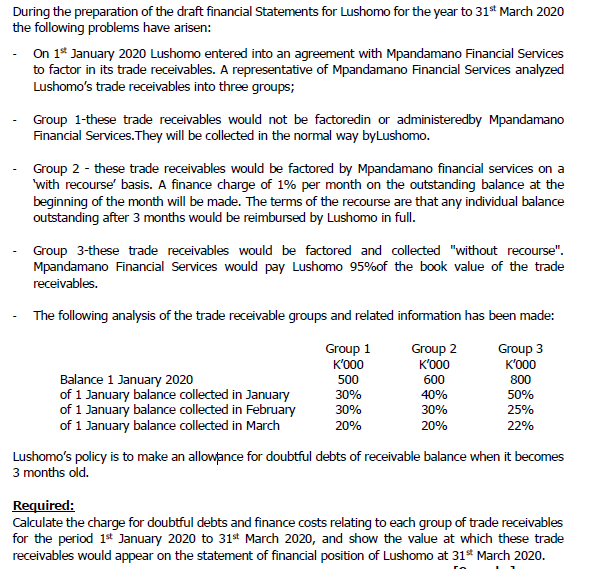

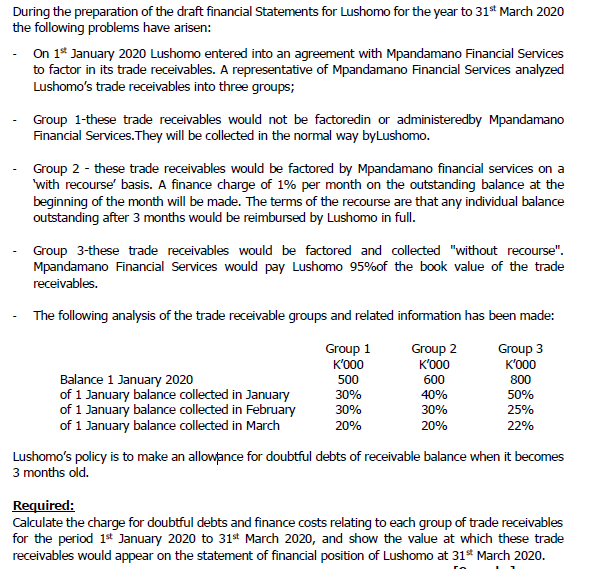

During the preparation of the draft financial Statements for Lushomo for the year to 31st March 2020 the following problems have arisen: - On 1st January 2020 Lushomo entered into an agreement with Mpandamano Financial Services to factor in its trade receivables. A representative of Mpandamano Financial Services analyzed Lushomo's trade receivables into three groups; Group 1-these trade receivables would not be factoredin or administered by Mpandamano Financial Services. They will be collected in the normal way byLushomo. Group 2 - these trade receivables would be factored by Mpandamano financial services on a 'with recourse' basis. A finance charge of 1% per month on the outstanding balance at the beginning of the month will be made. The terms of the recourse are that any individual balance outstanding after 3 months would be reimbursed by Lushomo in full. Group 3-these trade receivables would be factored and collected "without recourse". Mpandamano Financial Services would pay Lushomo 95% of the book value of the trade receivables. The following analysis of the trade receivable groups and related information has been made: Group 1 Group 2 Group 3 K'000 K'000 K'000 Balance 1 January 2020 500 600 800 30% 40% 50% of 1 January balance collected in January of 1 January balance collected in February of 1 January balance collected in March 30% 30% 25% 20% 20% 22% Lushomo's policy is to make an allowance for doubtful debts of receivable balance when it becomes 3 months old. Required: Calculate the charge for doubtful debts and finance costs relating to each group of trade receivables for the period 1st January 2020 to 31st March 2020, and show the value at which these trade receivables would appear on the statement of financial position of Lushomo at 31st March 2020. During the preparation of the draft financial Statements for Lushomo for the year to 31st March 2020 the following problems have arisen: - On 1st January 2020 Lushomo entered into an agreement with Mpandamano Financial Services to factor in its trade receivables. A representative of Mpandamano Financial Services analyzed Lushomo's trade receivables into three groups; Group 1-these trade receivables would not be factoredin or administered by Mpandamano Financial Services. They will be collected in the normal way byLushomo. Group 2 - these trade receivables would be factored by Mpandamano financial services on a 'with recourse' basis. A finance charge of 1% per month on the outstanding balance at the beginning of the month will be made. The terms of the recourse are that any individual balance outstanding after 3 months would be reimbursed by Lushomo in full. Group 3-these trade receivables would be factored and collected "without recourse". Mpandamano Financial Services would pay Lushomo 95% of the book value of the trade receivables. The following analysis of the trade receivable groups and related information has been made: Group 1 Group 2 Group 3 K'000 K'000 K'000 Balance 1 January 2020 500 600 800 30% 40% 50% of 1 January balance collected in January of 1 January balance collected in February of 1 January balance collected in March 30% 30% 25% 20% 20% 22% Lushomo's policy is to make an allowance for doubtful debts of receivable balance when it becomes 3 months old. Required: Calculate the charge for doubtful debts and finance costs relating to each group of trade receivables for the period 1st January 2020 to 31st March 2020, and show the value at which these trade receivables would appear on the statement of financial position of Lushomo at 31st March 2020