during the year ((2016 )) listed in the Muscat Securities Market. Find the following. Please i want the ( solution method ) in detail.

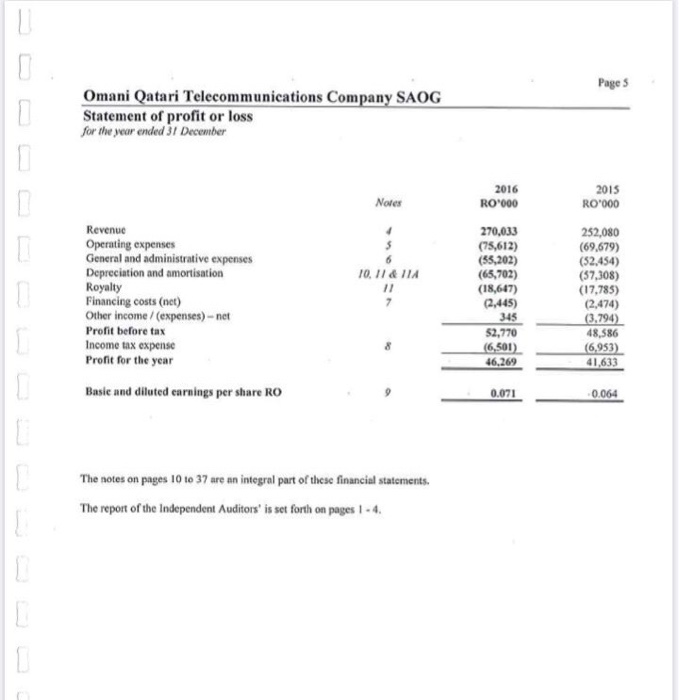

a. Net income

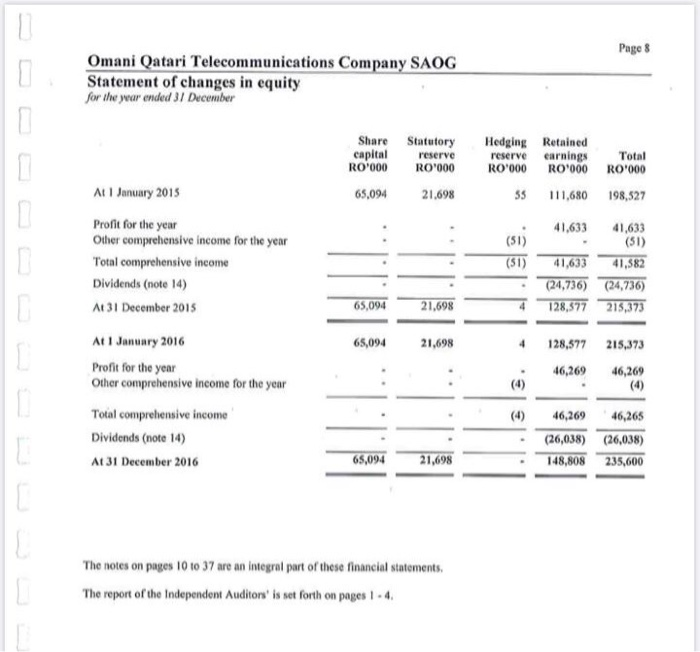

b. Comprehensive income

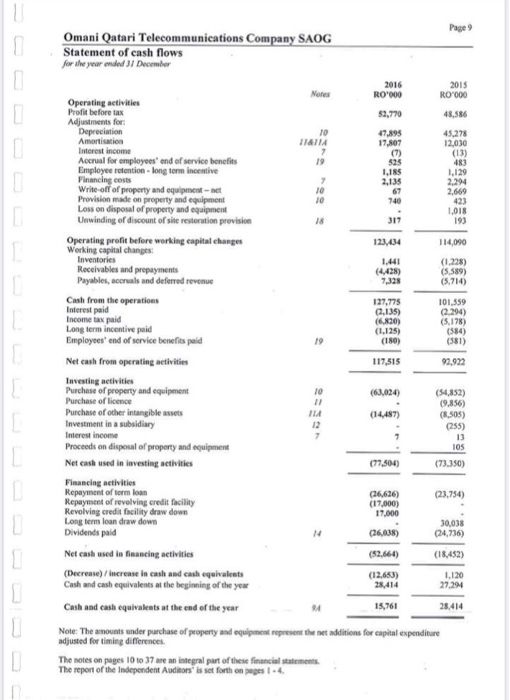

c. Cash flow from operations

d. Cash flow for investing

e. Cash flow for financing

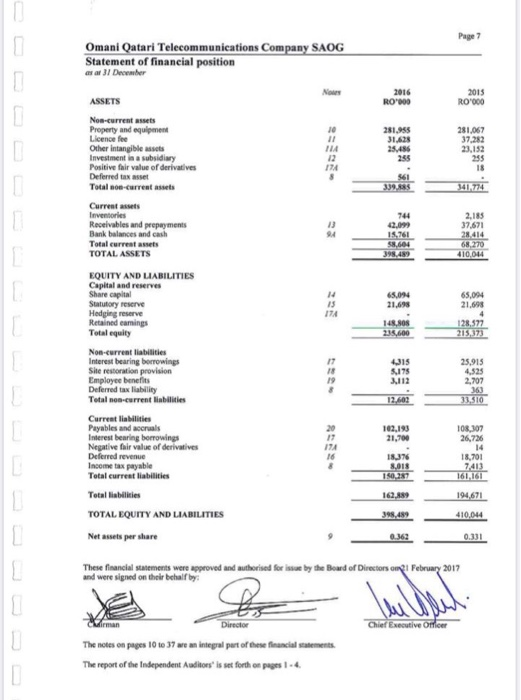

f. Common shareholders equity

g. Common shares outstanding

h. Total assets

Page 5 Omani Qatari Telecommunications Company SAOG Statement of profit or loss for the year ended 31 December C Notes Revenue Operating expenses General and administrative expenses Depreciation and amortisation Royalty Financing costs (net) Other income / (expenses)-net Profit before tax Income tax expense Profit for the year 10, 11 & 14 11 7 2016 RO'000 270,033 (75,612) (55,202) (65,702) (18,647) (2,445) 345 52,770 (6,501) 46,269 2015 RO'000 252,080 (69.679) (52,454) (57,308) (17,785) (2,474) (3,794) 48,586 (6,953) 41,633 - Basie and diluted carnings per share RO 0.071 0.064 The notes on pages 10 to 37 are an integral part of these financial statements. The report of the Independent Auditors' is set forth on pages 1 - 4. D Page 8 Omani Qatari Telecommunications Company SAOG Statement of changes in equity for the year ended 31 December Share Statutory capital reserve RO'000 RO'000 65,094 21.698 Hedging Retained reserve earnings Total RO'000 RO 000 RO'000 35 111,680 198,527 (51) (51) 41,633 41,633 (51) 41,633 41,582 (24,736) (24,736) 128,577 215,373 65,094 21.698 4 At January 2015 Profit for the year Other comprehensive income for the year Total comprehensive income Dividends (note 14) At 31 December 2015 At 1 January 2016 Profit for the year Other comprehensive income for the year Total comprehensive income Dividends (note 14) At 31 December 2016 65,094 21,698 4 128,577 215,373 46,269 46,269 (4) 46,269 46,265 (26,038) (26,038) 148,808 235,600 65,094 21,698 The notes on pages 10 to 37 are an integral part of these financial statements, The report of the Independent Auditors' is set forth on pages 1.4 Page 7 L Omani Qatari Telecommunications Company SAOG Statement of financial position arar I December 2016 2015 1000 RO 209 10 11 281.955 31.628 D 281,067 37.282 23,152 255 18 255 174 ASSETS Non-current assets Property and equipment Licence fee Other intangible assets Investment in a subsidiary Positive fair value of derivatives Deferred to set Total non-current assets Current assets Inventories Receivables and prepayments Bank balances and cash Total currentes TOTAL ASSETS 3412774 2,185 744 (2.097 15. 761 37.671 28.414 68,270 410,044 14 EQUITY AND LIABILITIES Capital and reserves Share capital Statutory reserve Hedging reserve Retained camings Total equity 65,094 21.69 174 65,094 21.698 4 128,577 215,373 148,808 235,600 25,915 $175 3.112 2,707 12.603 33,510 102,193 21,700 108,307 26,726 Non-current liabilities Interest bearing borrowings Site restoration provision Employee benefits Deferred tax liability Total non-current liabilities Current liabilities Payables and accruals Interest bearing borrowings Negative fair value of derivatives Deferred revenue Income tax payable Total current liabilities Total liabilities TOTAL EQUITY AND LIABILITIES Net assets per share 174 1876 8.018 18,701 7413 161,161 162,889 194,671 398,489 410,044 0.362 0.131 These financial statements were approved and authorised for ise by the Board of Directors om! February 2017 and were signed on their behalf by Chief Executive Officer Director The notes on pages 10 to 37 are an integral part of these financial statements The report of the Independent Auditors' is set forth on page 1.4 I C Page 9 Omani Qatari Telecommunications Company SAOG Statement of cash flows for w the year ended 31 December 2016 2015 No RO'000 | 0 000 Operating activities Profit before tax 52,770 48,586 Adjustments for: Depreciation 10 47.895 45,278 Amortisation 114114 17.807 12,030 Interest income 7 (7) (13) Accrual for employees' end of service benefits 19 525 483 Employee retention long term incentive 1,185 1.129 Financing costs 2,135 2.294 Write-off of property and equipment het 10 67 2,669 Provision made on property and equipment 10 740 Loss on disposal of property and equipment 1,018 Unwinding of discount of site restoration provision 18 317 193 Operating profit before working capital changes 123,434 114,090 Working capital changes Inventories 1.441 (1,228) Receivables and prepayments (4428) (5.589) Payables, accruals and deferred revenue 7.328 (5.714) Cash from the operations 127,775 101.559 Interest paid (2.135) (2.294) Income tax paid (6.820) (5.178) Long term incentive paid (1.125) (584) Employees' end of service benefits paid 19 (180) (581) Net cash from operating activities 117,515 91.922 Investing activities Purchase of property and equipment 10 (63,024) (54,852) Purchase of licence (9,856) Purchase of other intangible assets (14,487) (8.505) Investment in a subsidiary 12 (255) Interest income 7 13 Proceeds on disposal of property and equipment 105 Net cash used in investing activities (77.504) (73.350) Financing activities Repayment of term loan (26,626) (23.754) Repayment of revolving credit facility (17,000) Revolving credit facility draw down 17.000 Long term loan draw down 30,038 Dividends paid (26,038) (24,736) Net cash used in financing activities (52.666) (18,452) (Decrease) / increase in cash and cash equivalents (12.653) 1.120 Cash and cash equivalents at the beginning of the you 28.414 27.294 Cash and cash equivalents at the end of the year 15,761 28.414 Note: The amounts under purchase of property and equipment represent the het additions for capital expenditure adjusted for timing differences The notes on pages 10 to 37 are an integral part of these financial statements The report of the Independent Auditors' is set forth onges 1.4 7 D