Question

During the year, Maura rented her vacation home for 12 days for $3,500 and she used it personally for three months. The following expenses

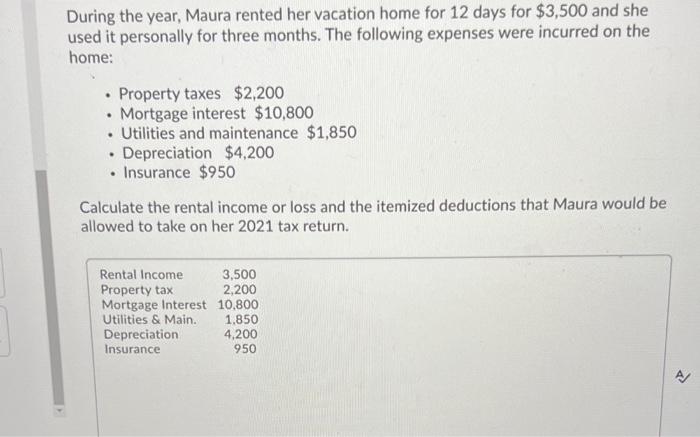

During the year, Maura rented her vacation home for 12 days for $3,500 and she used it personally for three months. The following expenses were incurred on the home: Property taxes $2,200 . Mortgage interest $10,800 . Utilities and maintenance $1,850 Depreciation $4,200 Insurance $950 Calculate the rental income or loss and the itemized deductions that Maura would be allowed to take on her 2021 tax return. Rental Income 3,500 Property tax 2,200 Mortgage Interest 10,800 Utilities & Main. 1,850 4,200 Depreciation Insurance 950

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Rental Income Property Tax Mortgage Interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2015

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

38th Edition

978-1305310810, 1305310810, 978-1285439631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App