Question

During the year 2016, Ceria Bhd sold merchandise to Bestari Bhd for invoiced amounts totaling RM2,500,000 of which RM600,000 remained in the closing inventory

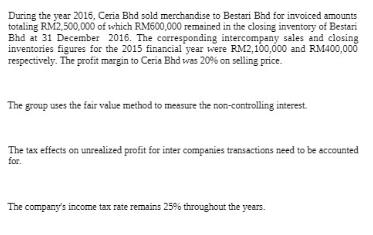

During the year 2016, Ceria Bhd sold merchandise to Bestari Bhd for invoiced amounts totaling RM2,500,000 of which RM600,000 remained in the closing inventory of Bestari Bhd at 31 December 2016. The corresponding intercompany sales and closing inventories figures for the 2015 financial year were RM2,100,000 and RM400,000 respectively. The profit margin to Ceria Bhd was 20% on selling price. The group uses the fair value method to measure the non-controlling interest. The tax effects on unrealized profit for inter companies transactions need to be accounted for. The company's income tax rate remains 25% throughout the years. REQUIRED: (a) Prepare the relevant consolidation journal entries for the year ended 31 December 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Contemporary Approach

Authors: David Haddock, John Price, Michael Farina

3rd edition

77639731, 978-0077639730

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App