Question

During the year, the wiliams rented their vacation home for $60,000. They rented it for half the year, and used it for personal purposes the

During the year, the wiliams rented their vacation home for $60,000. They rented it for half the year, and used it for personal purposes the other half of the year. Costs associated with the home were:

Mortgage interest and taxes $20,000

Utilities, repairs, and misc. expenses $10,000

New Roof $30,000

New heating system $30000

Depreciation $2,000

Appraisers fee (to see how much their house might be worth) $2,000

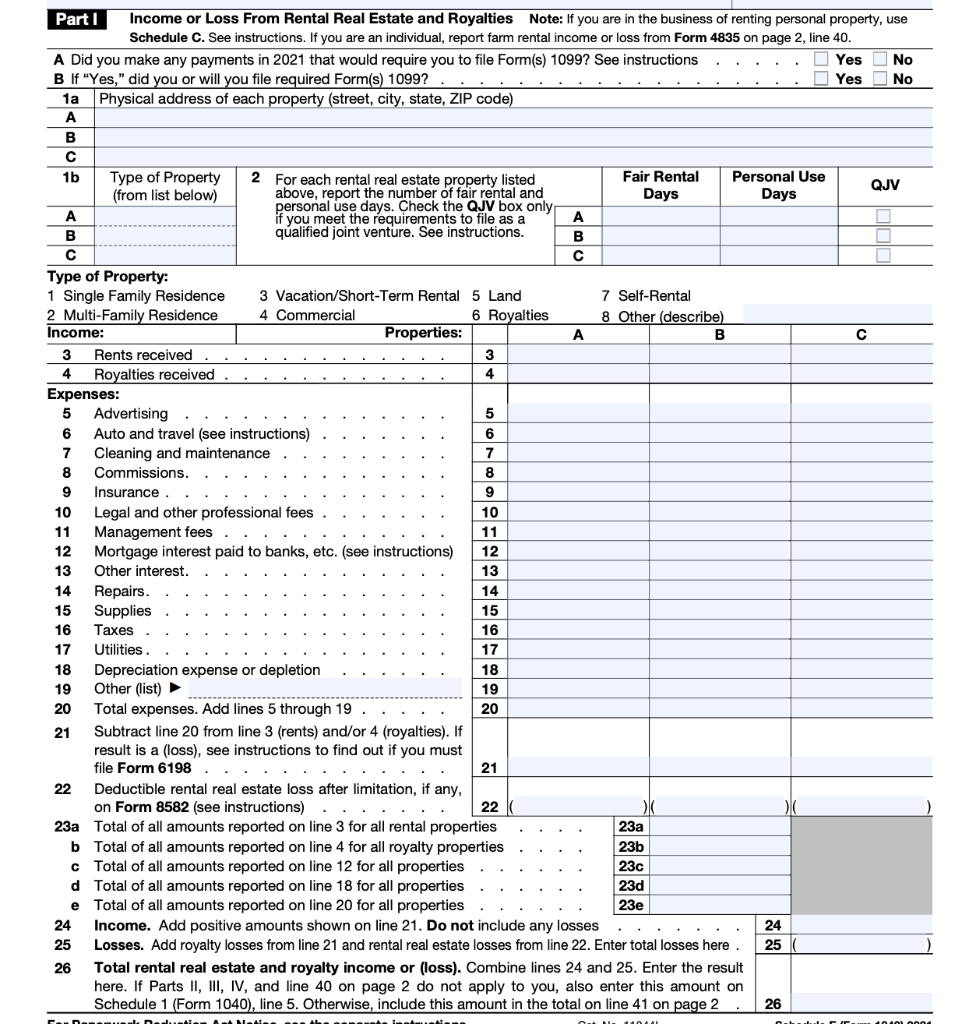

vacation home income and expense-- put on P1 of schedule E

please screenshot my screenshot and fill in the blanks. and explain to me how you did it.

Part Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions Yes No B If "Yes," did you or will you file required Form(s) 1099? Yes No 1a Physical address of each property (street, city, state, ZIP code) A B 1b Type of Property 2 For each rental real estate property listed Fair Rental Personal Use QJV (from list below) above, report the number of fair rental and Days Days personal use days. Check the QJV box only A if you meet the requirements to file as a A B qualified joint venture. See instructions. B C Type of Property: 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Income: Properties: B 3 Rents received 3 4 Royalties received 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 7 Cleaning and maintenance 7 8 Commissions. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest. 13 14 Repairs. 14 15 Supplies 15 16 Taxes 16 17 Utilities 17 18 Depreciation expense or depletion 18 19 Other (list) 19 20 Total expenses. Add lines 5 through 19 20 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Form 6198. 21 22 Deductible rental real estate loss after limitation, if any, on Form 8582 (see instructions) 22 KO 23a Total of all amounts reported on line 3 for all rental properties 23a b Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c d Total of all amounts reported on line 18 for all properties 23d Total of all amounts reported on line 20 for all properties 24 Income. Add positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here. 25 26 Total rental real estate and royalty income or loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2. 26 - - - - - - e 23e 1 na.....AM. . Part Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40. A Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions Yes No B If "Yes," did you or will you file required Form(s) 1099? Yes No 1a Physical address of each property (street, city, state, ZIP code) A B 1b Type of Property 2 For each rental real estate property listed Fair Rental Personal Use QJV (from list below) above, report the number of fair rental and Days Days personal use days. Check the QJV box only A if you meet the requirements to file as a A B qualified joint venture. See instructions. B C Type of Property: 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 7 Self-Rental 2 Multi-Family Residence 4 Commercial 6 Royalties 8 Other (describe) Income: Properties: B 3 Rents received 3 4 Royalties received 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 7 Cleaning and maintenance 7 8 Commissions. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest. 13 14 Repairs. 14 15 Supplies 15 16 Taxes 16 17 Utilities 17 18 Depreciation expense or depletion 18 19 Other (list) 19 20 Total expenses. Add lines 5 through 19 20 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must file Form 6198. 21 22 Deductible rental real estate loss after limitation, if any, on Form 8582 (see instructions) 22 KO 23a Total of all amounts reported on line 3 for all rental properties 23a b Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c d Total of all amounts reported on line 18 for all properties 23d Total of all amounts reported on line 20 for all properties 24 Income. Add positive amounts shown on line 21. Do not include any losses 24 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here. 25 26 Total rental real estate and royalty income or loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2. 26 - - - - - - e 23e 1 na.....AMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started