Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the year, Pro-Con, Inc., purchased the three assets described as follows: Heavy Equipment (used): Purchase price $ 300,000 Expected useful life 8 years

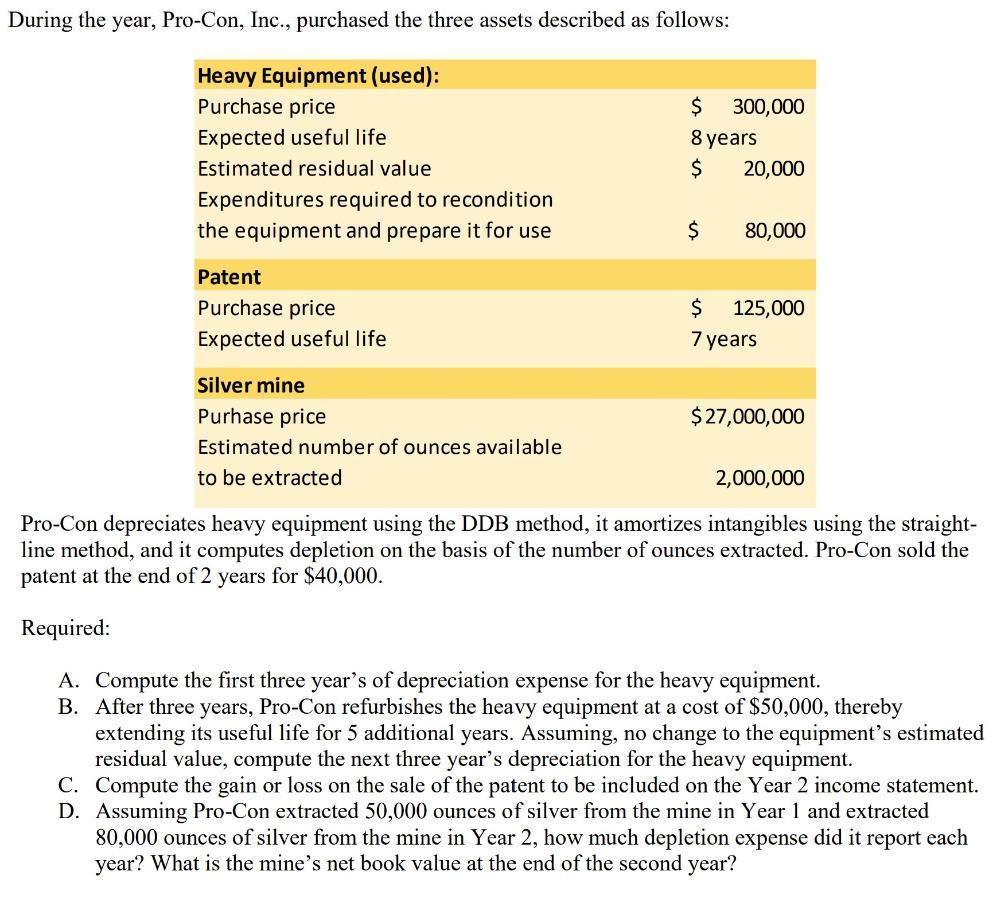

During the year, Pro-Con, Inc., purchased the three assets described as follows: Heavy Equipment (used): Purchase price $ 300,000 Expected useful life 8 years Estimated residual value $ 20,000 Expenditures required to recondition the equipment and prepare it for use $ 80,000 Patent Purchase price $ 125,000 Expected useful life 7 years Silver mine Purhase price $ 27,000,000 Estimated number of ounces available to be extracted 2,000,000 Pro-Con depreciates heavy equipment using the DDB method, it amortizes intangibles using the straight- line method, and it computes depletion on the basis of the number of ounces extracted. Pro-Con sold the patent at the end of 2 years for $40,000. Required: A. Compute the first three year's of depreciation expense for the heavy equipment. B. After three years, Pro-Con refurbishes the heavy equipment at a cost of $50,000, thereby extending its useful life for 5 additional years. Assuming, no change to the equipment's estimated residual value, compute the next three year's depreciation for the heavy equipment. C. Compute the gain or loss on the sale of the patent to be included on the Year 2 income statement. D. Assuming Pro-Con extracted 50,000 ounces of silver from the mine in Year 1 and extracted 80,000 ounces of silver from the mine in Year 2, how much depletion expense did it report each year? What is the mine's net book value at the end of the second year?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Rate of Dep 1useful life 18 1250 21250 25 Depreciation Depreciation Accumulated Net Book Va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started