Answered step by step

Verified Expert Solution

Question

1 Approved Answer

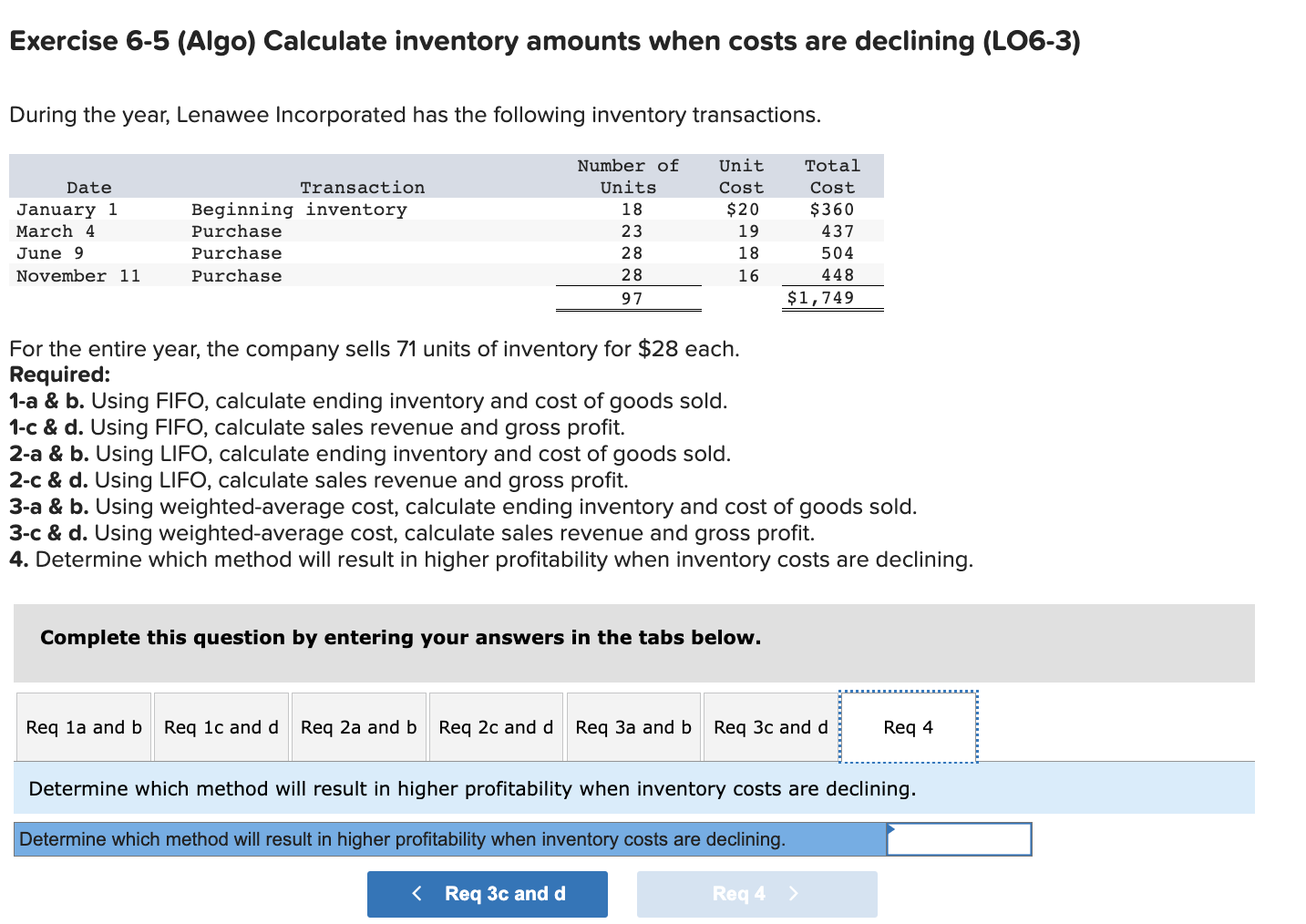

During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase

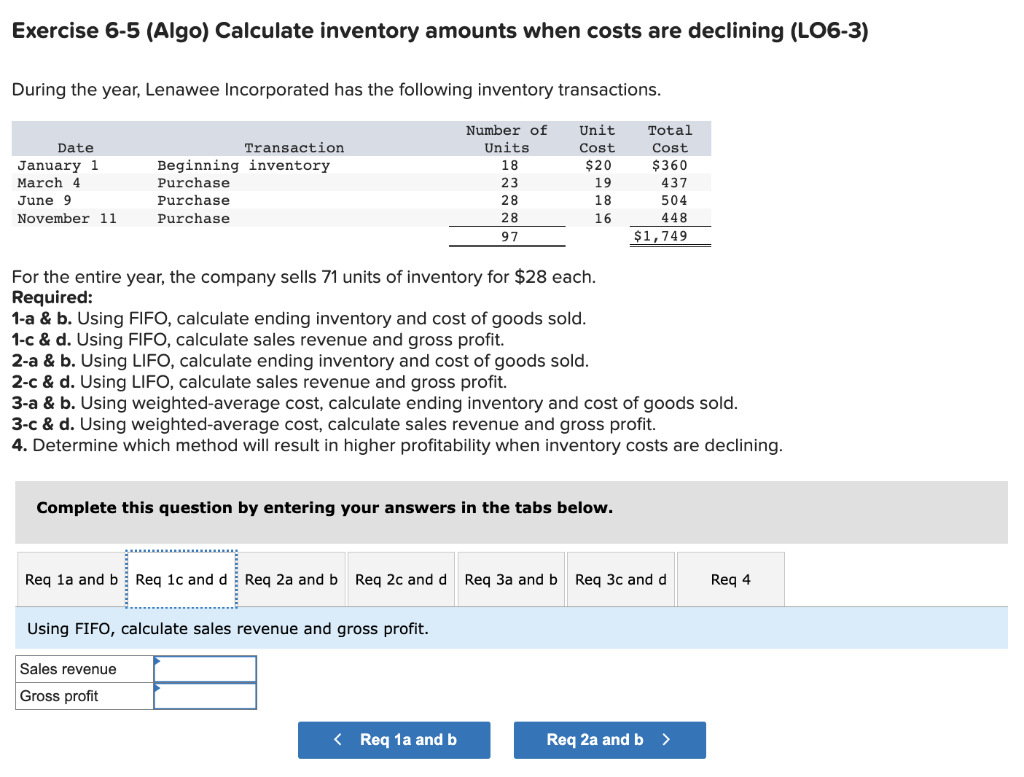

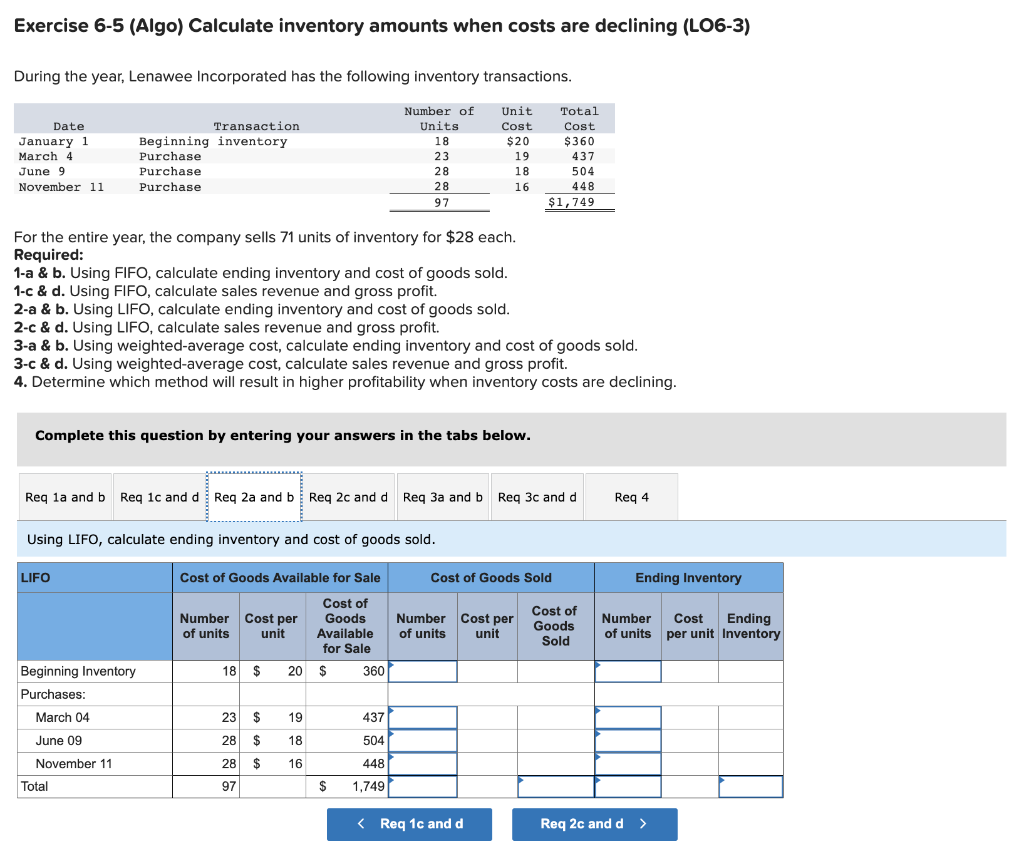

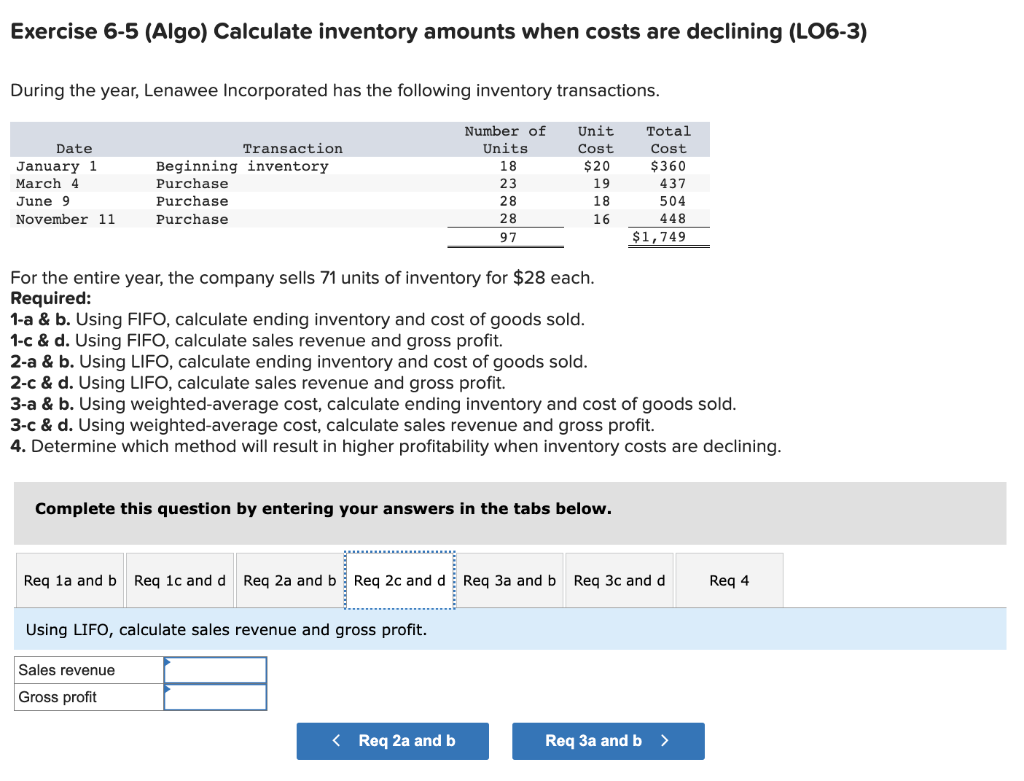

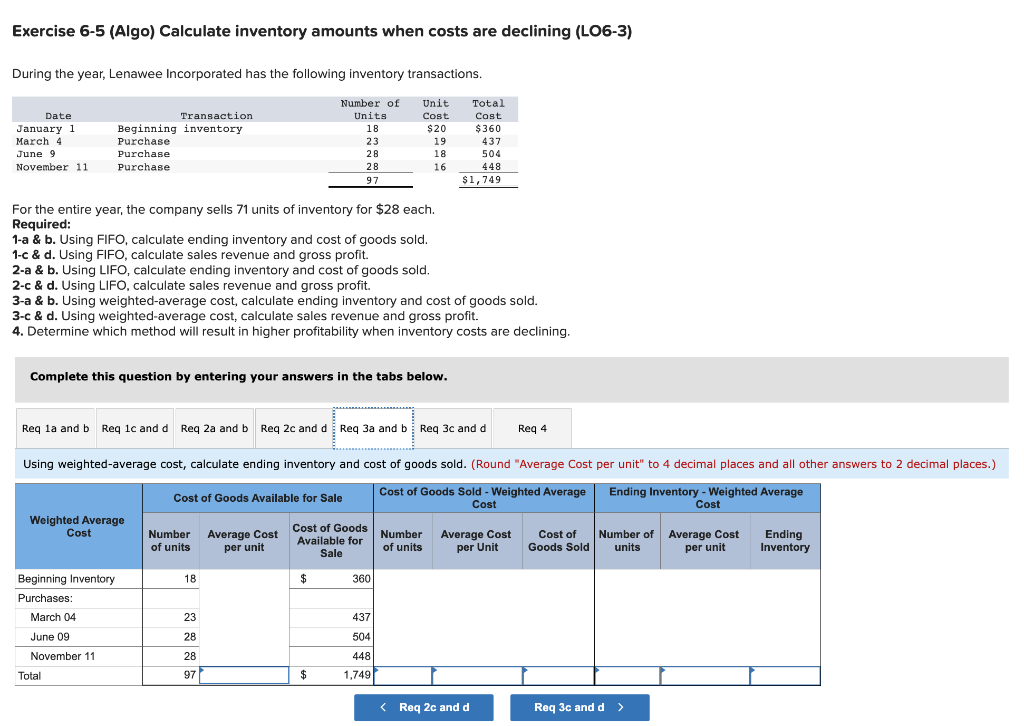

During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase For the entire year, the company sells 71 units of inventory for $28 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Beginning Inventory Purchases: March 04 June 09 November 11 Complete this question by entering your answers in the tabs below. Total Req la and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Using FIFO, calculate ending inventory and cost of goods sold. FIFO Cost of Goods Available for Sale Cost of Goods Available for Sale Number Cost per of units unit Number of Units 18 23 18 $ 20 $ 23 $ 28 $ 18 28 $ 97 19 986 28 28 97 16 $ Unit Total Cost Cost $20 $360 19 437 18 504 16 448 $1,749 360 437 504 448 1.749 Cost of Goods Sold Number Cost per of units unit Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO06-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase Number of Units 18 23 28 28 97 For the entire year, the company sells 71 units of inventory for $28 each. Required: Unit Total Cost Cost $20 $360 19 18 16 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. Using FIFO, calculate sales revenue and gross profit. Sales revenue Gross profit 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Complete this question by entering your answers in the tabs below. < Req 1a and b 437 504 448 $1,749 Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Req 2a and b > Req 4 Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO6-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase For the entire year, the company sells 71 units of inventory for $28 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. LIFO Complete this question by entering your answers in the tabs below. Using LIFO, calculate ending inventory and cost of goods sold. Beginning Inventory Purchases: March 04 June 09 November 11 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Total Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Cost of Goods Available for Sale Cost of Goods Available for Sale Number Cost per of units unit 18 $ Number of Units 18 23 28 28 97 20 $ 23 $ 19 28 $ 18 $ 16 28 97 Unit Cost $20 $ 360 19 18 16 437 504 448 1,749 < Req 1c and d Total Cost $360 437 504 448 $1,749 Cost of Goods Sold Number Cost per of units unit Cost of Goods Sold Req 4 Ending Inventory Number Cost Ending of units per unit Inventory Req 2c and d > Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO6-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase Number of Units 18 23 28 28 97 For the entire year, the company sells 71 units of inventory for $28 each. Required: Unit Cost $20 Using LIFO, calculate sales revenue and gross profit. Sales revenue Gross profit 19 18 16 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Complete this question by entering your answers in the tabs below. < Req 2a and b Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Total Cost $360 437 504 448 $1,749 Req 3a and b > Req 4 Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO6-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4. June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase For the entire year, the company sells 71 units of inventory for $28 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Complete this question by entering your answers in the tabs below. Weighted Average Cost Total Req la and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Beginning Inventory Purchases: March 04 June 09 November 11 Using weighted-average cost, calculate ending inventory and cost of goods sold. (Round "Average Cost per unit" to 4 decimal places and all other answers to 2 decimal places.) Cost of Goods Sold - Weighted Average Cost Ending Inventory - Weighted Average Cost Number of Units 18 23 28 28 97 Cost of Goods Available for Sale Number of units 18 23 28 28 97 Average Cost per unit Unit Cost $20 19 18 16 Cost of Goods Available for Sale $ $ 360 Total Cost $360 437 504 448 $1,749 437 504 448 1,749 Number of units Average Cost per Unit Req 4 < Req 2c and d Cost of Goods Sold Number of Average Cost units per unit Req 3c and d > Ending Inventory Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO6-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase Number of Units 18 23 28 28 97 For the entire year, the company sells 71 units of inventory for $28 each. Required: Unit Cost $20 19 18 16 Sales revenue Gross profit Complete this question by entering your answers in the tabs below. 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. < Req 3a and b Total Cost $360 437 504 448 $1,749 Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Using weighted-average cost, calculate sales revenue and gross profit. (Round answers to 2 decimal places.) Req 4 > Req 4 Exercise 6-5 (Algo) Calculate inventory amounts when costs are declining (LO6-3) During the year, Lenawee Incorporated has the following inventory transactions. Date January 1 March 4 June 9 November 11 Transaction Beginning inventory. Purchase Purchase Purchase Number of Units 18 23 28 28 97 Unit Cost $20 19 18 16 For the entire year, the company sells 71 units of inventory for $28 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. Total Cost $360 437 504 448 $1,749 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Complete this question by entering your answers in the tabs below. Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Determine which method will result in higher profitability when inventory costs are declining. Determine which method will result in higher profitability when inventory costs are declining. < Req 3c and d Req 4 > Req 4

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started