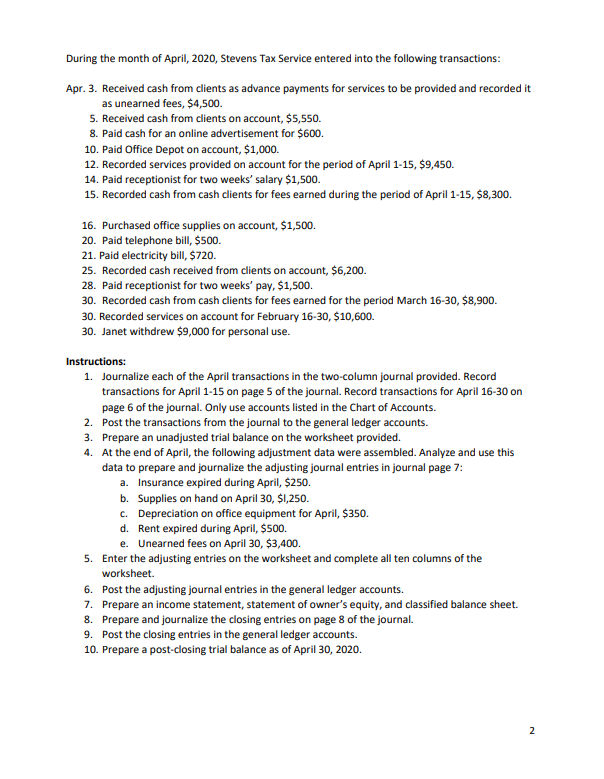

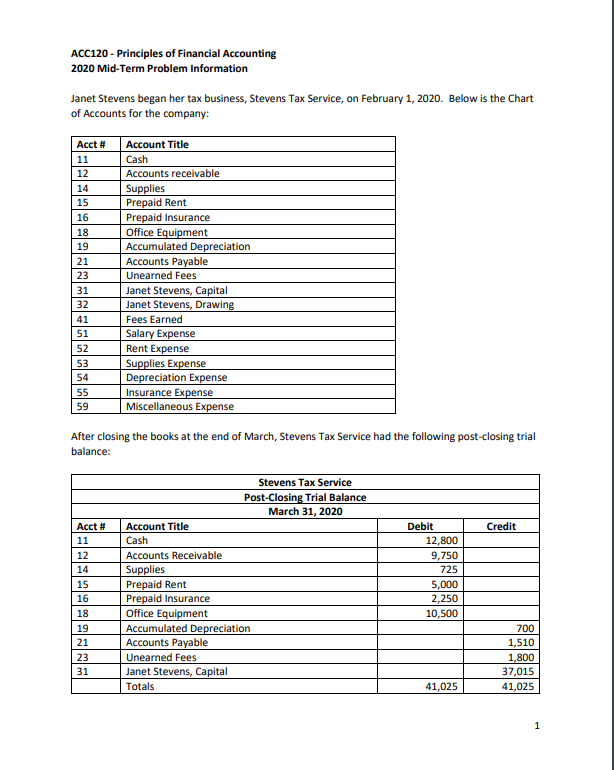

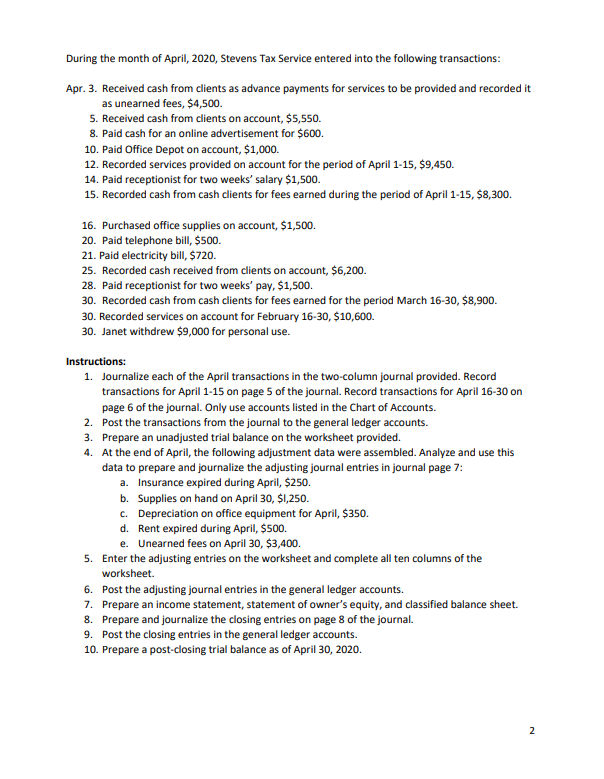

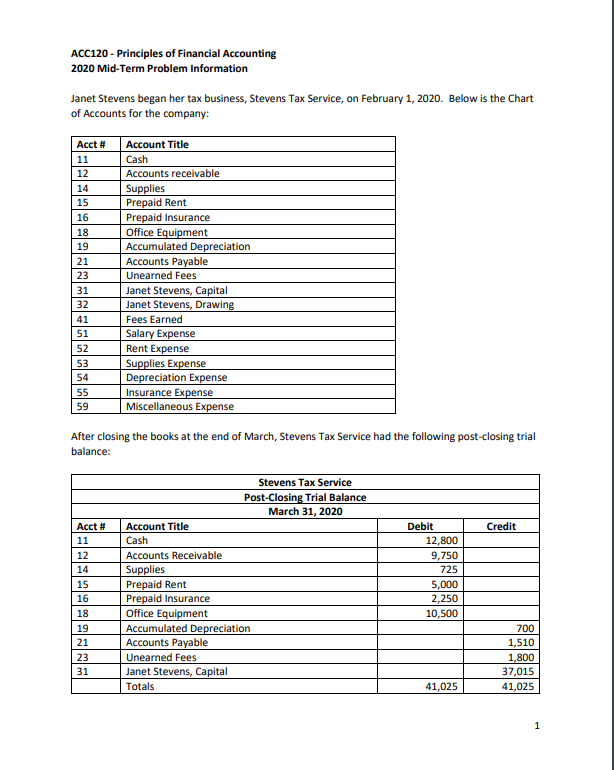

During the month of April, 2020, Stevens Tax Service entered into the following transactions: Apr. 3. Received cash from clients as advance payments for services to be provided and recorded it as unearned fees, $4,500 5. Received cash from clients on account, $5,550. 8. Paid cash for an online advertisement for $600. 10. Paid Office Depot on account, $1,000. 12. Recorded services provided on account for the period of April 1-15, $9,450. 14. Paid receptionist for two weeks' salary $1,500. 15. Recorded cash from cash clients for fees earned during the period of April 1-15, $8,300. 16. Purchased office supplies on account, $1,500. 20. Paid telephone bill, $500. 21. Paid electricity bill, $720 25. Recorded cash received from clients on account, $6,200. 28. Paid receptionist for two weeks' pay, $1,500. 30. Recorded cash from cash clients for fees earned for the period March 16-30, $8,900. 30. Recorded services on account for February 16-30, $10,600. 30. Janet withdrew $9,000 for personal use. Instructions: 1. Journalize each of the April transactions in the two-column journal provided. Record transactions for April 1-15 on page 5 of the journal. Record transactions for April 16-30 on page 6 of the journal. Only use accounts listed in the Chart of Accounts. 2. Post the transactions from the journal to the general ledger accounts. 3. Prepare an unadjusted trial balance on the worksheet provided. 4. At the end of April, the following adjustment data were assembled. Analyze and use this data to prepare and journalize the adjusting journal entries in journal page 7: a. Insurance expired during April, $250. b. Supplies on hand on April 30, $1,250. c. Depreciation on office equipment for April, $350. d. Rent expired during April, $500. e. Unearned fees on April 30, $3,400. 5. Enter the adjusting entries on the worksheet and complete all ten columns of the worksheet. 6. Post the adjusting journal entries in the general ledger accounts. 7. Prepare an income statement, statement of owner's equity, and classified balance sheet. 8. Prepare and journalize the closing entries on page 8 of the journal. 9. Post the closing entries in the general ledger accounts. 10. Prepare a post-closing trial balance as of April 30, 2020. 2 2 ACC120 - Principles of Financial Accounting 2020 Mid-Term Problem Information Janet Stevens began her tax business, Stevens Tax Service, on February 1, 2020. Below is the Chart of Accounts for the company: Acct # 11 12 14 15 16 18 19 21 23 31 32 41 51 52 53 54 55 59 Account Title Cash Accounts receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Unearned Fees Janet Stevens, Capital Janet Stevens, Drawing Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense After closing the books at the end of March, Stevens Tax Service had the following post-closing trial balance: Credit Acct # 11 12 14 15 16 18 19 21 23 31 Stevens Tax Service Post-Closing Trial Balance March 31, 2020 Account Title Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation Accounts Payable Unearned Fees Janet Stevens, Capital Totals Debit 12,800 9,750 725 5,000 2,250 10,500 700 1,510 1,800 37,015 41,025 41,025 1