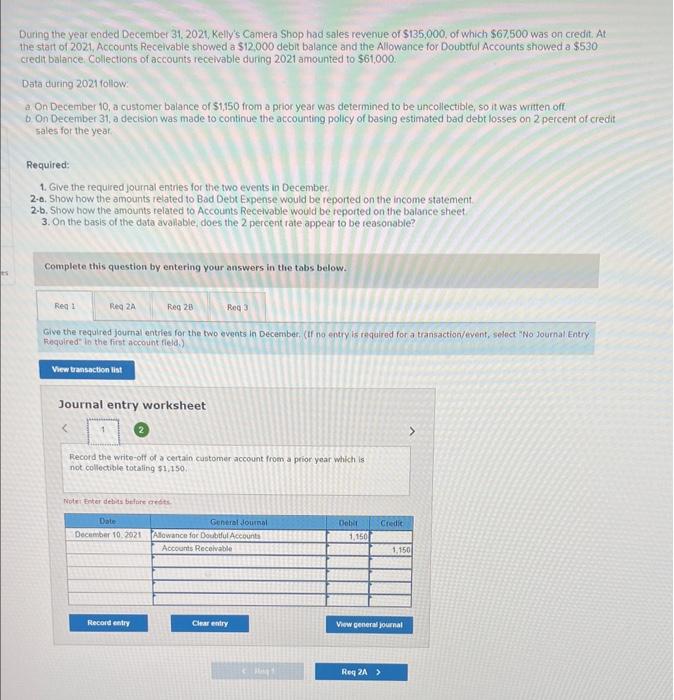

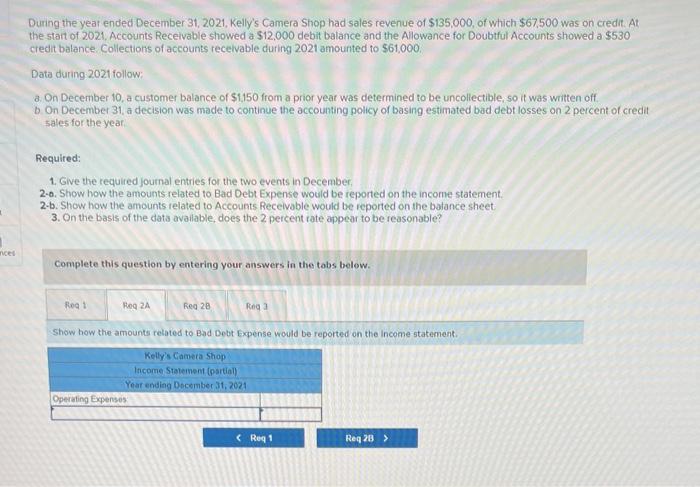

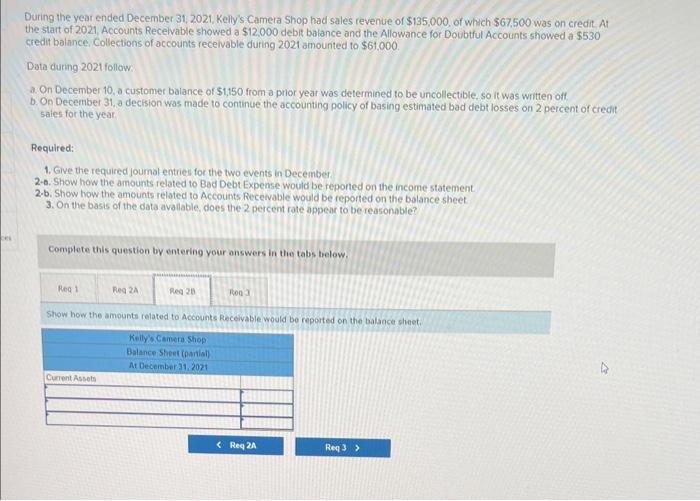

During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $135,000, of which $67.500 was on credit. At the stait of 2021. Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtrul Accounts showed a $530 credit balance, Collections of accounts receivable during 2021 amounted to $61,000 Data during 2021 foltow: a On December 10, a customer balance of $1,450 from a ptior year was determined to be uncollectible, so it was written off b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December 2.a. Show how the amounts related to Bad Debt Expense would be reported on the income statement 2-b. Show how the amounts related to Accounts Recelvoble would be reported on the balance sheet 3. On the basis of the data avallable, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. Give the requlred journal entrles for the two events in December, (tf no entry is maquired for a transaction/event, select "No Journal Entry. Froquired" io the first account field.) Journal entry worksheet Record the write-off of a certain customer account from a prior year which is not collectible totaling $1,150. router Enter debids befare iredts. During the yeat ended December 31, 2021, Kelly's Camera Shop had sales revenue of $135,000, of which $67,500 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $530 credit balance. Collections of accounts recelvable during 2021 amounted to $61,000. Data during 2021 follow: a. On December 10, a customer balance of $1.150 from a prior yeat was determined to be uncollectible, so it was written off b On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year Required: 1. Give the required journal entries for the two events in December. 2-0. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Recelvable would be reported on the batance sheet 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. Show how the amounts related to Bad Debt Expense would be reported on the Income statement. During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $135,000, of which $67,500 was on credit. At the start of 2021 . Accounts Recelvable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $530 credit balance, Collections of accounts recelvable during 2021 amounted to $61,000. Data during 2021 follow. a. On December 10, a customer balance of $1,150 from a prior year was determined to be uncollectible, so li was written oft. b. On December 31, a deciston was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit saies for the year Required: 1. Give the required joumal entries for the two events in December 2-a. Show how the amounts related to Bad Debt Expense would be reponted on the income statement 2.b. Show how the amounts related to Accounts Recenable would be reported on the balance sheet. 3. On the basis of the data avallable, does the 2 percent rate appear to be reosonable? Complete this question by entering your answers in the tabs below. Show how the amounts related to Accounts Recelvable would be reported on the balsace shet: During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $135,000, of which $67,500 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $530 credit balance: Collections of accounts recelvable during 2021 amounted to $61,000 Date during 2021 follow a. On December 10, a customer balance of $1.150 from a prior year was determined to be uncollectible, so it was written off. b. On December 31 a decision was made to continue the accounting policy of basing estimated bad debt losses an 2 percent of credit sales for the year: Required: 1. Give the required journal entries for the two events in December 2-0. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2.b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet 3. On the basis of the data avalable, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. On the basis of the data avallable; does the 2 percent rate appear to be reaconable