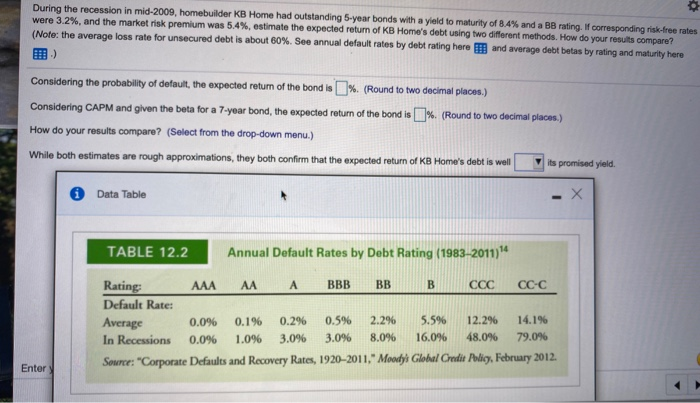

During the recession in mid-2009, homebuilder KB Home had outstanding 5-year bonds with a yield to maturity of 8.4% and a BB rating. If corresponding risk-free rates were 3.2%, and the market risk premium was 5.4%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating here and average debt betas by rating and maturity here Considering the probability of default, the expected return of the bond is %. (Round to two decimal places.) Considering CAPM and given the beta for a 7-year bond, the expected return of the bond is 1% (Round to two decimal places.) How do your results compare? (Select from the drop-down menu.) While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well its promised yield. Data Table TABLE 12.2 Annual Default Rates by Debt Rating (1983-2011) 14 Rating: AAA AA BBB BB B CC-C Default Rate: Average 0.0% 0.196 0.296 0.5% 2.2% 5.5% 12.2% 14.1% In Recessions 0.0% 1.096 3.096 3.0% 8.0% 16.096 48.0% 79.0% Source: "Corporate Defaults and Recovery Rates, 1920-2011," Moody's Global Credit Pulicy, February 2012. Enter During the recession in mid-2009, homebuilder KB Home had outstanding 5-year bonds with a yield to maturity of 8.4% and a BB rating. If corresponding risk-free rates were 3.2%, and the market risk premium was 5.4%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating here and average debt betas by rating and maturity here Considering the probability of default, the expected return of the bond is %. (Round to two decimal places.) Considering CAPM and given the beta for a 7-year bond, the expected return of the bond is 1% (Round to two decimal places.) How do your results compare? (Select from the drop-down menu.) While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well its promised yield. Data Table TABLE 12.2 Annual Default Rates by Debt Rating (1983-2011) 14 Rating: AAA AA BBB BB B CC-C Default Rate: Average 0.0% 0.196 0.296 0.5% 2.2% 5.5% 12.2% 14.1% In Recessions 0.0% 1.096 3.096 3.0% 8.0% 16.096 48.0% 79.0% Source: "Corporate Defaults and Recovery Rates, 1920-2011," Moody's Global Credit Pulicy, February 2012. Enter