Answered step by step

Verified Expert Solution

Question

1 Approved Answer

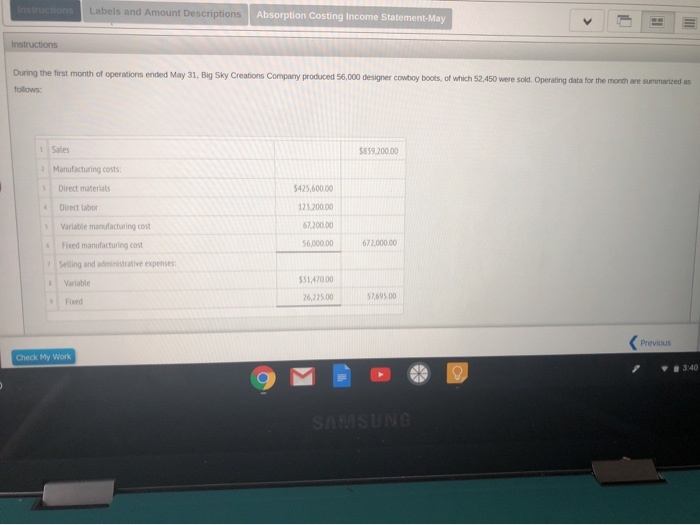

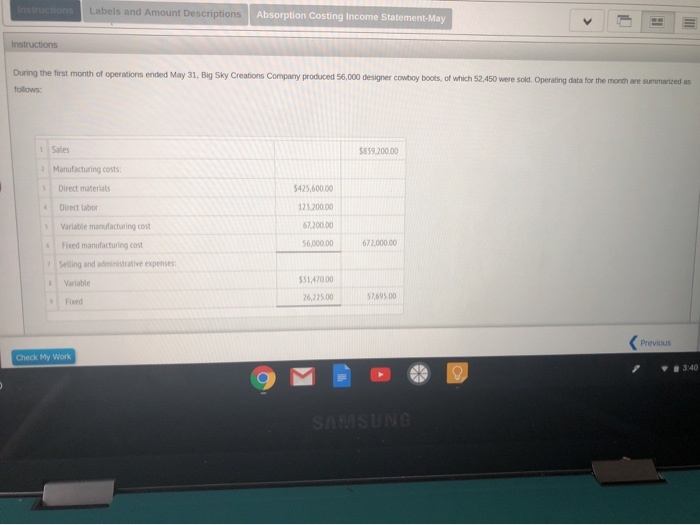

During the first of the month of operations ended May 31, Big Sky Creations Company Labels and Amount Descriptions Instructions Absorption Costing Income Statement-May Instructions

During the first of the month of operations ended May 31, Big Sky Creations Company

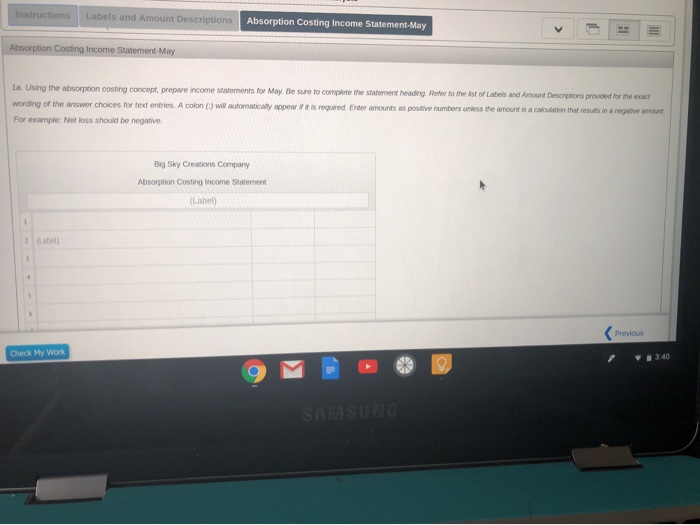

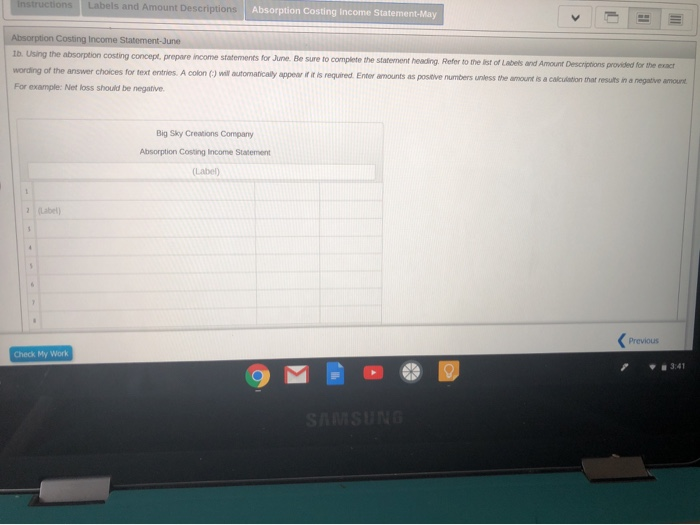

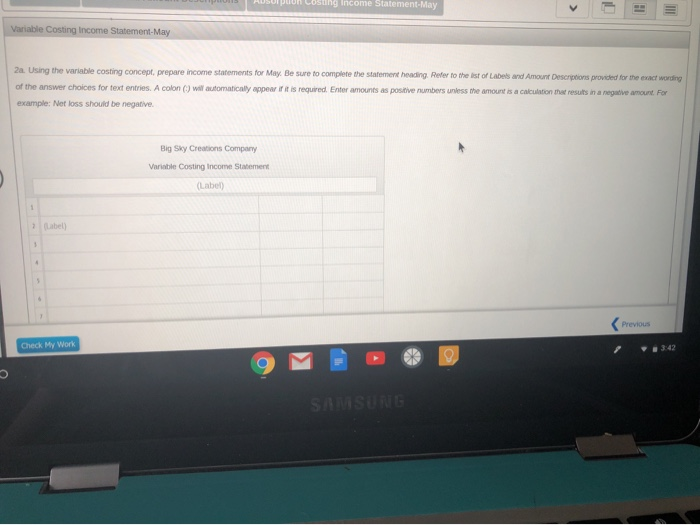

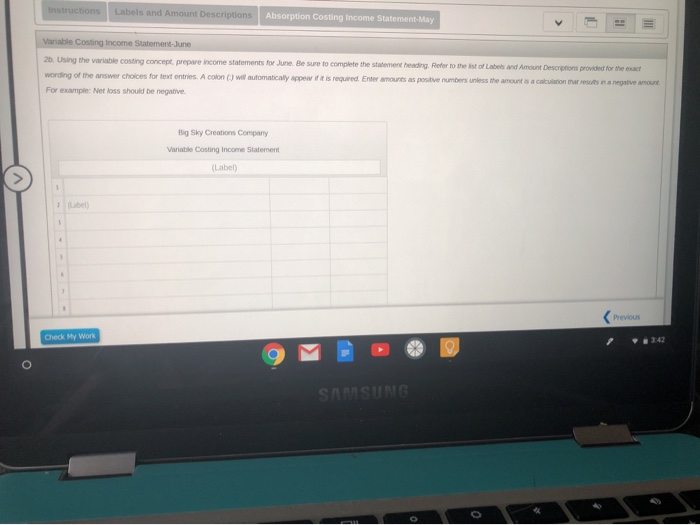

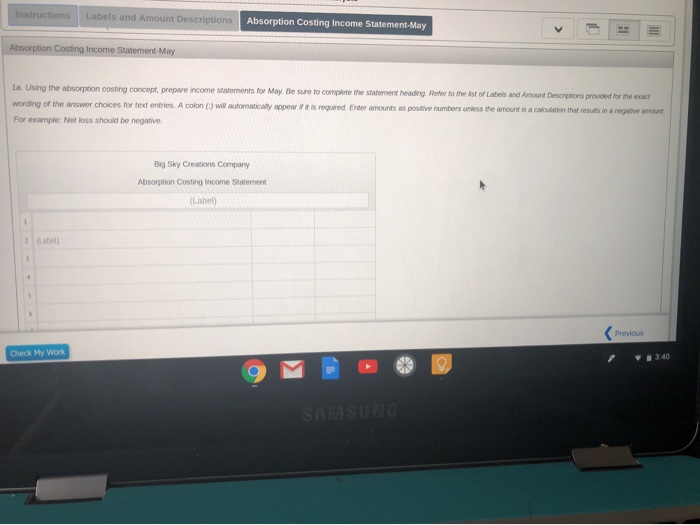

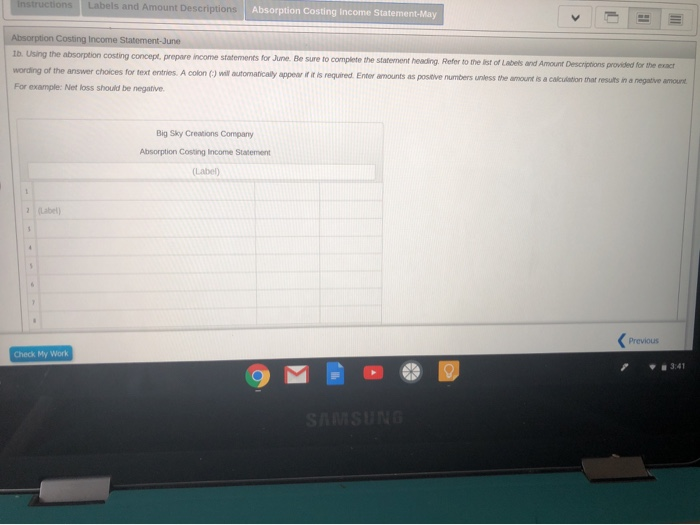

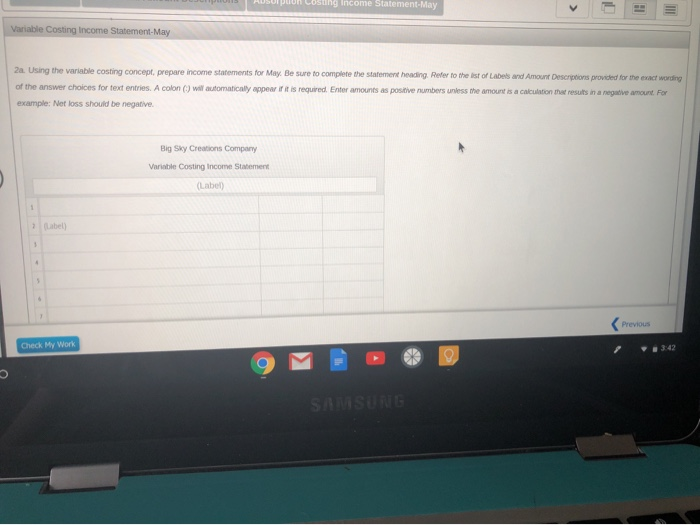

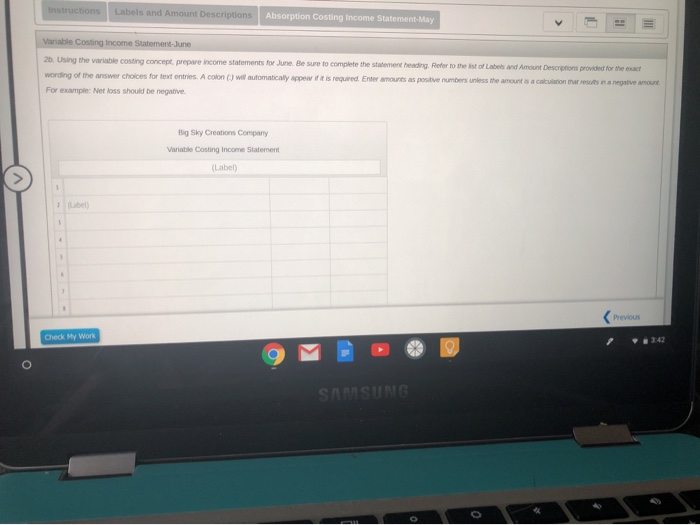

Labels and Amount Descriptions Instructions Absorption Costing Income Statement-May Instructions During the first month of perations ended May 31, Big Sky Creations Company produced 56,000 designer cowboy boots, of which 52,450 were sold. Operating data for the month are summarized as follows: 1Sales $839.200.00 2 Manufacturing costs $425,600,00 Direct materials 123,200.00 Direct labor 67200 00 Variable manufacturing cost 56,000.00 672,000.00 Fixed manufacturing cost Selling and administrative expenses $51,470.00 Variable 57695 00 26,225.00 Fxed Previous Check My Work 3:40 SAMSUNG Instructions Labels and Amount Descriptions Absorption Costing Income Statement-May Absorption Costing Income Statement-May 1a. Using the absorption costing concept, prepare income statements for May. Be sure to complete the statement heading Refer to the ist of Labels and Amount Descripnions provided for the exact wording of the answer cholces for text entries. A colon () will automaticaly appear if it is required Enter amounts as positive numbers unless the amount is a calculanion that results in a negative amount For example: Net loss should be negative. Big Sky Creations Company Absorption Costing Income Statement (Label) 2Label) Previous Check My Work 3:40 SAMSUNG instructions Labels and Amount Descriptions Absorption Costing Income Statement-May Absorption Costing Income Statement-June Ib. Using the absorption costing concept, prepare income statements for June. Be sure to complete the statement heading Refer to the ist of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon () will automatically appear if it is required Enter amounts as poseive numbers unless the amount is a calculation that results in a negative amourst For example: Net loss should be negative Big Sky Creations Company Absorption Costing Income Statement (Label) 2 Label) Previous Check My Work 3:41 SAMSUNG AUsUrpuon Cosung income Statement-May Variable Costing Income Statement-May 2a. Using the variable costing concept, prepare income statements for May Be sure to complete the statement heading Refer to the list of Labels and Amount Descriptions provided for the exact wordings of the answer choices for text entries. A colon () will automatically appear if it is required Enter amounts as positive numbers unless the amount is a calculation that results in a negative amount For example: Net loss should be negative Big Sky Creations Company Variable Costing Income Statement (Label) 2abel) Previous Check My Work 3:42 SAMSUNG Instructions Labels and Amount Descriptions Absorption Costing Income Statement-May Variable Costing Income Statement-Juner 2b. Using the variable costing concept, prepare income statements for June Be sure to complete the statement headng Refer to the list of Labels and Amount Descprons provided for the exact wording of the answer choices for text entries. A colon () will automatically appear if it is required Enter amounes as positive numbers unless the amount is a calculation thar resuts ina negative amount For example: Net loss should be negative Big Sky Creations Company Variable Costing Income Statement (Label) 2abel) Previous Check My Work 3:42 SAMSUNG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started