During the first week of February, Gabe Hopen earned $300. Assume that FICA taxes are 7.65 percent of wages up to $106,800, state unemployment

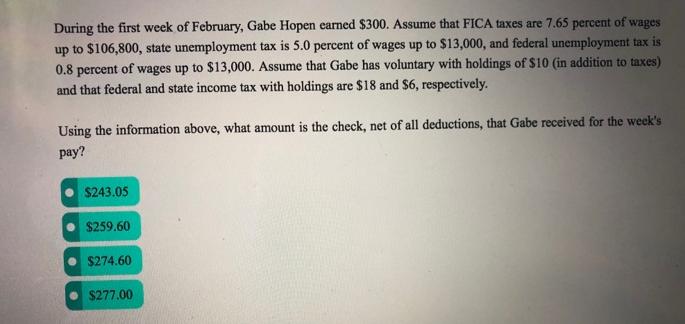

During the first week of February, Gabe Hopen earned $300. Assume that FICA taxes are 7.65 percent of wages up to $106,800, state unemployment tax is 5.0 percent of wages up to $13,000, and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Gabe has voluntary with holdings of $10 (in addition to taxes) and that federal and state income tax with holdings are $18 and $6, respectively. Using the information above, what amount is the check, net of all deductions, that Gabe received for the week's pay? $243.05 $259.60 $274.60 $277.00

Step by Step Solution

3.61 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Solution Amount in Gross Wages 300 Less FICA taxes ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e0f8ab9e0e_181112.pdf

180 KBs PDF File

635e0f8ab9e0e_181112.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started