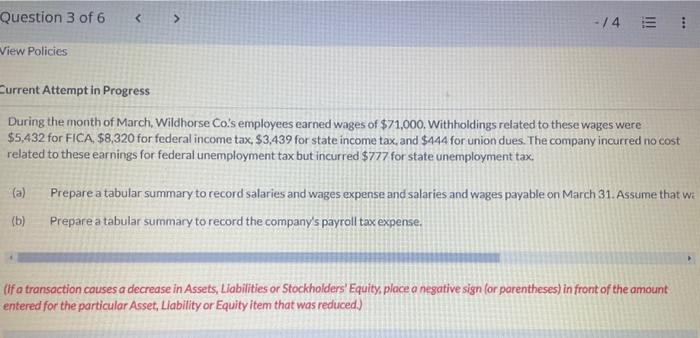

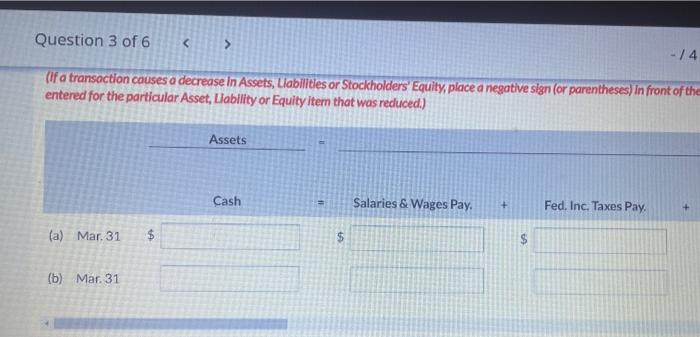

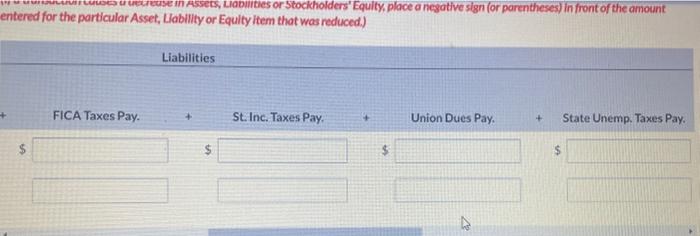

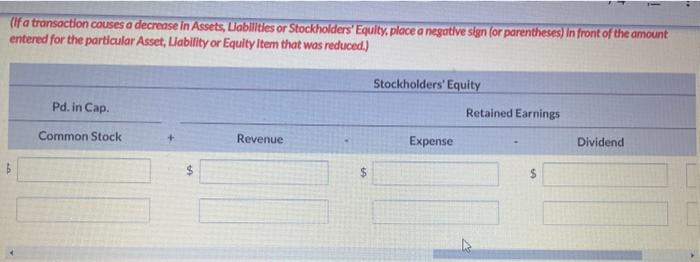

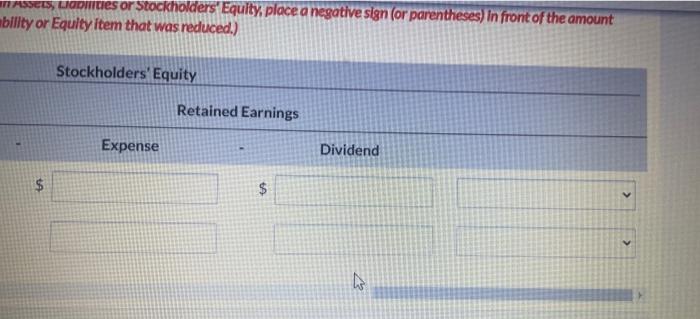

During the month of March. Wildhorse Co.s employees earned wages of $71,000. Withioldings related to these wages were $5,432 for FICA, $8,320 for federal income tax, $3,439 for state income tax, and $444 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $777 for state unemployment tax. (a) Prepare a tabular summary to record salaries and wages expense and salaries and wages payable on March 31. Assume that w: (b) Prepare a tabular summary to record the company's payroll tax expense. (If a transaction couses a decrease in Assets, Liabilities or Stockholders' Equity, ploce a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) (If a transoction causes a decrease in Assets, Llabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of th entered for the particular Asset, Lability or Equity item that was reduced.) entered for the particular Asset, Lability or Equity item that was reduced.) Equity, place a negative sign (or parentheses) in front of the amount (If a transaction couses a decrease in Acsets, Labilities or Stockholders' Eqully, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llability or Equilty item that wos reduced.) vility or Equity item that was reduced.) During the month of March. Wildhorse Co.s employees earned wages of $71,000. Withioldings related to these wages were $5,432 for FICA, $8,320 for federal income tax, $3,439 for state income tax, and $444 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $777 for state unemployment tax. (a) Prepare a tabular summary to record salaries and wages expense and salaries and wages payable on March 31. Assume that w: (b) Prepare a tabular summary to record the company's payroll tax expense. (If a transaction couses a decrease in Assets, Liabilities or Stockholders' Equity, ploce a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) (If a transoction causes a decrease in Assets, Llabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of th entered for the particular Asset, Lability or Equity item that was reduced.) entered for the particular Asset, Lability or Equity item that was reduced.) Equity, place a negative sign (or parentheses) in front of the amount (If a transaction couses a decrease in Acsets, Labilities or Stockholders' Eqully, place a negative sign (or parentheses) In front of the amount entered for the particular Asset, Llability or Equilty item that wos reduced.) vility or Equity item that was reduced.)