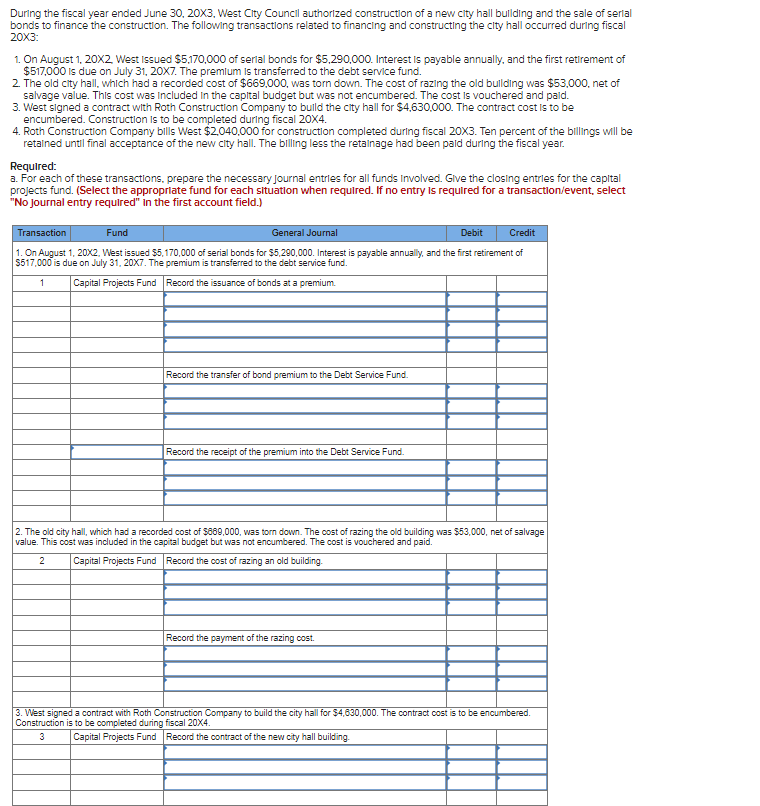

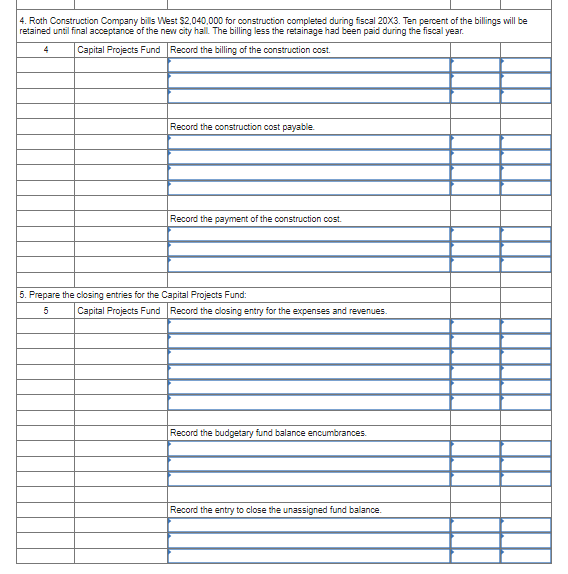

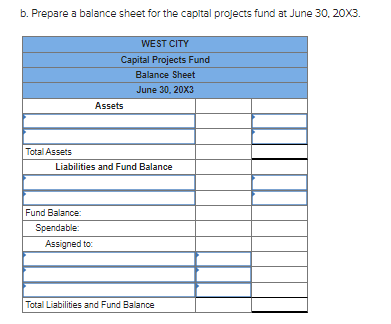

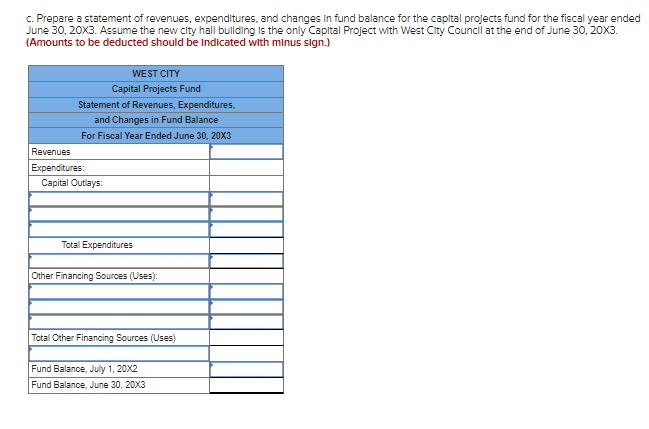

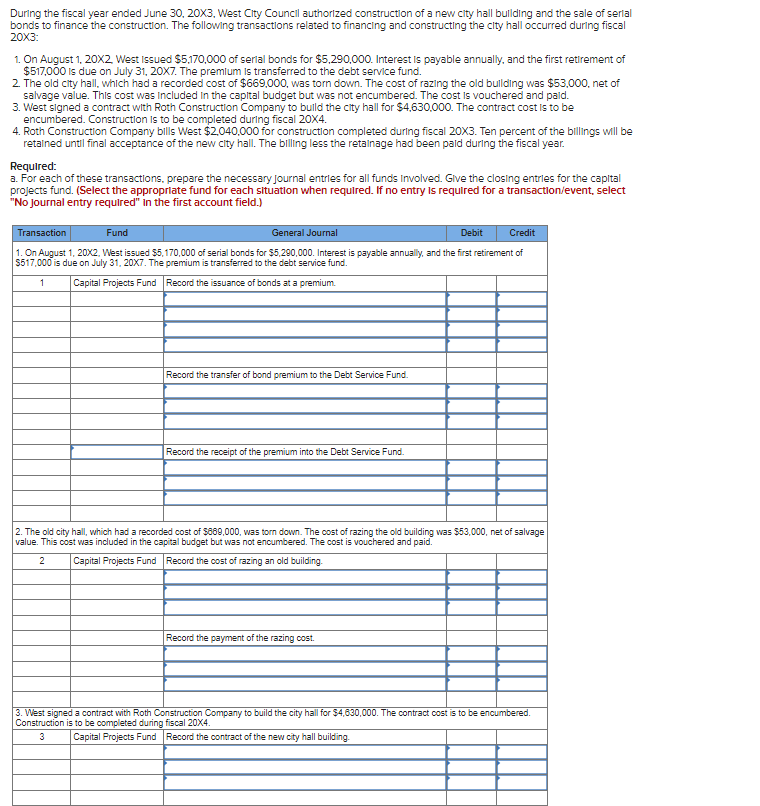

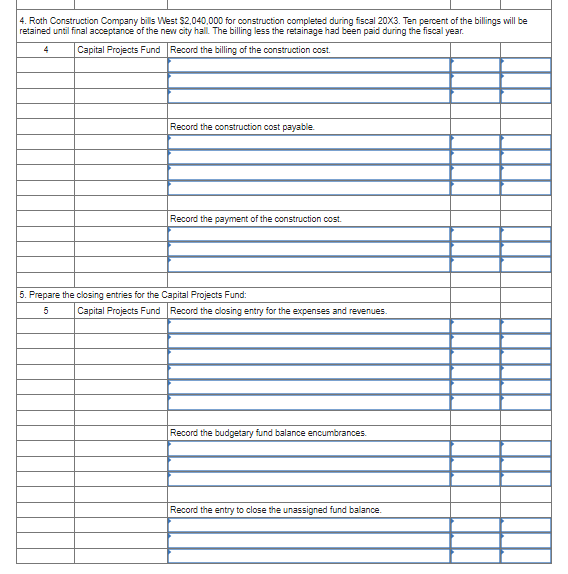

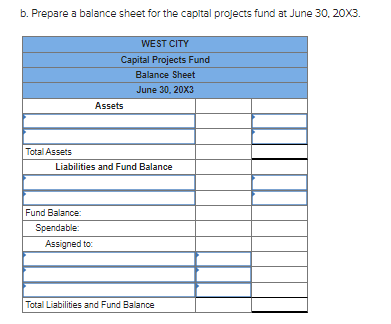

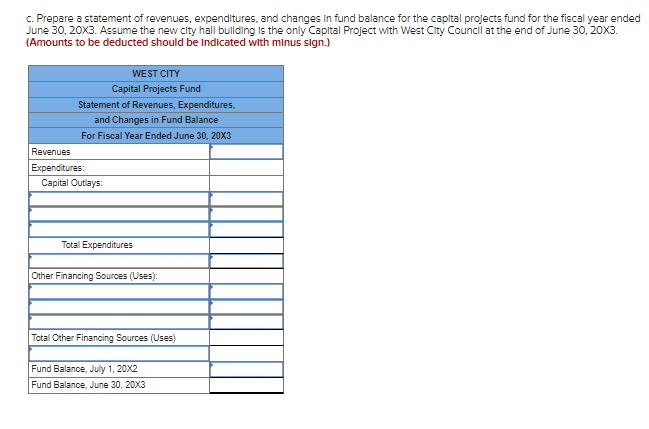

During the fiscal year ended June 30, 20X3. West City Council authorized construction of a new city hall building and the sale of serial bonds to finance the construction. The following transactions related to financing and constructing the city hall occurred during fiscal 20X3: 1. On August 1, 20X2 West issued $5.170.000 of serial bonds for $5.290.000. Interest is payable annually, and the first retirement of $517.000 is due on July 31, 20x7. The premium is transferred to the debt service fund. 2 The old city hall, which had a recorded cost of $669.000, was torn down. The cost of razing the old building was $53.000.net of salvage value. This cost was included in the capital budget but was not encumbered. The cost is vouchered and paid 3. West signed a contract with Roth Construction Company to build the city hall for $4.630.000. The contract cost is to be encumbered. Construction is to be completed during fiscal 20X4. 4. Roth Construction Company bills West $2.040.000 for construction completed during fiscal 20X3. Ten percent of the billings will be retained until final acceptance of the new city hall. The billing less the retainage had been paid during the fiscal year. Required: a. For each of these transactions, prepare the necessary Journal entries for all funds Involved. Give the closing entries for the capital projects fund. (Select the appropriate fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Transaction Fund General Journal Debit Credit 1. On August 1, 20X2, West issued $5,170,000 of serial bonds for $5,290,000. Interest is payable annually, and the first retirement of S517,000 is due on July 31, 20X7. The premium is transferred to the debt service fund. 1 Capital Projects Fund Record the issuance of bonds at a premium Record the transfer of bond premium to the Debt Service Fund. Record the receipt of the premium into the Debt Service Fund. 2. The old city hall, which had a recorded cost of $889,000, was torn down. The cost of razing the old building was $53,000, net of salvage value. This cost was included in the capital budget but was not encumbered. The cost is vouchered and paid. 2 Capital Projects Fund Record the cost of razing an old building. Record the payment of the razing cost. 3. West signed a contract with Roth Construction Company to build the city hall for $4,630,000. The contract cost is to be encumbered. Construction is to be completed during fiscal 20X4. 3 Capital Projects Fund Record the contract of the new city hall building. 4. Roth Construction Company bills West $2.040,000 for construction completed during fiscal 20X3. Ten percent of the billings will be retained until final acceptance of the new city hall The billing less the retainage had been paid during the fiscal year. Capital Projects Fund Record the billing of the construction cost. 4 Record the construction cost payable Record the payment of the construction cost. 5. Prepare the closing entries for the Capital Projects Fund: 5 Capital Projects Fund Record the closing entry for the expenses and revenues. Record the budgetary fund balance encumbrances. Record the entry to close the unassigned fund balance b. Prepare a balance sheet for the capital projects fund at June 30, 20X3. WEST CITY Capital Projects Fund Balance Sheet June 30, 20X3 Assets Total Assets Liabilities and Fund Balance Fund Balance Spendable Assigned to: Total Liabilities and Fund Balance c. Prepare a statement of revenues, expenditures, and changes in fund balance for the capital projects fund for the fiscal year ended June 30, 20X3. Assume the new city hall building is the only Capital Project with West City Council at the end of June 30, 20X3. (Amounts to be deducted should be indicated with minus sign.) WEST CITY Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Fiscal Year Ended June 30, 20X3 Revenues Expenditures: Capital Outlays: Total Expenditures Other Financing Sources (Uses): Total Other Financing Sources (Uses) Fund Balance, July 1, 20X2 Fund Balance, June 30, 20X3