Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the year, Portal Corp. received $100,000 in dividends from Sal Corp., its 80%-owned subsidiary. What net amount of dividend income should Portal include

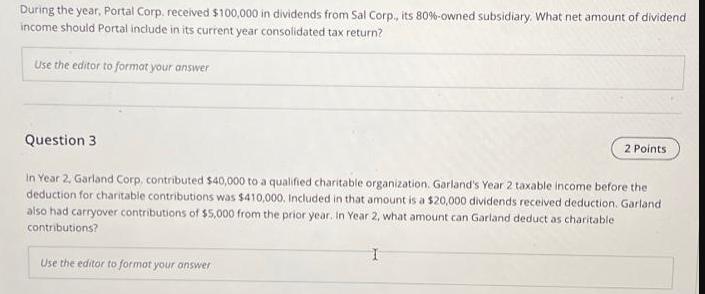

During the year, Portal Corp. received $100,000 in dividends from Sal Corp., its 80%-owned subsidiary. What net amount of dividend income should Portal include in its current year consolidated tax return? Use the editor to format your answer Question 3 In Year 2, Garland Corp, contributed $40,000 to a qualified charitable organization. Garland's Year 2 taxable income before the deduction for charitable contributions was $410,000. Included in that amount is a $20,000 dividends received deduction. Garland also had carryover contributions of $5,000 from the prior year. In Year 2, what amount can Garland deduct as charitable contributions? Use the editor to format your answer 2 Points

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 Portal Corp as an 80owned subsidiary of Sal Corp received 100000 in dividends from Sal Corp To determine the net amount of dividend income that Portal should include in its current year con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started