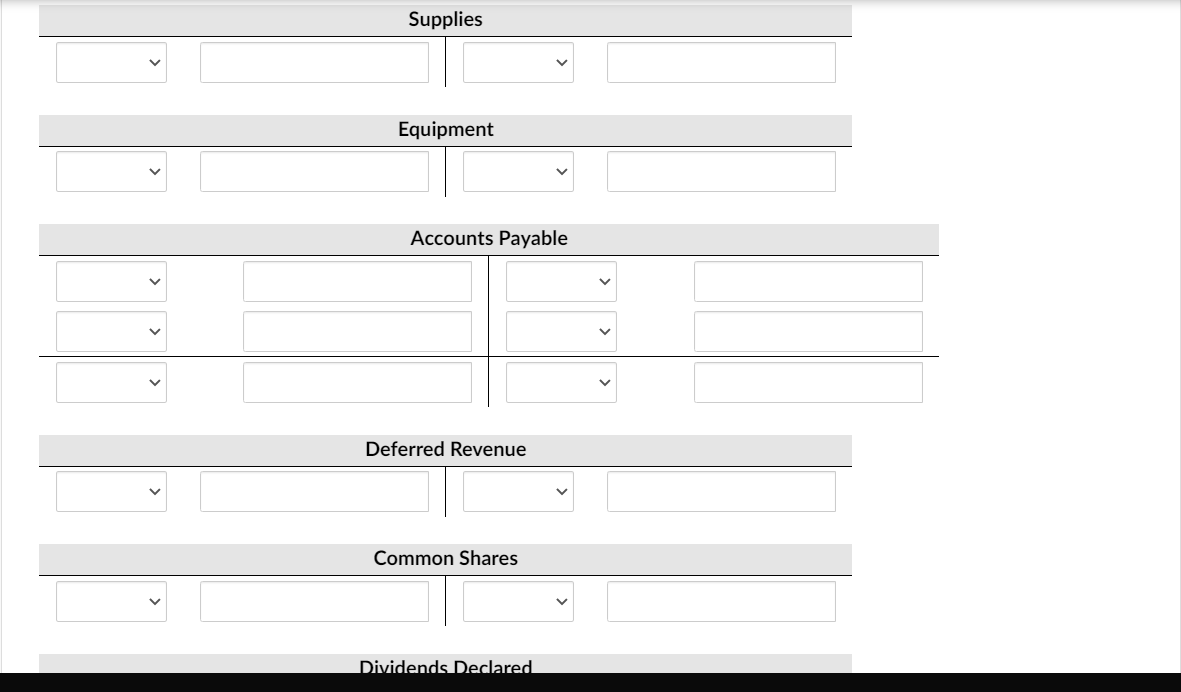

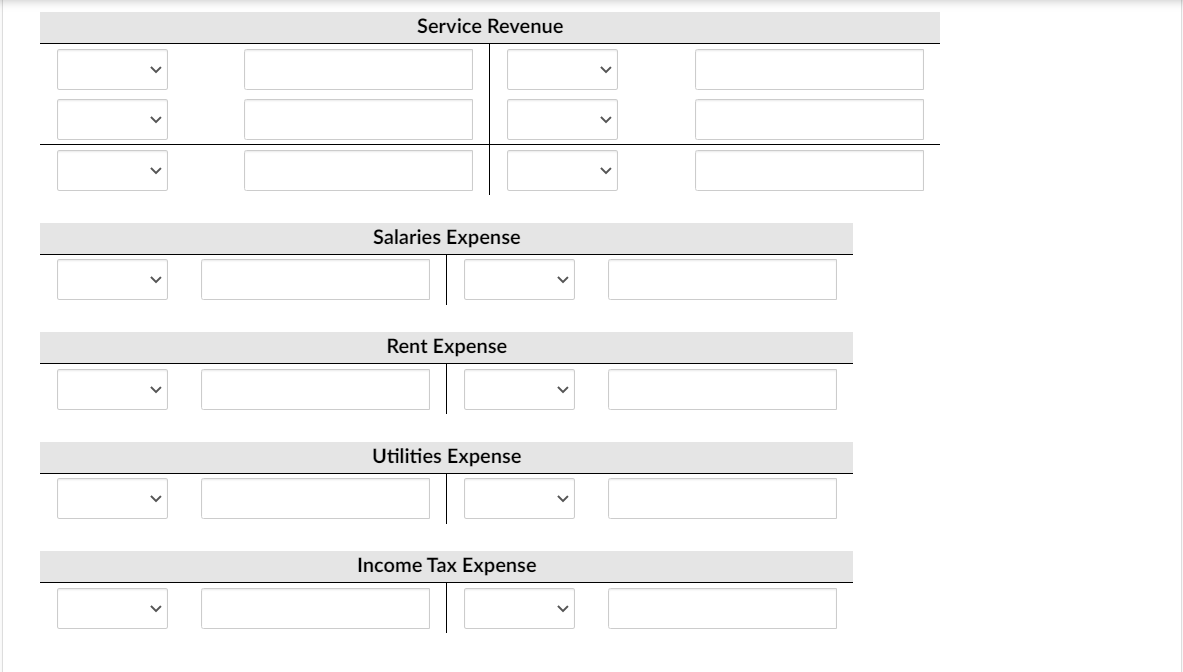

Using T accounts, post the journal entries to the general ledger. (Post entries in the order of journal entries presented in the question.)

Using T accounts, post the journal entries to the general ledger. (Post entries in the order of journal entries presented in the question.) Cash Accounts Receivable Supplies are Equipment Accounts Payable Deferred Revenue Common Shares Dividends Declared Service Revenue Salaries Expense Rent Expense Utilities Expense Income Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started