Answered step by step

Verified Expert Solution

Question

1 Approved Answer

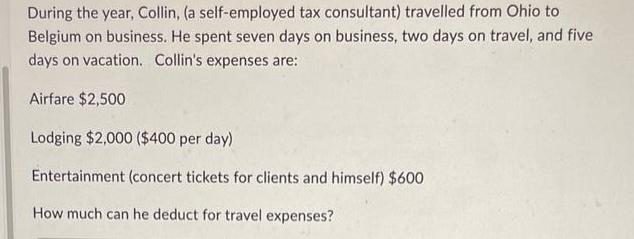

During the year, Collin, (a self-employed tax consultant) travelled from Ohio to Belgium on business. He spent seven days on business, two days on

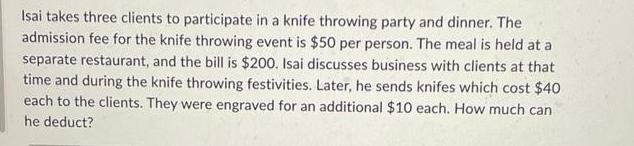

During the year, Collin, (a self-employed tax consultant) travelled from Ohio to Belgium on business. He spent seven days on business, two days on travel, and five days on vacation. Collin's expenses are: Airfare $2,500 Lodging $2,000 ($400 per day) Entertainment (concert tickets for clients and himself) $600 How much can he deduct for travel expenses? Isai takes three clients to participate in a knife throwing party and dinner. The admission fee for the knife throwing event is $50 per person. The meal is held at a separate restaurant, and the bill is $200. Isai discusses business with clients at that time and during the knife throwing festivities. Later, he sends knifes which cost $40 each to the clients. They were engraved for an additional $10 each. How much can he deduct?

Step by Step Solution

★★★★★

3.59 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Collins Travel Expenses Deduction Collin can deduct his travel expenses that are direct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started