Answered step by step

Verified Expert Solution

Question

1 Approved Answer

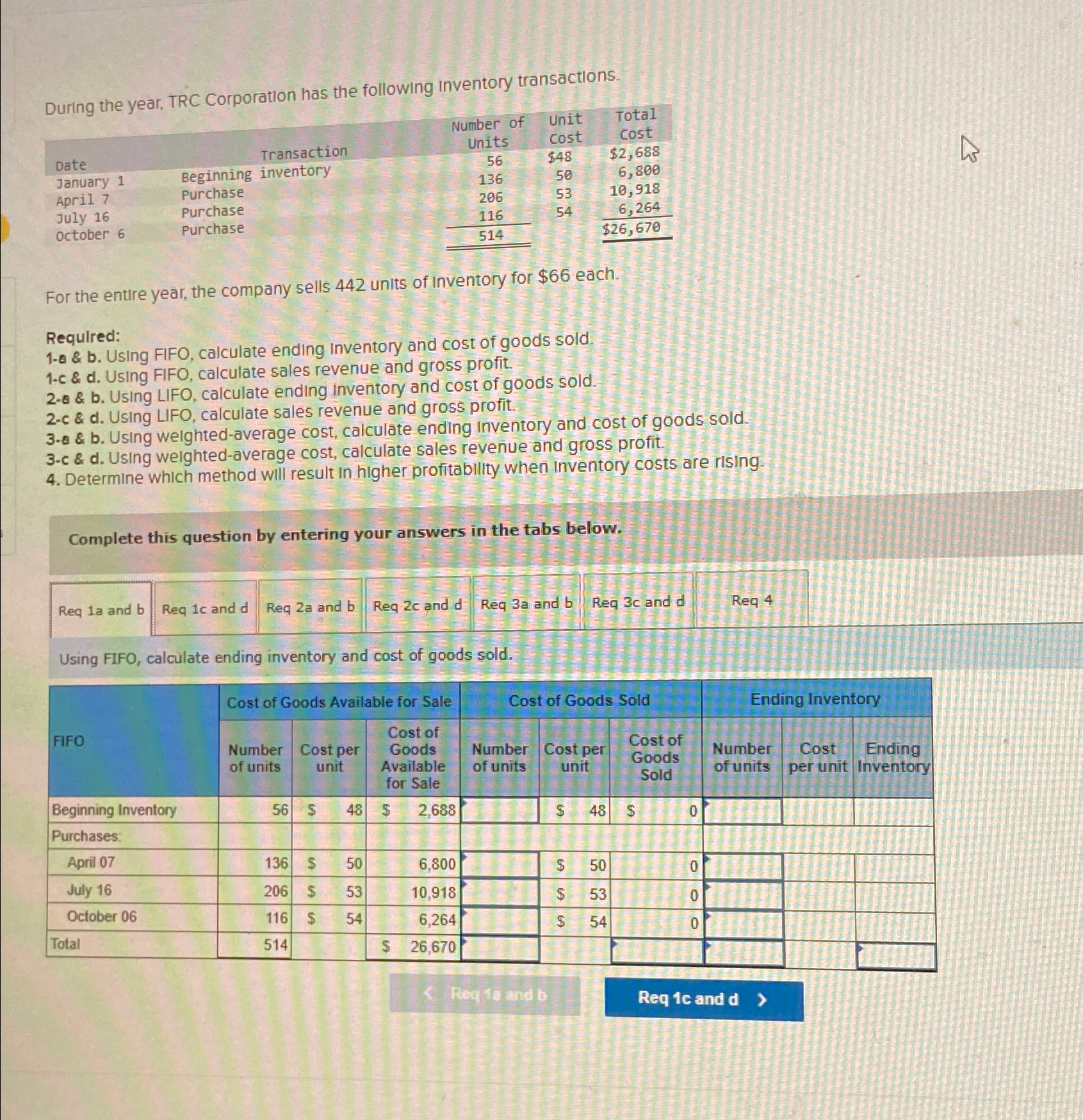

During the year, TRC Corporation has the following Inventory transactions. Date Transaction January 1 Beginning inventory April 7 Purchase July 16 Purchase October 6

During the year, TRC Corporation has the following Inventory transactions. Date Transaction January 1 Beginning inventory April 7 Purchase July 16 Purchase October 6 Purchase Number of Unit Total Units Cost Cost 56 $48 $2,688 136 50 206 53 6,800 10,918 116 54 6,264 514 $26,670 For the entire year, the company sells 442 units of Inventory for $66 each. Required: 1-a & b. Using FIFO, calculate ending Inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending Inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending Inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when Inventory costs are rising. Complete this question by entering your answers in the tabs below. Req 1a and b Req 3a and b Req 1c and d Req 2a and b Req 2c and d Req 3c and d Req 4 Using FIFO, calculate ending inventory and cost of goods sold. FIFO Beginning Inventory Ending Inventory Cost of Goods Available for Sale Cost of Goods Sold Number of units Cost per unit Cost of Goods Available for Sale Number of units Cost per unit Cost of Goods Sold Number of units 56 A 48 $ 2,688 $ 48 $ 0 Purchases: April 07 136 $ 50 6,800 July 16 206 $ 53 10,918 October 06 116 S 54 6,264 $ SSS $ 50 0 $ 53 O 0 54 0 Total 514 $ 26,670 13 Ending Cost per unit Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started