Answered step by step

Verified Expert Solution

Question

1 Approved Answer

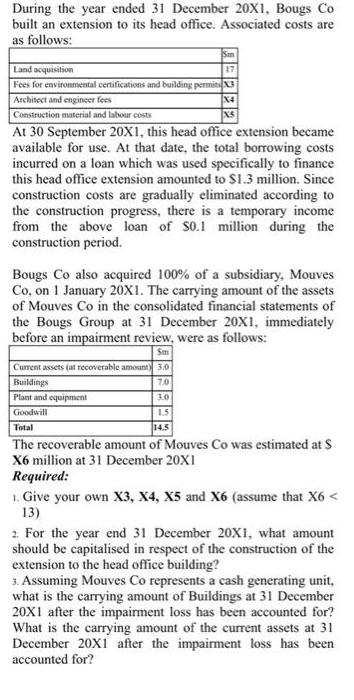

During the year ended 31 December 20X1. Bougs Co built an extension to its head office. Associated costs are as follows: Sm Land acquisition

During the year ended 31 December 20X1. Bougs Co built an extension to its head office. Associated costs are as follows: Sm Land acquisition 17 Fees for environmental certifications and building permit X3 X4 XS Architect and engineer fees Construction material and labour costs At 30 September 20X1, this head office extension became available for use. At that date, the total borrowing costs incurred on a loan which was used specifically to finance this head office extension amounted to $1.3 million. Since construction costs are gradually eliminated according to the construction progress, there is a temporary income from the above loan of $0.1 million during the construction period. Bougs Co also acquired 100% of a subsidiary, Mouves Co, on 1 January 20X1. The carrying amount of the assets of Mouves Co in the consolidated financial statements of the Bougs Group at 31 December 20X1, immediately before an impairment review, were as follows: Sm Current assets (at recoverable amount) 3.0 7.0 Buildings 3.0 Plant and equipment Goodwill 1.5 Total 14.5 The recoverable amount of Mouves Co was estimated at S X6 million at 31 December 20X1 Required: 1. Give your own X3, X4, X5 and X6 (assume that X6 < 13) 2. For the year end 31 December 20X1, what amount should be capitalised in respect of the construction of the extension to the head office building? 3. Assuming Mouves Co represents a cash generating unit, what is the carrying amount of Buildings at 31 December 20X1 after the impairment loss has been accounted for? What is the carrying amount of the current assets at 31 December 20X1 after the impairment loss has been accounted for?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Ans Give your own X3 X4 X5 and X6 assume that X6 12 X3 2 million X4 15 million X5 12 million X6 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started