Question

During the last week of August, Oneida Companys owner approaches the bank for a $108,500 loan to be made on September 2 and repaid on

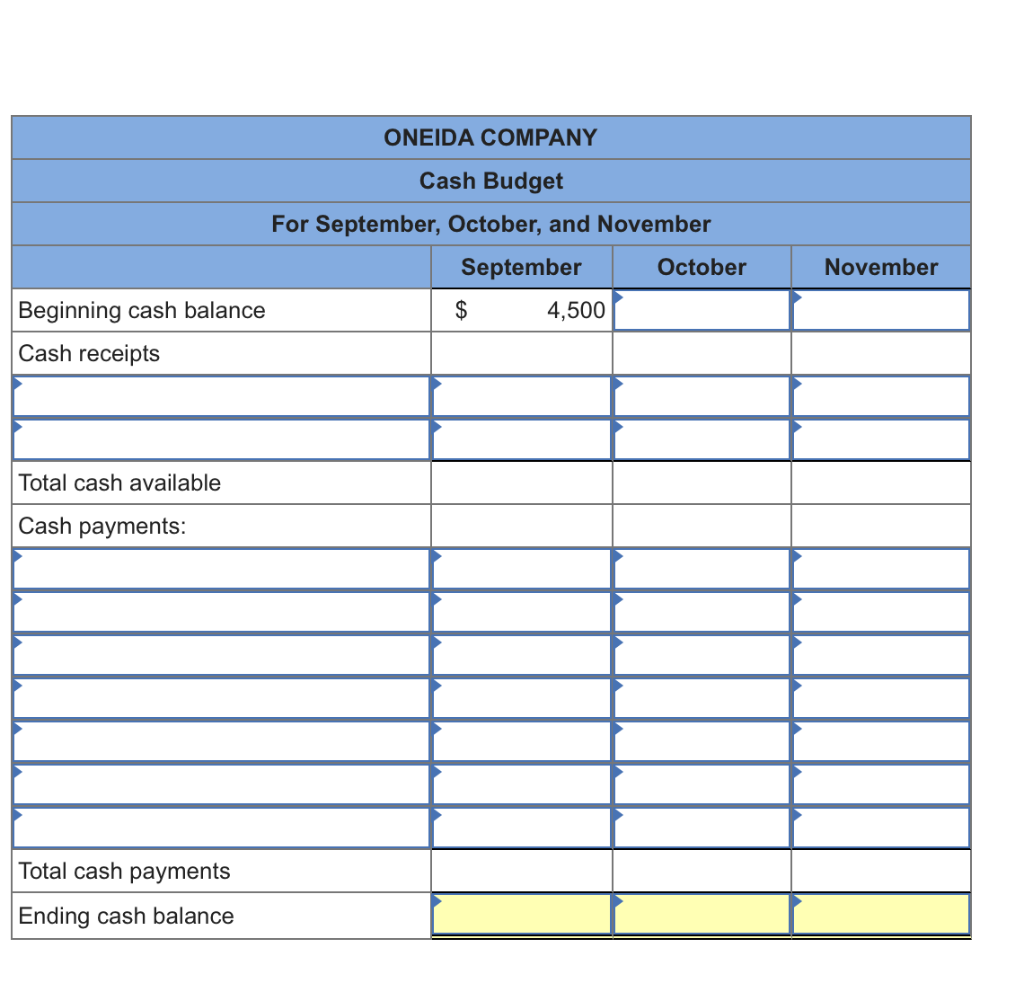

During the last week of August, Oneida Companys owner approaches the bank for a $108,500 loan to be made on September 2 and repaid on November 30 with annual interest of 14%, for an interest cost of $3,798. The owner plans to increase the stores inventory by $60,000 during September and needs the loan to pay for inventory acquisitions. The banks loan officer needs more information about Oneidas ability to repay the loan and asks the owner to forecast the stores November 30 cash position. On September 1, Oneida is expected to have a $4,500 cash balance, $138,600 of net accounts receivable, and $100,000 of accounts payable. Its budgeted sales, merchandise purchases, and various cash disbursements for the next three months follow.

| Budgeted Figures* | September | October | November | |||

| Sales | $ | 240,000 | $ | 435,000 | $ | 430,000 |

| Merchandise purchases | 235,000 | 210,000 | 191,000 | |||

| Cash payments | ||||||

| Payroll | 19,600 | 21,900 | 23,700 | |||

| Rent | 10,000 | 10,000 | 10,000 | |||

| Other cash expenses | 34,600 | 31,200 | 21,600 | |||

| Repayment of bank loan | 108,500 | |||||

| Interest on the bank loan | 3,798 | |||||

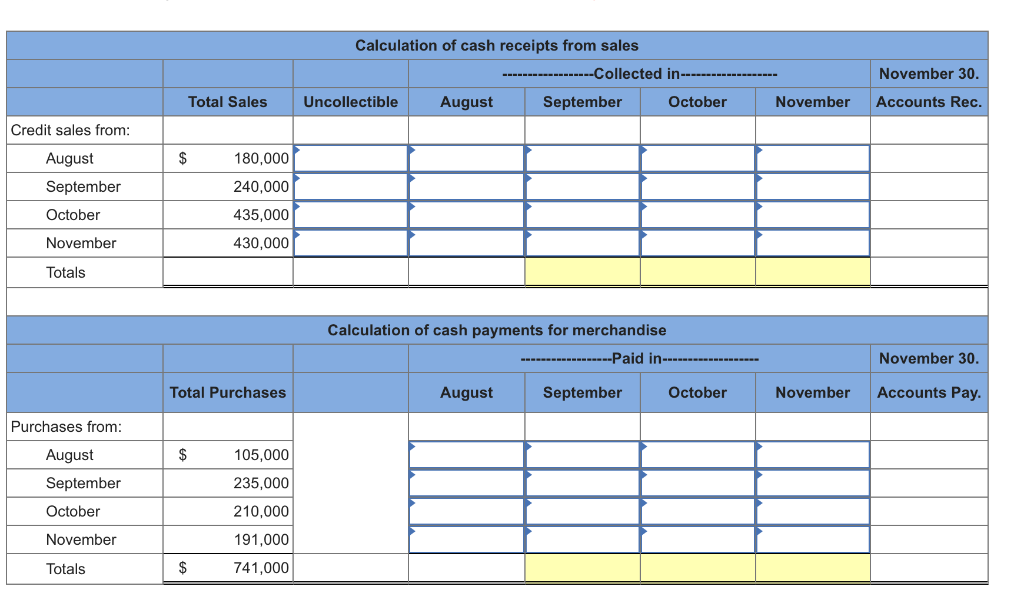

*Operations began in August; August sales were $180,000 and purchases were $105,000. The budgeted September merchandise purchases include the inventory increase. All sales are on account. The company predicts that 23% of credit sales is collected in the month of the sale, 47% in the month following the sale, 19% in the second month, 7% in the third, and the remainder is uncollectible. Applying these percents to the August credit sales, for example, shows that $84,600 of the $180,000 will be collected in September, $34,200 in October, and $12,600 in November. All merchandise is purchased on credit; 60% of the balance is paid in the month following a purchase, and the remaining 40% is paid in the second month. For example, of the $105,000 August purchases, $63,000 will be paid in September and $42,000 in October. Required: Prepare a cash budget for September, October, and November. (Round your final answers to the nearest whole dollar.)

Calculation of cash receipts from sales ------------------Collected in ---........... Uncollectible August September October November 30. Accounts Rec. Total Sales November Credit sales from: August September October November 180,000 240,000 435,000 430,000 Totals Calculation of cash payments for merchandise ------------------Paid in --------.... November 30. Total Purchases August September October November November Accounts Pay. | $ Purchases from: August September October November 105,000 235,000 210,000 191,000 741,000 Totals ONEIDA COMPANY Cash Budget For September, October, and November September October Beginning cash balance $ 4,500 Cash receipts November Total cash available Cash payments: Total cash payments Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started