Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the real estate bubble of the early 2000s, real estate prices were soaring, so most Americans felt relatively well-off. As a result, they had

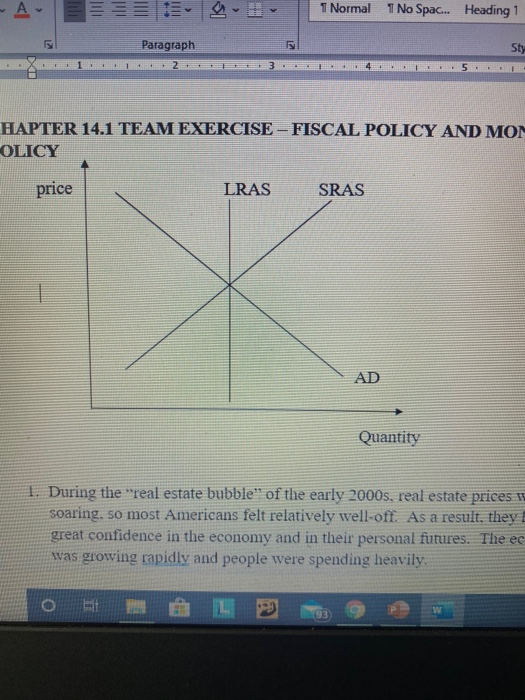

- During the real estate bubble of the early 2000s, real estate prices were soaring, so most Americans felt relatively well-off. As a result, they had great confidence in the economy and in their personal futures. The economy was growing rapidly and people were spending heavily.

- On the graph above, draw what you think was happening as consumer confidence surged. What problem(s) might the government be worried about in the economy as this is happening?

- Identify one monetary policy and one fiscal policy the government might use to stabilize this situation.

- Explain in your own words how the two policies in (b) will have the desired effect. Can you show or describe the effect on the graph too?

- Assume the governments economists estimate that the gap between the natural rate of output and the current rate of output is $3 trillion. The MPC= 0.5. Based on the multiplier, what should be the amount of money involved in the policies you suggested in part b?

- Do you think the monetary or fiscal policy in (b) is a better idea? Why? (There is no right answer here. Its a matter of opinion. I just want you to have one and be able to justify it.)

- Suppose the government reduces taxes by $20 billion, that there is no crowding out, and that the MPC is 1/4 or 0.25.

- What is the initial (immediate) effect of the tax reduction on aggregate demand?

- What additional effects follow this initial effect? What is the total effect of the tax cut on AD?

- How does the total effect of this $20 billion tax cut compare to the total effect of a $20 billion increase in government purchases? Why?

- Based on your answer to part c, can you think of a way in which the government can increase aggregate demand without changing its budget deficit?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started