Answered step by step

Verified Expert Solution

Question

1 Approved Answer

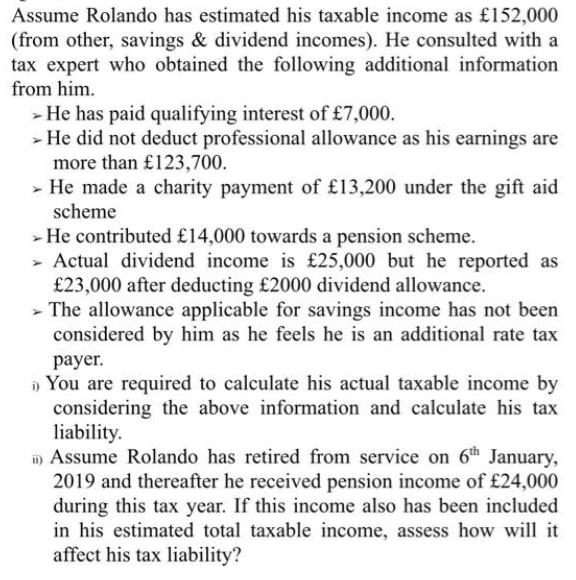

Assume Rolando has estimated his taxable income as 152,000 (from other, savings & dividend incomes). He consulted with a tax expert who obtained the

Assume Rolando has estimated his taxable income as 152,000 (from other, savings & dividend incomes). He consulted with a tax expert who obtained the following additional information from him. >He has paid qualifying interest of 7,000. >He did not deduct professional allowance as his earnings are more than 123,700. > He made a charity payment of 13,200 under the gift aid scheme > He contributed 14,000 towards a pension scheme. Actual dividend income is 25,000 but he reported as 23,000 after deducting 2000 dividend allowance. > The allowance applicable for savings income has not been considered by him as he feels he is an additional rate tax payer. You are required to calculate his actual taxable income by considering the above information and calculate his tax liability. ii) Assume Rolando has retired from service on 6th January, 2019 and thereafter he received pension income of 24,000 during this tax year. If this income also has been included in his estimated total taxable income, assess how will it affect his tax liability?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Rolandos taxable income is 152000 His tax liability i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started