Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the month of October, Loyal Co. completed the following business transactions: Oct. 1 3 5 8 11 11 12 15 26 27 Purchased

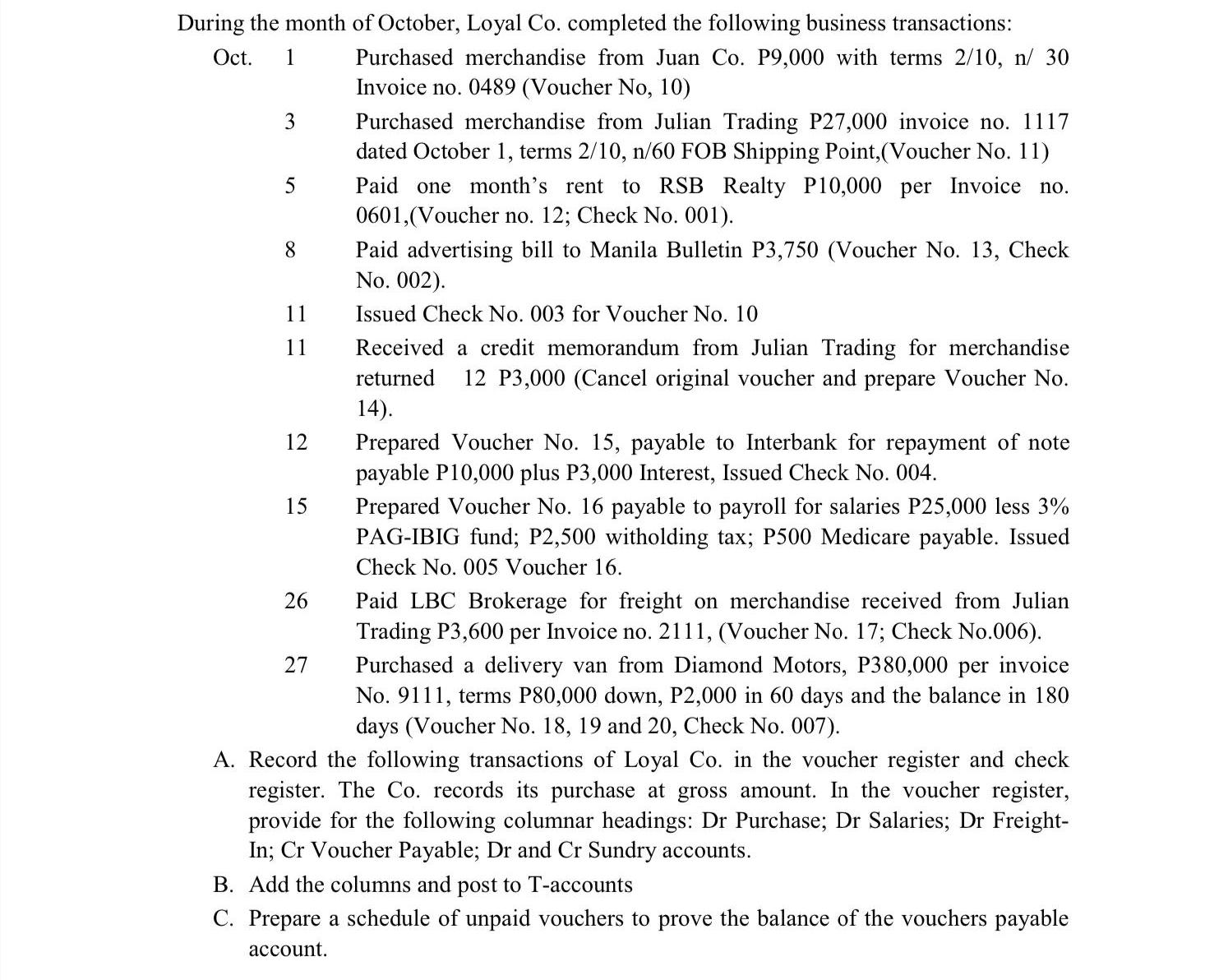

During the month of October, Loyal Co. completed the following business transactions: Oct. 1 3 5 8 11 11 12 15 26 27 Purchased merchandise from Juan Co. P9,000 with terms 2/10, n/ 30 Invoice no. 0489 (Voucher No, 10) Purchased merchandise from Julian Trading P27,000 invoice no. 1117 dated October 1, terms 2/10, n/60 FOB Shipping Point, (Voucher No. 11) Paid one month's rent to RSB Realty P10,000 per Invoice no. 0601,(Voucher no. 12; Check No. 001). Paid advertising bill to Manila Bulletin P3,750 (Voucher No. 13, Check No. 002). Issued Check No. 003 for Voucher No. 10 Received a credit memorandum from Julian Trading for merchandise returned 12 P3,000 (Cancel original voucher and prepare Voucher No. 14). Prepared Voucher No. 15, payable to Interbank for repayment of note payable P10,000 plus P3,000 Interest, Issued Check No. 004. Prepared Voucher No. 16 payable to payroll for salaries P25,000 less 3% PAG-IBIG fund; P2,500 witholding tax; P500 Medicare payable. Issued Check No. 005 Voucher 16. Paid LBC Brokerage for freight on merchandise received from Julian Trading P3,600 per Invoice no. 2111, (Voucher No. 17; Check No.006). Purchased a delivery van from Diamond Motors, P380,000 per invoice No. 9111, terms P80,000 down, P2,000 in 60 days and the balance in 180 days (Voucher No. 18, 19 and 20, Check No. 007). A. Record the following transactions of Loyal Co. in the voucher register and check register. The Co. records its purchase at gross amount. In the voucher register, provide for the following columnar headings: Dr Purchase; Dr Salaries; Dr Freight- In; Cr Voucher Payable; Dr and Cr Sundry accounts. B. Add the columns and post to T-accounts C. Prepare a schedule of unpaid vouchers to prove the balance of the vouchers payable account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started