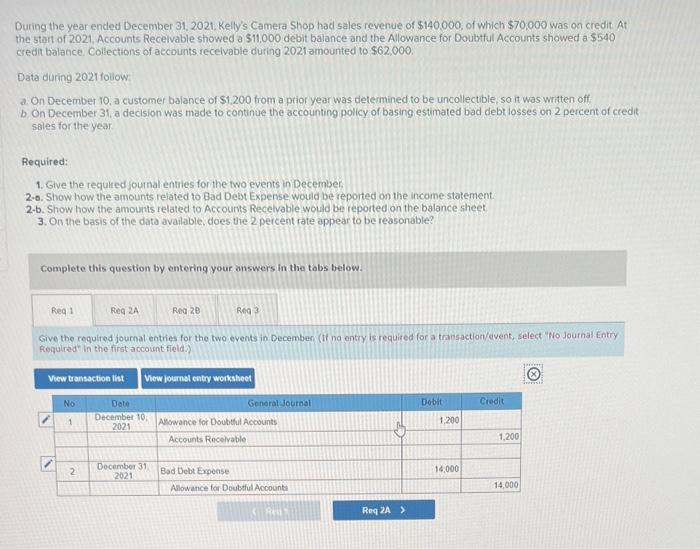

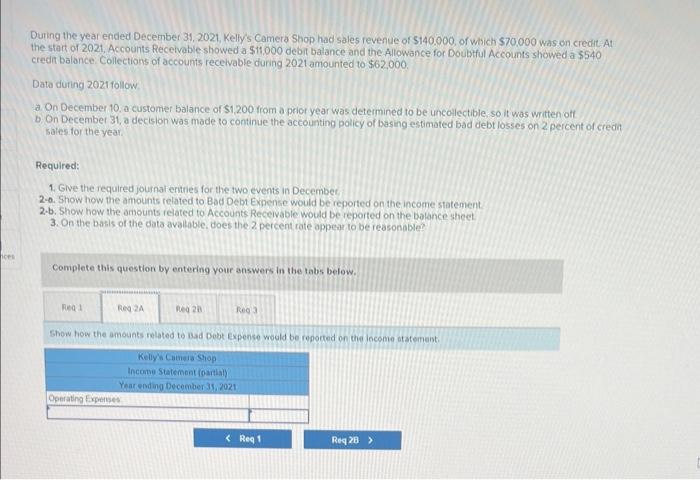

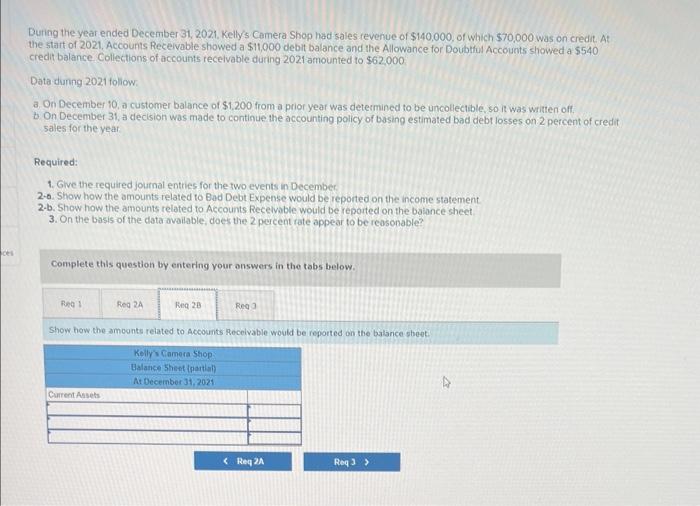

During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $140,000, of which $70,000 was on credit At the start of 2021. Accounts Recelvable showed a $11,000 debit balance and the Allowance for Doubtful Accounts showed a $540 credit balance. Collections of accounts recelvable during 2021 amounted to $62,000. Data during 2021 follow a. On December 10, a customer balance of $1,200 from a prior year was determined to be uncollectible, so it was written off. b, On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit siles for the year Required: 1. Give the required journal entries for the two events in December. 2-6. Show how the amounts related to Bad Debt Expense would be reported on the income statement 2.b. Show how the amounts related to Accounts Recelvable would be reported on the balance sheet 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. Give the required joumal entries for the two events in Decemben (It no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) During the year ended December 31, 2021. Kelly's Camera Shop had sales revenue or 5140.000 , of which $70.000 was on credit: At the start of 2021, Accounts Receivable showed a $11,000 debit balance and the Allowance for Doubtful Accounts showed a $540 credit balonce. Collections of accounts recelvable danng 2021 amounted to $62000 Data during 2021 follow a. On December 10. a customer balance of $1,200 from a prior year was determined to be uncollectible, so it was written oft b On Decembet 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credn sales for the year. Required: 1. Give the required journat enties for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement 2.b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis ot the data avalable, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. Show how the amounts related to Bad Dobt Expense would be repotted on the income atatement. During the year ended December 31, 2021. Kelly's Camera Shop had sales revenue of $140,000, of which $70,000 was on credit. At the start of 2021, Accounts Recelvable showed a $11,000 debit balance and the Allowance for Doubtful Accounts showed a $540 credit balance. Collections of accounts recelvable during 2021 amounted to $62000 Data dunng 2021 toliow: a. On December 10, a customer balance of $1,200 from a prior year was determined to be uncollectible, so it was written oft b On December 31 , a decision was made to continue the accounting policy of basing estimated bad debt losses on. 2 percent of credit sales for the year Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Recelvoble would be reported on the baiance sheet 3. On the basis of the data ovaiable, does the 2 percent rate appear to be reasonable? Complete this question by entering your onswers in the tabs below. Show how the amoonte related to Accounts Receivable would be reported on the balance sbeet: During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $140,000, of which $70,000 was on credit. At the start of 2021, Accounts Receivable showed a \$11,000 debit balance and the Allowance for Doubtful Accounts showed a $540 credit balance. Collections of accounts recelvable during 2021 amounted to $62,000 Data during 2021 follow a. On December 10, a customer balance of $1,200 from a prior year was determined to be uncollectible, so it was written off b On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the yeat. Required: 1. Give the required journal entries for the two events in December 2-0. Show how the amounts related to Bad Debi Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Recelvable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in the tabs below. On the basis of the data available, does the 2 percent rate appoar to be reabonable