Answered step by step

Verified Expert Solution

Question

1 Approved Answer

If a principal P is borrowed at an annual rater, then after t years if interest is compounded n times a year, the borrower

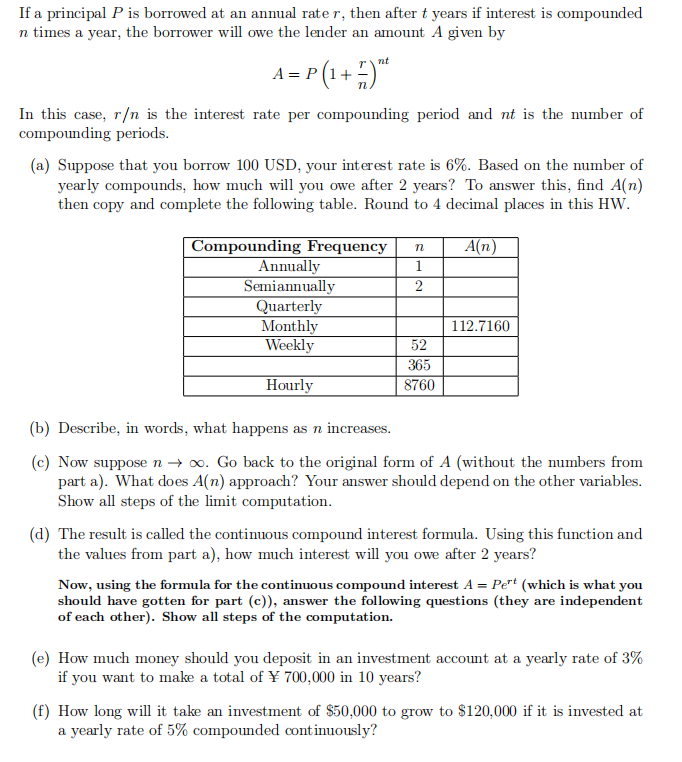

If a principal P is borrowed at an annual rater, then after t years if interest is compounded n times a year, the borrower will owe the lender an amount A given by nt A = P (1 + 7) In this case, r/n is the interest rate per compounding period and nt is the number of compounding periods. (a) Suppose that you borrow 100 USD, your interest rate is 6%. Based on the number of yearly compounds, how much will you owe after 2 years? To answer this, find A(n) then copy and complete the following table. Round to 4 decimal places in this HW. A(n) Compounding Frequency n 1 2 Annually Semiannually Quarterly Monthly Weekly Hourly 52 365 8760 112.7160 (b) Describe, in words, what happens as n increases. (c) Now suppose n o. Go back to the original form of A (without the numbers from part a). What does A(n) approach? Your answer should depend on the other variables. Show all steps of the limit computation. (d) The result is called the continuous compound interest formula. Using this function and the values from part a), how much interest will you owe after 2 years? Now, using the formula for the continuous compound interest A = Pert (which is what you should have gotten for part (c)), answer the following questions (they are independent of each other). Show all steps of the computation. (e) How much money should you deposit in an investment account at a yearly rate of 3% if you want to make a total of 700,000 in 10 years? (f) How long will it take an investment of $50,000 to grow to $120,000 if it is invested at a yearly rate of 5% compounded continuously?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Lets calculate the values for An for different compounding frequencies Given P 100 r 6 006 t 2 yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started