Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the first month of operations, the following transactions occurred for Cullumber Bookkeeping and Tax Services Inc.: Jan. 1 Shareholders invested cash of $16,800

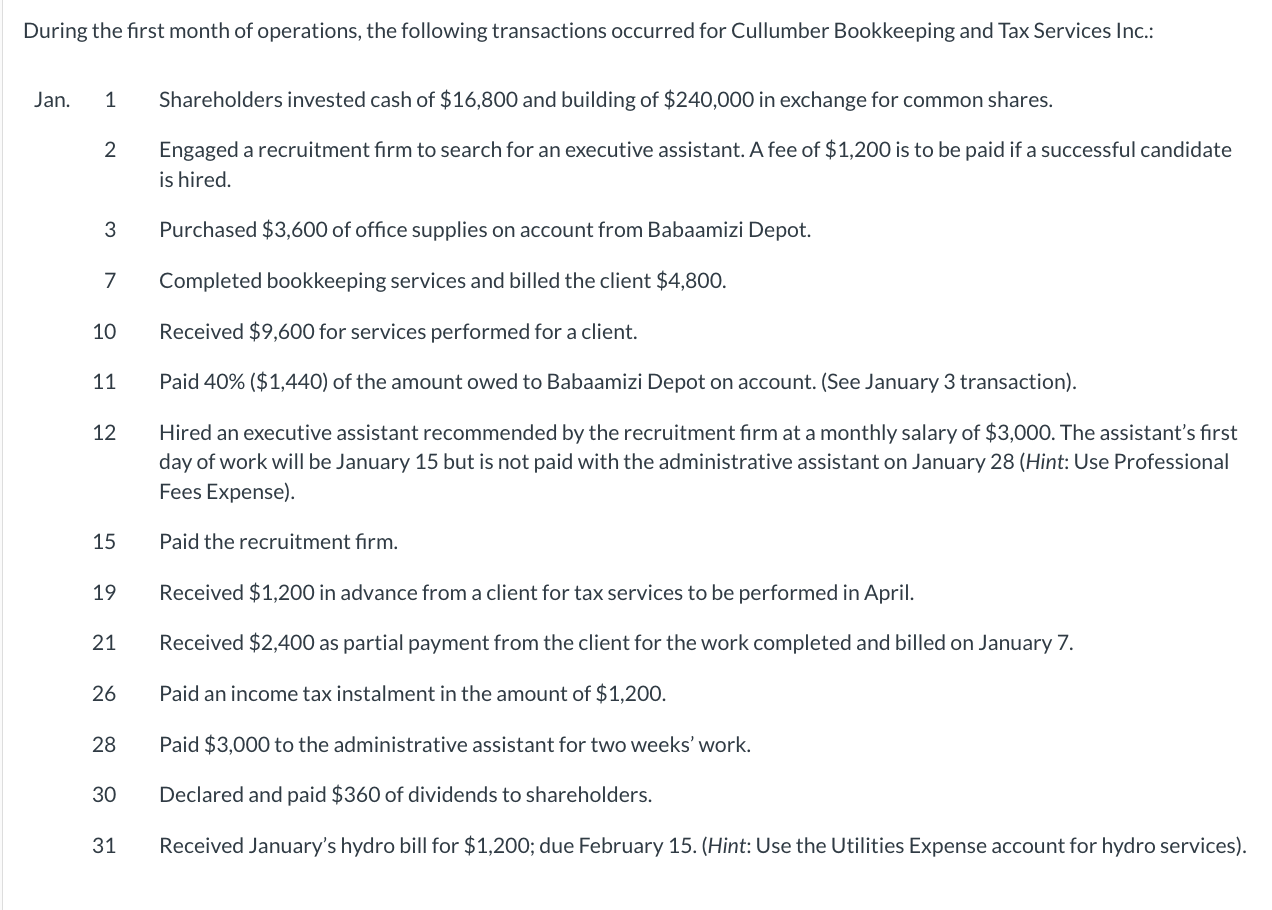

During the first month of operations, the following transactions occurred for Cullumber Bookkeeping and Tax Services Inc.: Jan. 1 Shareholders invested cash of $16,800 and building of $240,000 in exchange for common shares. 2 Engaged a recruitment firm to search for an executive assistant. A fee of $1,200 is to be paid if a successful candidate is hired. 3 Purchased $3,600 of office supplies on account from Babaamizi Depot. 7 Completed bookkeeping services and billed the client $4,800. 10 Received $9,600 for services performed for a client. 11 Paid 40% ($1,440) of the amount owed to Babaamizi Depot on account. (See January 3 transaction). 12 Hired an executive assistant recommended by the recruitment firm at a monthly salary of $3,000. The assistant's first day of work will be January 15 but is not paid with the administrative assistant on January 28 (Hint: Use Professional Fees Expense). 15 19 Paid the recruitment firm. Received $1,200 in advance from a client for tax services to be performed in April. 21 Received $2,400 as partial payment from the client for the work completed and billed on January 7. 26 26 Paid an income tax instalment in the amount of $1,200. 28 Paid $3,000 to the administrative assistant for two weeks' work. 30 Declared and paid $360 of dividends to shareholders. 31 Received January's hydro bill for $1,200; due February 15. (Hint: Use the Utilities Expense account for hydro services).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started