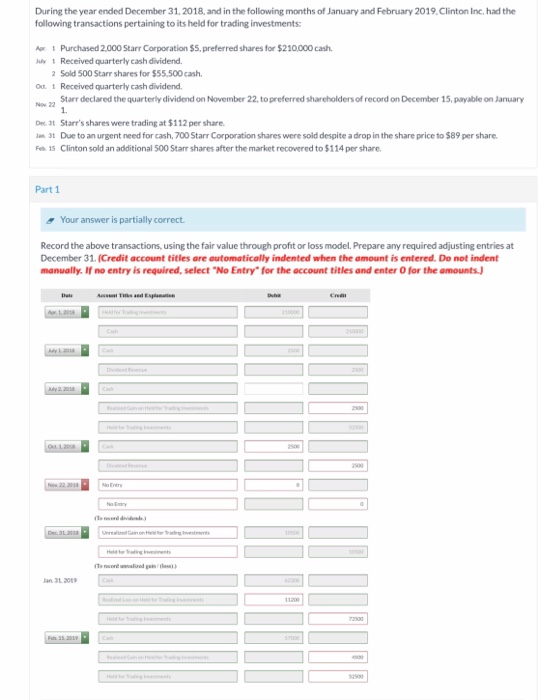

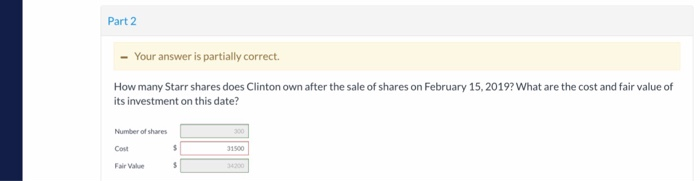

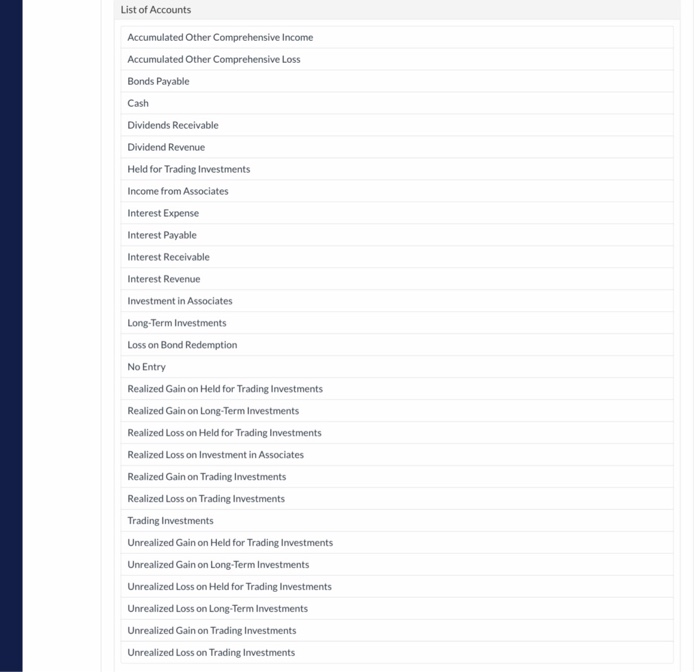

During the year ended December 31, 2018, and in the following months of January and February 2019. Clinton Inc. had the following transactions pertaining to its held for trading investments: Ar 1 Purchased 2.000 Starr Corporation $5, preferred shares for $210.000 cash Jhly Received quarterly cash dividend. 2 Sold 500 Starr shares for $55,500 cash. Oct 1 Received quarterly cash dividend. Starr declared the quarterly dividend on November 22, to preferred shareholders of record on December 15, payable on January Nov 22 1. Starr's shares were trading at $112 per share. Dec 31 Due to an urgent need for cash, 700 Starr Corporation shares were sold despite a drop in the share price to $89 per share. Jan 31 Feb 15 Clinton sold an additional 500 Starr shares after the market recovered to $114 per share. Part 1 Your answer is partially correct Record the above transactions, using the fair value through profit or loss model. Prepare any required adjusting entries at December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Acc Tis and Esp Duba Crea Apr1,20 Tg 21000 210000 Cash y2 Divnd R y220 Ca ne 2500 He e Oct 1,2008 C 2500 D e 200 Now 22 20 NoEtry No Entry d didesh) Dec. 31 2 Unreand Gain on He r ingIvestes Held forag t T cord ualioed gain ass) Jan 31, 201 11200 7200 F 15.2019 Ca Part 2 Your answer is partially correct. How many Starr shares does Clinton own after the sale of shares on February 15, 2019? What are the cost and fair value of its investment on this date? Number of shares 300 Cost 31500 Fair Value 34200 List of Accounts Accumulated Other Comprehensive Income Accumulated Other Comprehensive Loss Bonds Payable Cash Dividends Receivable Dividend Revenue Held for Trading Investments Income from Associates Interest Expense Interest Payable Interest Receivable Interest Revenue Investment in Associates Long-Term Investments Loss on Bond Redemption No Entry Realized Gain on Held for Trading Investments Realized Gain on Long-Term Investments Realized Loss on Held for Trading Investments Realized Loss on Investment in Associates Realized Gain on Trading Investments Realized Loss on Trading Investments Trading Investments Unrealized Gain on Held for Trading Investments Unrealized Gain on Long-Term Investments Unrealized Loss on Held for Trading Investments Unrealized Loss on Long-Term Investments Unrealized Gain on Trading Investments Unrealized Loss on Trading Investments