Question

During the recession in mid-2009, homebuilder KB Home had outstanding 6-year bonds with a yield to maturity of 8.2 % and a BB rating. If

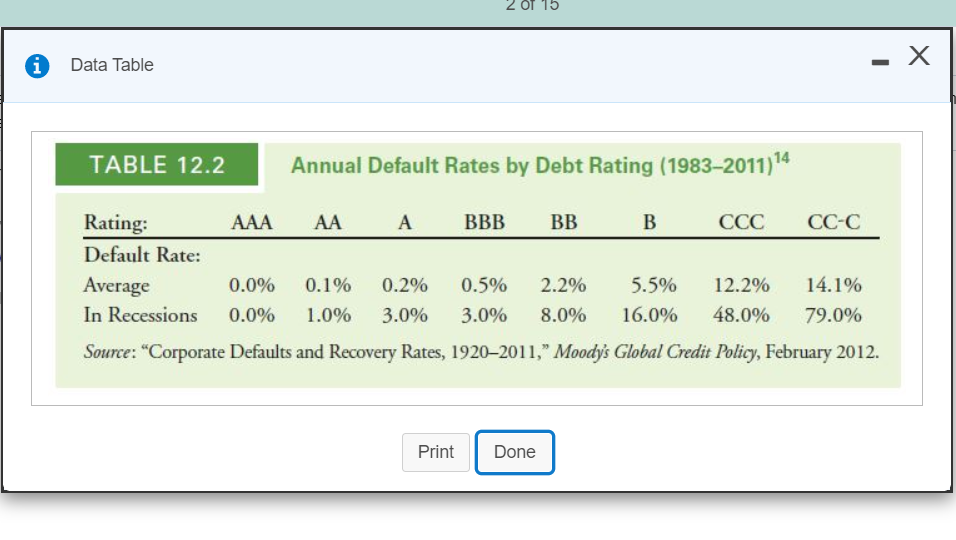

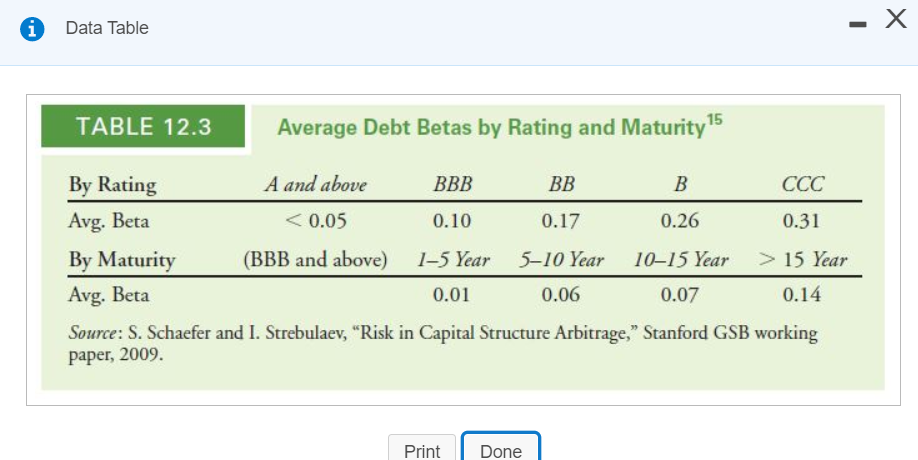

During the recession in mid-2009, homebuilder KB Home had outstanding 6-year bonds with a yield to maturity of 8.2 % and a BB rating. If corresponding risk-free rates were 2.7 %, and the market risk premium was 4.7 %, estimate the expected return of KB Home's debt using two different methods. How do your results compare? (Note: the average loss rate for unsecured debt is about 60 %. See annual default rates by debt rating and average debt betas by rating and maturity

Considering the probability of default, the expected return of the bond is_____%. (Round to two decimal places.)

Considering CAPM and given the beta for a 7-year bond, the expected return of the bond is_____%. (Round to two decimal places.)

How do your results compare?

While both estimates are rough approximations, they both confirm that the expected return of KB Home's debt is well______ its promised yield.

2 OT 15 A Data Table - X TABLE 12.2 Annual Default Rates by Debt Rating (1983 Rating: AAA AAA BBB BB B CCC CC-C Default Rate: Average 0.0% 0.1% 0.2% 0.5% 2.2% 5.5% 12.2% 14.1% In Recessions 0.0% 1.0% 3.0% 3.0% 8.0% 16.0% 48.0% 79.0% Source: "Corporate Defaults and Recovery Rates, 19202011," Moody's Global Credit Policy, February 2012. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started