Answered step by step

Verified Expert Solution

Question

1 Approved Answer

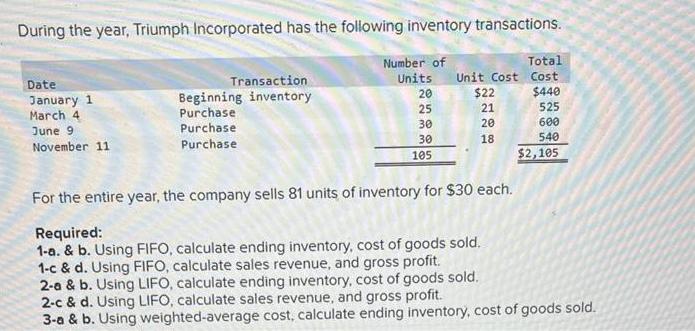

During the year, Triumph Incorporated has the following inventory transactions. Number of Date January 1 March 4 June 9 November 11 Transaction Beginning inventory

During the year, Triumph Incorporated has the following inventory transactions. Number of Date January 1 March 4 June 9 November 11 Transaction Beginning inventory Purchase Purchase Purchase Units Unit Cost 20 25 30 30 105 $22 21 20 18 For the entire year, the company sells 81 units of inventory for $30 each. Required: 1-a. & b. Using FIFO, calculate ending inventory, cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue, and gross profit. 2-a & b. Using LIFO, calculate ending inventory, cost of goods sold. Total Cost $440 525 600 540 $2,105 2-c & d. Using LIFO, calculate sales revenue, and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory, cost of goods sold.

Step by Step Solution

★★★★★

3.28 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ending inventory cost of goods sold COGS sales revenue and gross profit using FIFO LIFO and weightedaverage cost well go through each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started