During the recession in mid-2009, homebuilder KB Home had outstanding 77-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%.)

During the recession in mid-2009, homebuilder KB Home had outstanding 77-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%.)

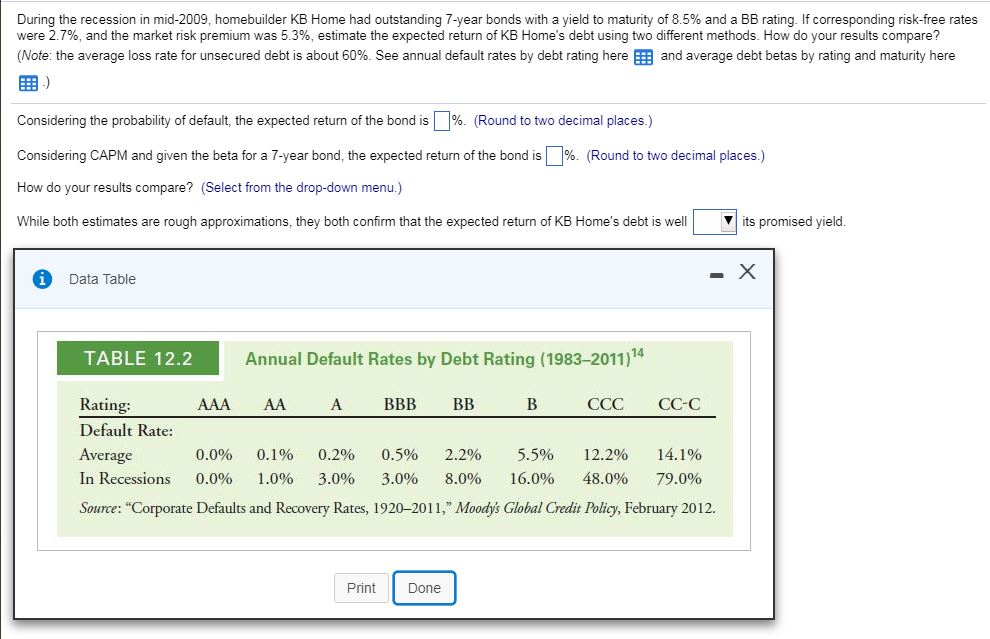

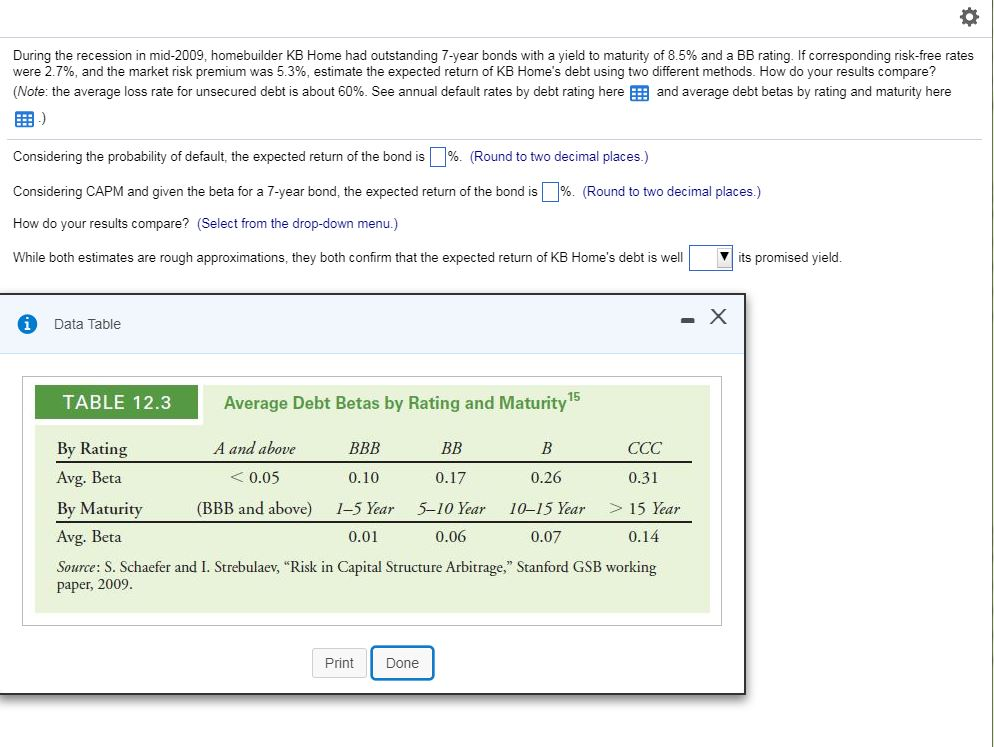

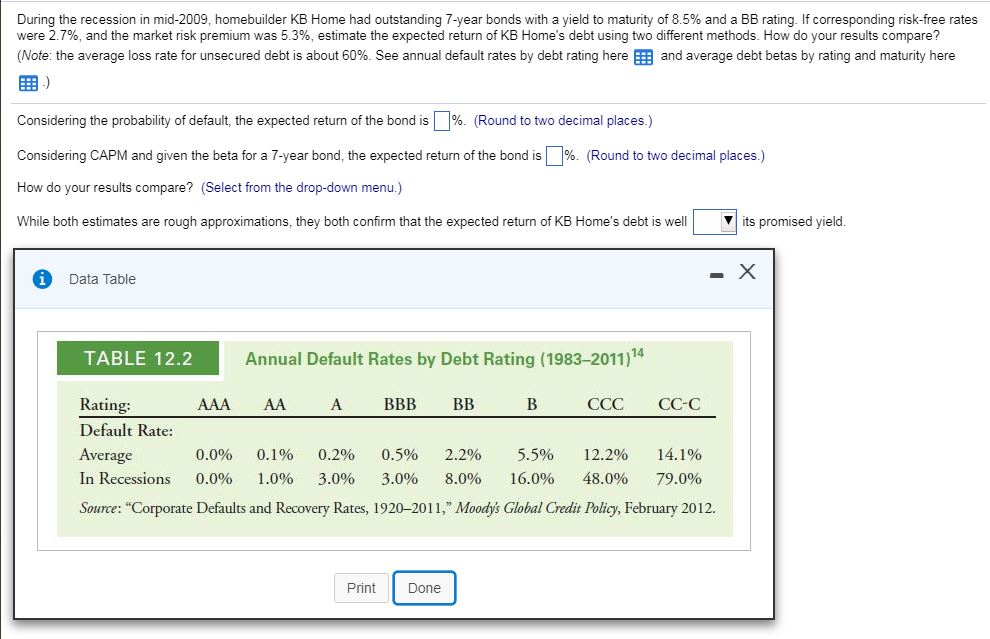

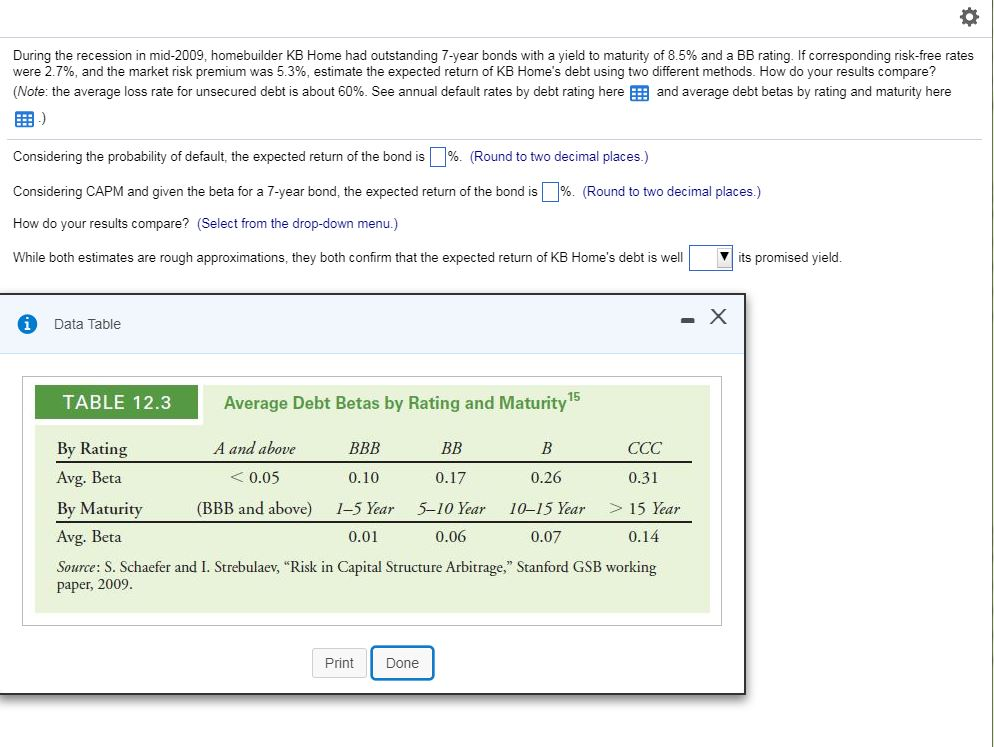

During the recession in mid-2009, homebuilder KB Home had outstanding 7-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating hereand average debt betas by rating and maturity here Considering the probability of default, the expected return of the bond is | %. (Round to two decimal places.) Considering CAPM and given the beta for a 7-year bond, the expected return of the bond is%(Round to two decimal places.) How do your results compare? (Select from the drop-down menu.) While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well V its promised yield i Data Table 15 TABLE 12.3 Average Debt Betas by Rating and Maturity By Rating Avg. Beta By Maturity Avg. Beta Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working A and above 0.05 (BBB and above) 0.10 1-5 Year 0.01 0.17 5-10 Year 0.06 0.26 10-15 Year 0.07 0.31 >15 Year 0.14 paper, 2009 Print Done During the recession in mid-2009, homebuilder KB Home had outstanding 7-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%. See annual default rates by debt rating hereand average debt betas by rating and maturity here Considering the probability of default, the expected return of the bond is | %. (Round to two decimal places.) Considering CAPM and given the beta for a 7-year bond, the expected return of the bond is%(Round to two decimal places.) How do your results compare? (Select from the drop-down menu.) While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well V its promised yield i Data Table 15 TABLE 12.3 Average Debt Betas by Rating and Maturity By Rating Avg. Beta By Maturity Avg. Beta Source: S. Schaefer and I. Strebulaev, "Risk in Capital Structure Arbitrage," Stanford GSB working A and above 0.05 (BBB and above) 0.10 1-5 Year 0.01 0.17 5-10 Year 0.06 0.26 10-15 Year 0.07 0.31 >15 Year 0.14 paper, 2009 Print Done

During the recession in mid-2009, homebuilder KB Home had outstanding 77-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%.)

During the recession in mid-2009, homebuilder KB Home had outstanding 77-year bonds with a yield to maturity of 8.5% and a BB rating. If corresponding risk-free rates were 2.7%, and the market risk premium was 5.3%, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60%.)