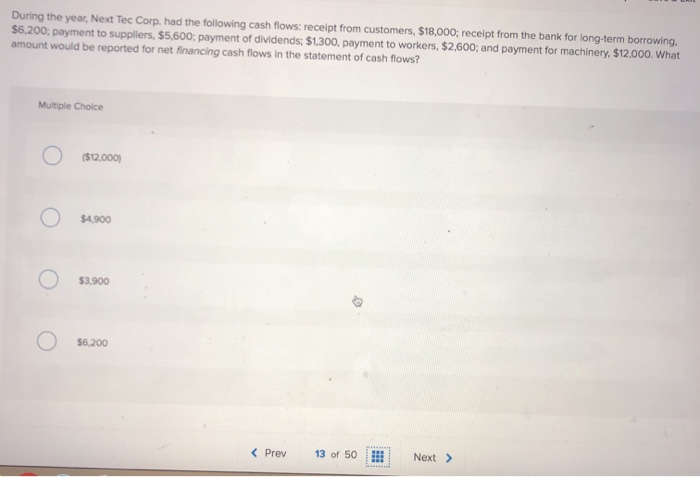

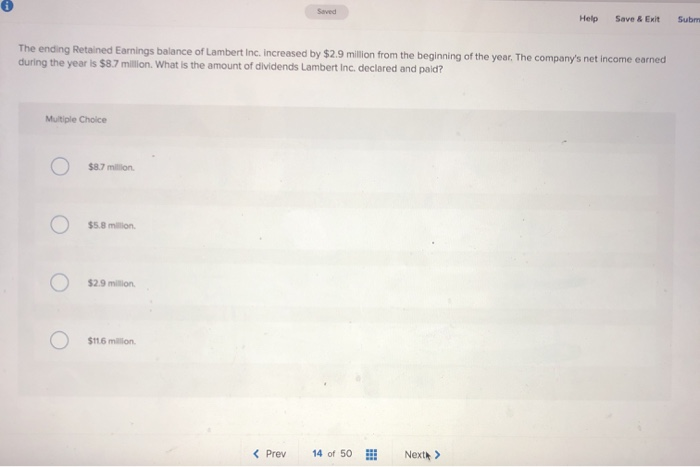

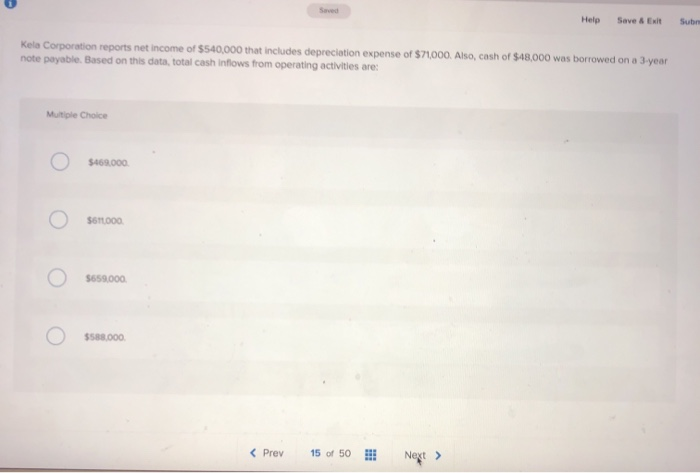

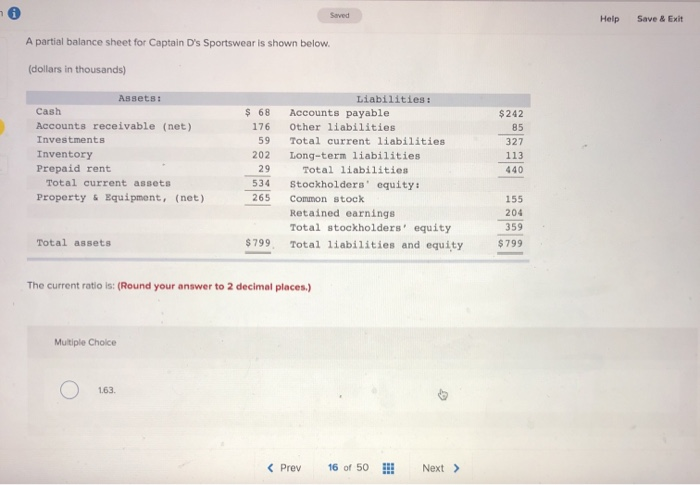

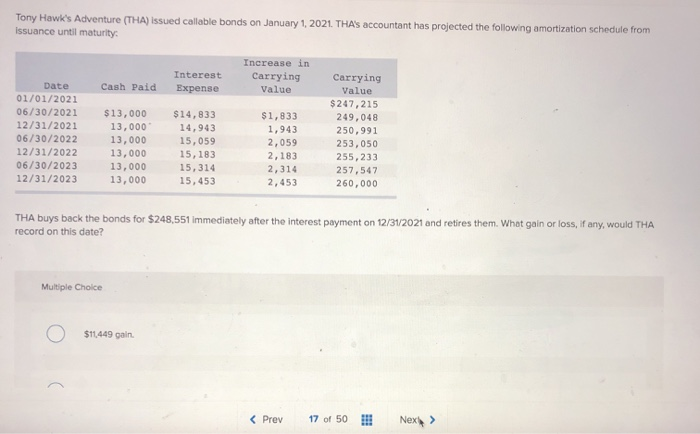

During the year, Next Tec Corp. had the following cash flows: receipt from customers, $18,000; receipt from the bank for long-term borrowing, $6.200, payment to suppliers, 55,600; payment of dividends, $1,300, payment to workers, $2,600; and payment for machinery, $12,000. What amount would be reported for net financing cash flows in the statement of cash flows? Multiple Choice O $12.000 $4.900 $3.900 $6,200 Saved Help Save & Exit Subm The ending Retained Earnings balance of Lambert Inc. increased by $2.9 million from the beginning of the year. The company's net income earned during the year is $8.7 million. What is the amount of dividends Lambert Inc. declared and paid? Multiple Choice $8.7 million $5.8 million $2.9 million $115 millon Saved Help Save & Exit Sub Kela Corporation reports net income of $540,000 that includes depreciation expense of $71000. Also, cash of $48,000 was borrowed on a 3-year note payable. Based on this data, total cash inflows from operating activities are Multiple Choice $469.000 $611000 $659.000 $588.000 Saved Help Save & Exit A partial balance sheet for Captain D's Sportswear is shown below. (dollars in thousands) $ 68 176 59 Assets: Cash Accounts receivable (net) Investments Inventory Prepaid rent Total current assets Property & Equipment, (net) $ 242 85 327 113 440 202 29 Liabilities: Accounts payable Other liabilities Total current liabilities Long-term liabilities Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and equity 534 265 155 204 359 $ 799 Total assets $ 799 The current ratio is: (Round your answer to 2 decimal places) Multiple Choice 163 Tony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Increase in Carrying Value Interest Expense Cash Paid Date 01/01/2022 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 $13,000 13,000 13,000 13,000 13,000 13,000 $14,833 14,943 15,059 15,183 15,314 15, 453 $1,833 1,943 2,059 2,183 2,314 2,453 Carrying Value $247,215 249,048 250,991 253,050 255,233 257,547 260,000 THA buys back the bonds for $248,551 immediately after the interest payment on 12/31/2021 and retires them. What gain or loss, if any, would THA record on this date? Multiple Choice $11.449 gain