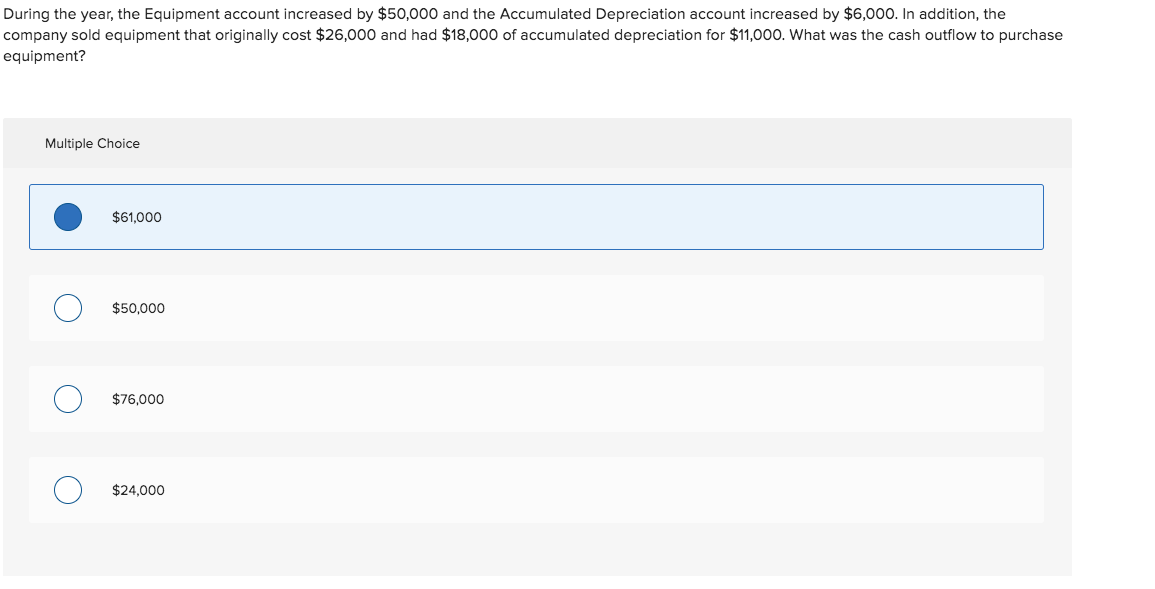

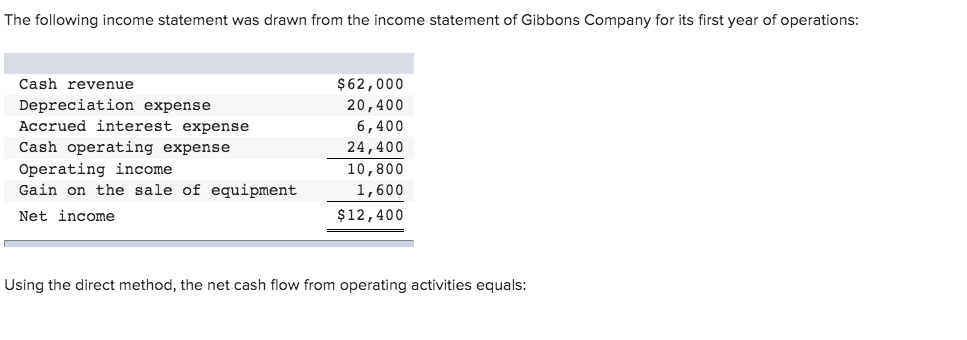

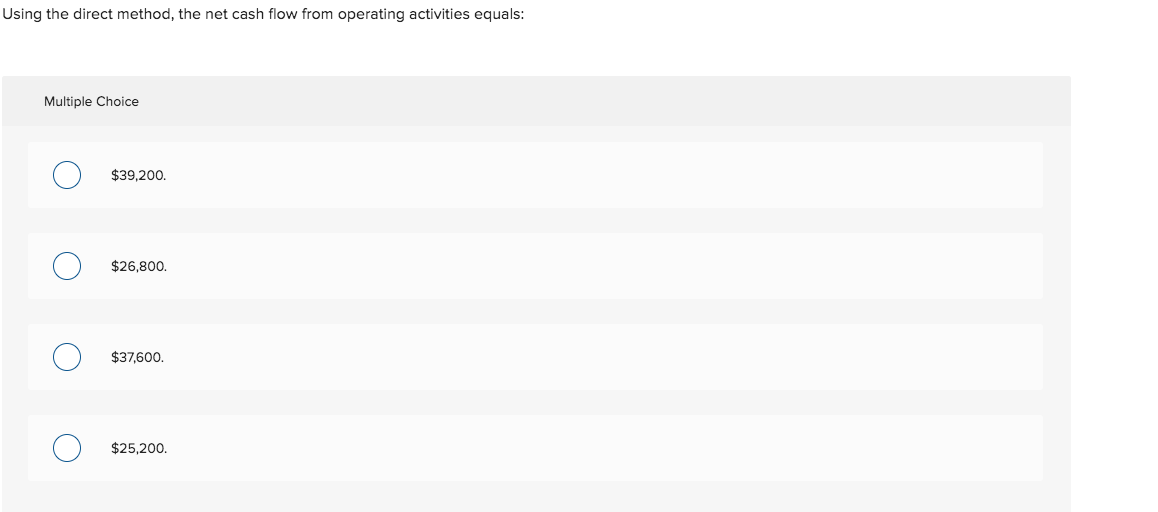

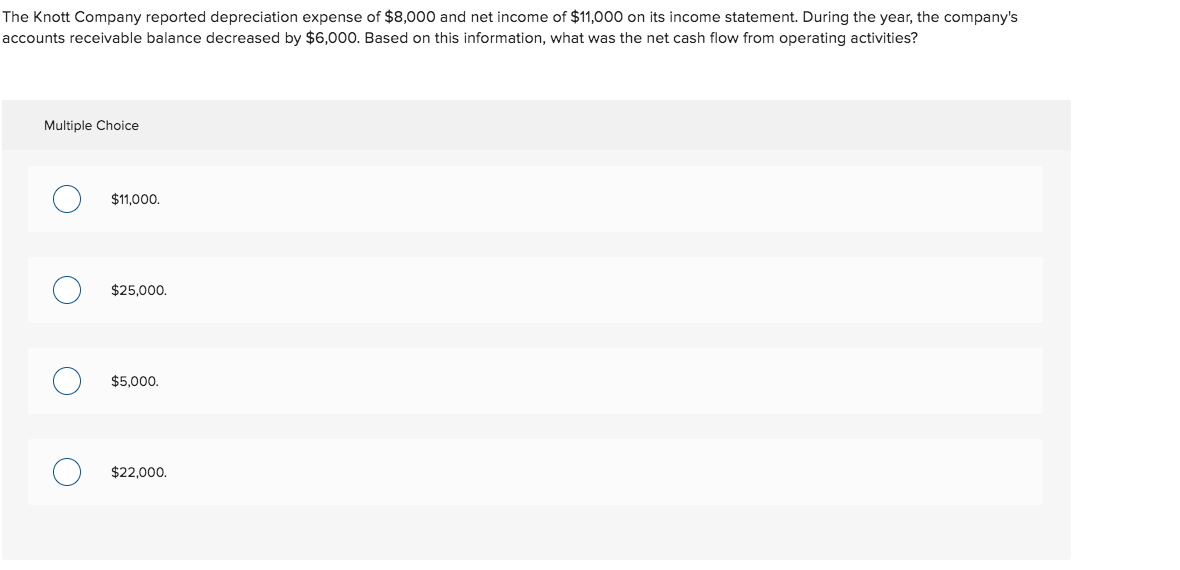

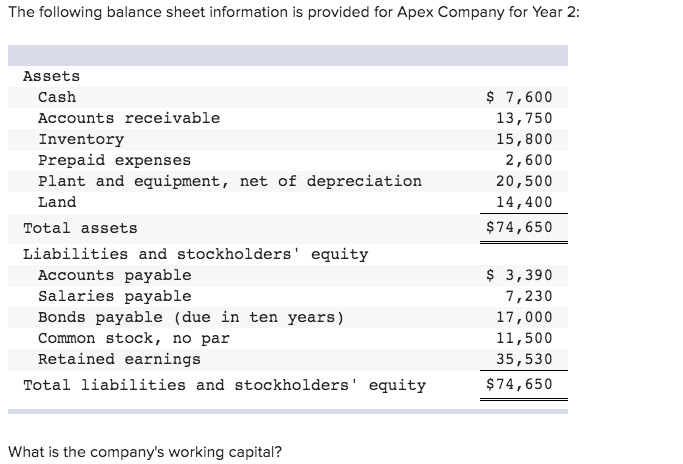

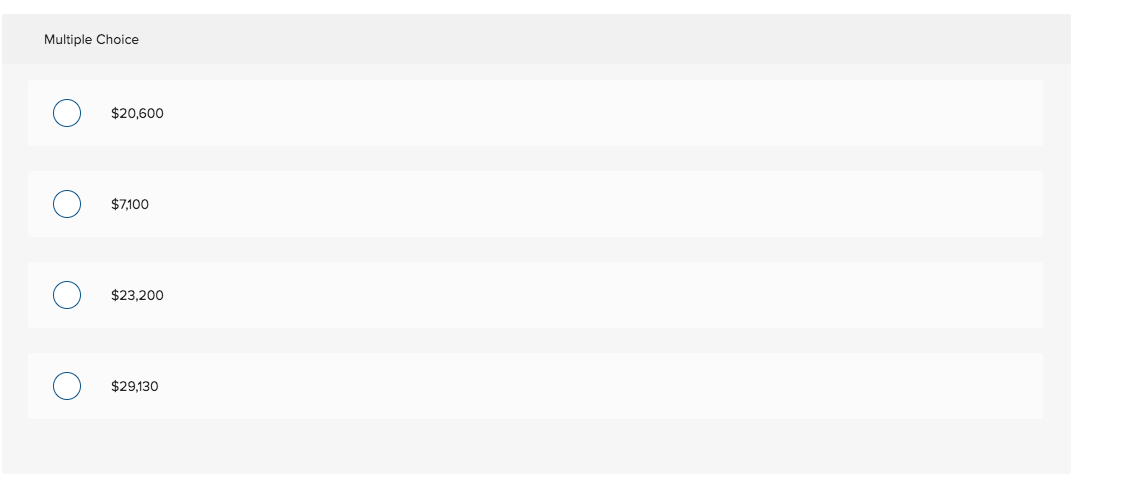

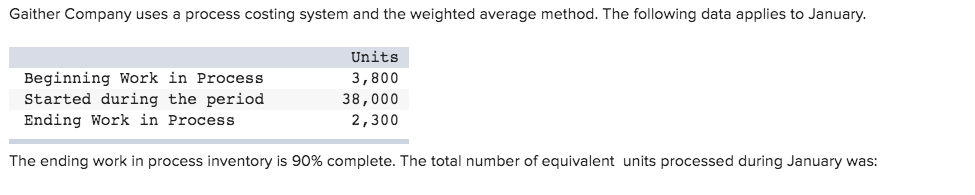

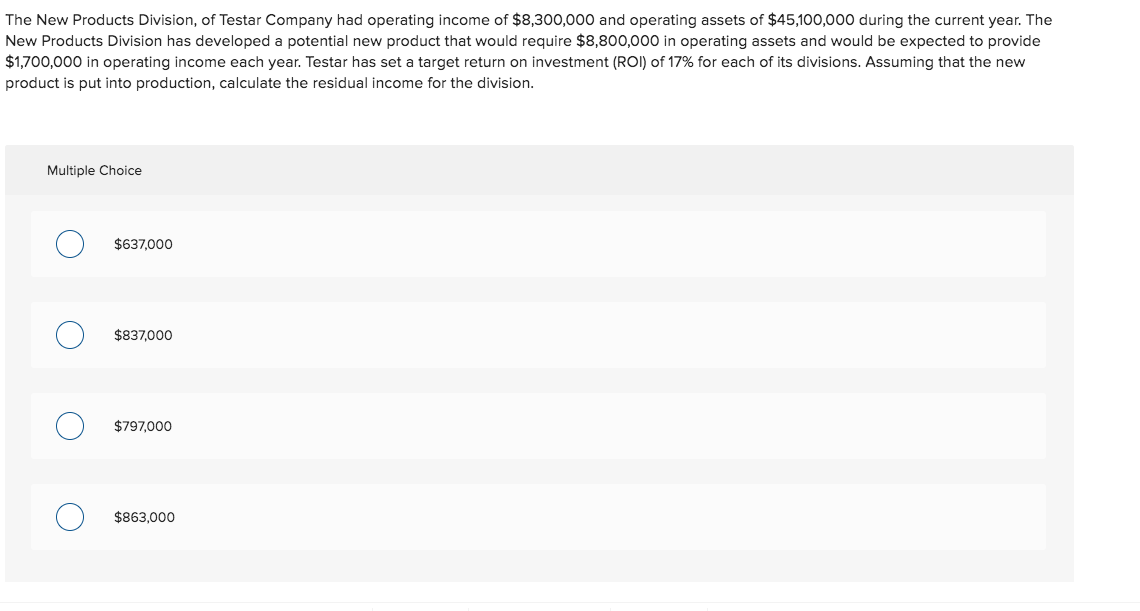

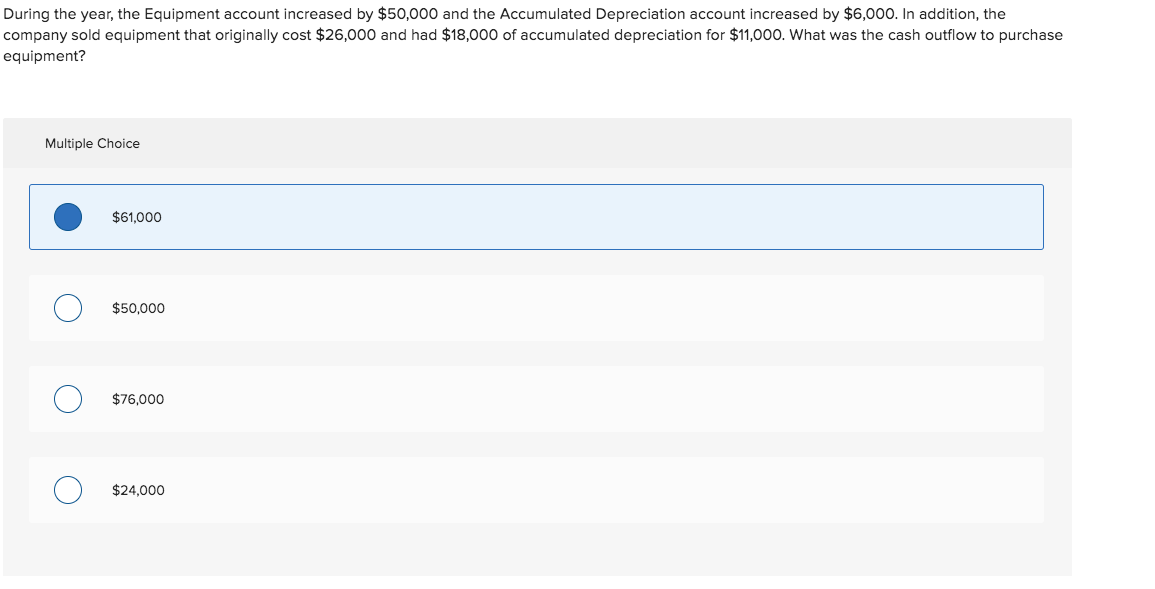

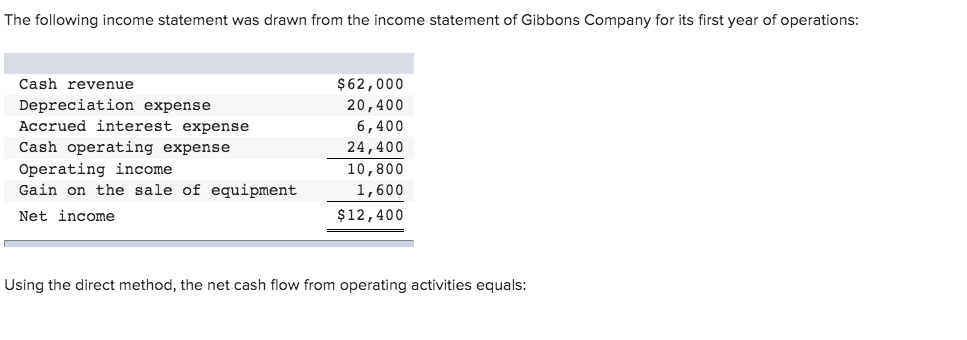

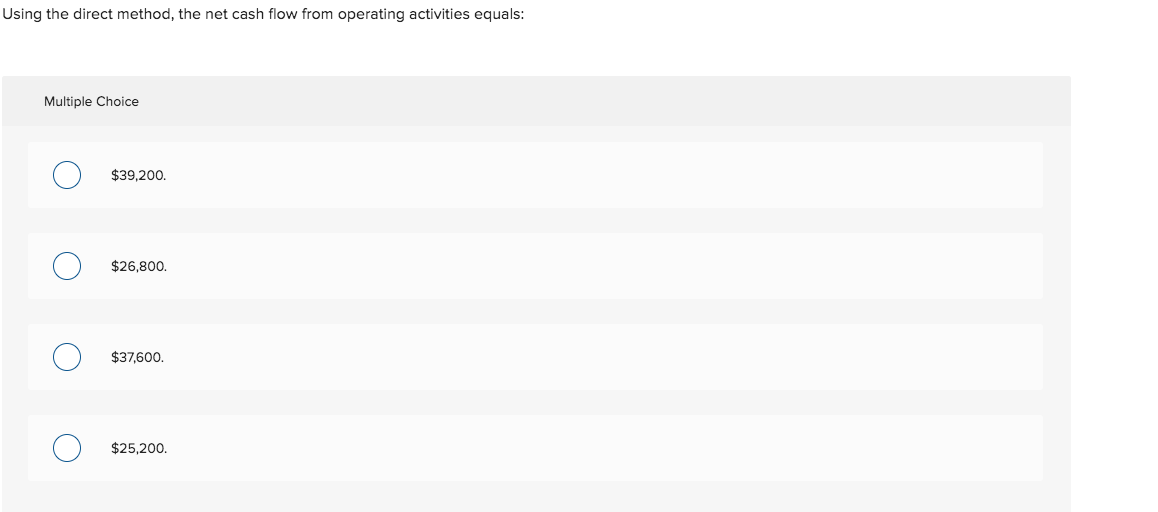

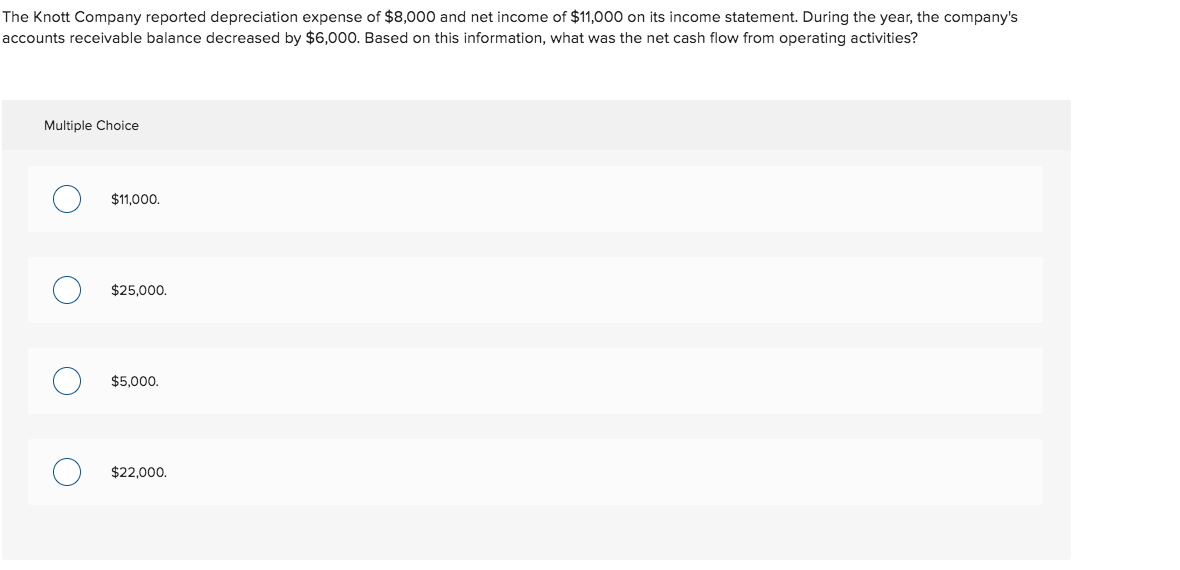

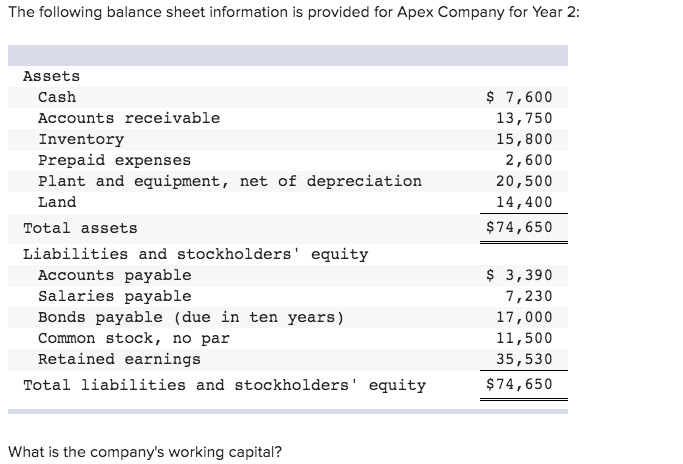

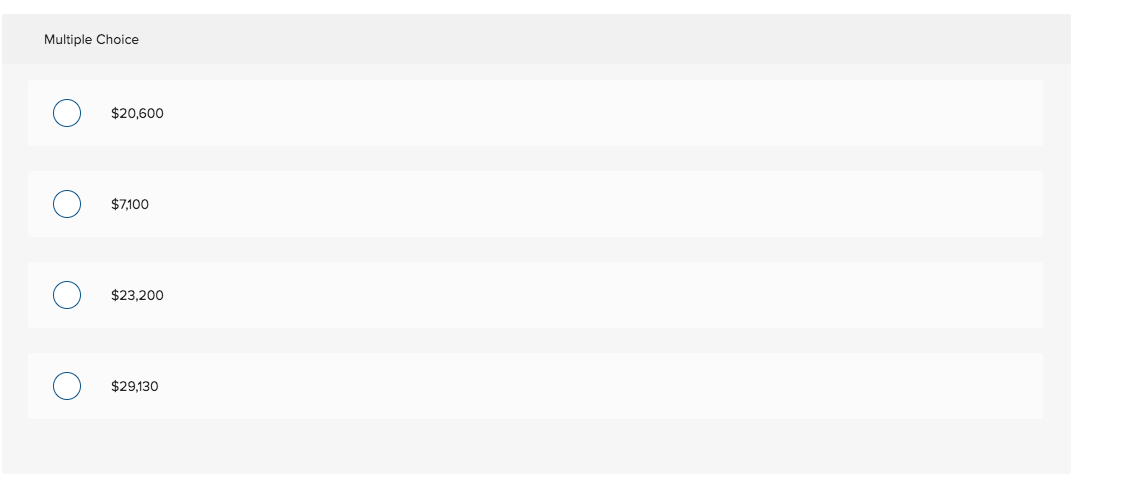

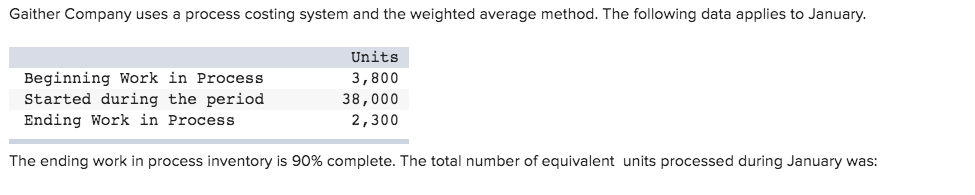

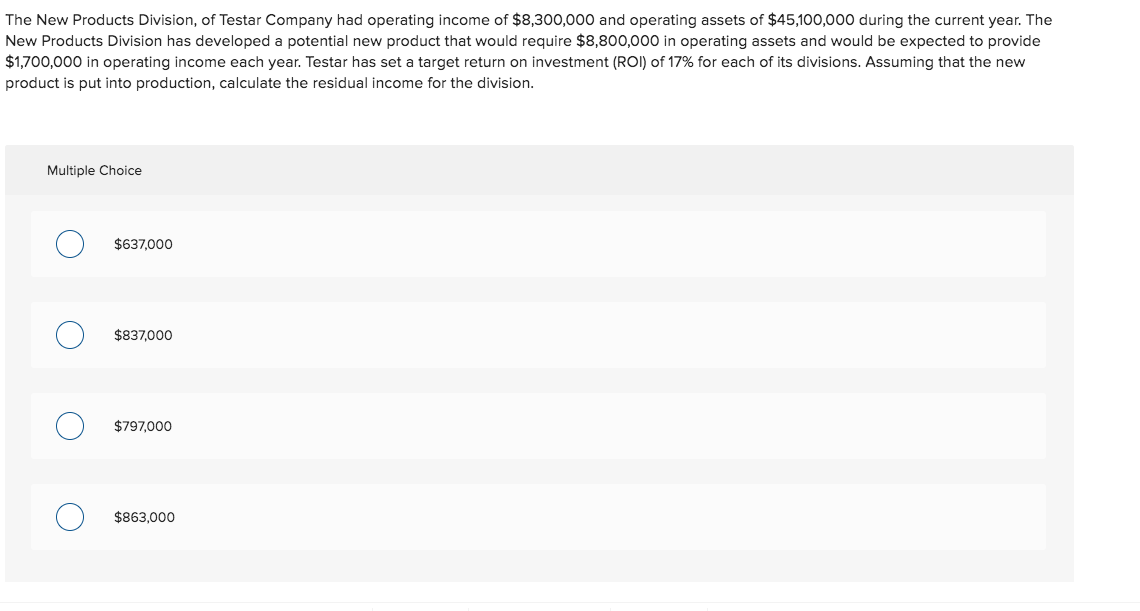

During the year, the Equipment account increased by $50,000 and the Accumulated Depreciation account increased by $6,000. In addition, the company sold equipment that originally cost $26,000 and had $18,000 of accumulated depreciation for $11,000. What was the cash outflow to purchase equipment? Multiple Choice $61,000 0 $50,000 0 $76,000 0 $24,000 The following income statement was drawn from the income statement of Gibbons Company for its first year of operations: Cash revenue Depreciation expense Accrued interest expense Cash operating expense Operating income Gain on the sale of equipment Net income $62,000 20,400 6,400 24,400 10,800 1,600 $12,400 Using the direct method, the net cash flow from operating activities equals: Using the direct method, the net cash flow from operating activities equals: Multiple Choice $39,200. $26,800. $37,600 $25,200. The Knott Company reported depreciation expense of $8,000 and net income of $11,000 on its income statement. During the year, the company's accounts receivable balance decreased by $6,000. Based on this information, what was the net cash flow from operating activities? Multiple Choice $11,000. O $25,000 O $5,000. $22,000. The following balance sheet information is provided for Apex Company for Year 2: Assets Cash Accounts receivable Inventory Prepaid expenses Plant and equipment, net of depreciation Land Total assets Liabilities and stockholders' equity Accounts payable Salaries payable Bonds payable (due in ten years) Common stock, no par Retained earnings Total liabilities and stockholders' equity $ 7,600 13,750 15,800 2,600 20,500 14,400 $ 74,650 $ 3,390 7,230 17,000 11,500 35,530 $ 74,650 What is the company's working capital? Multiple Choice o $20,600 o 57,100 o $23,200 o $29,130 Gaither Company uses a process costing system and the weighted average method. The following data applies to January. Beginning Work in Process Started during the period Ending Work in Process Units 3,800 38,000 2,300 The ending work in process inventory is 90% complete. The total number of equivalent units processed during January was: Multiple Choice o 37,430. o 39,500. o 41,800. o ) 41,570. The New Products Division, of Testar Company had operating income of $8,300,000 and operating assets of $45,100,000 during the current year. The New Products Division has developed a potential new product that would require $8,800,000 in operating assets and would be expected to provide $1,700,000 in operating income each year. Testar has set a target return on investment (ROI) of 17% for each of its divisions. Assuming that the new product is put into production, calculate the residual income for the division. Multiple Choice $637,000 0 $837,000 0 $797,000 0 $863,000