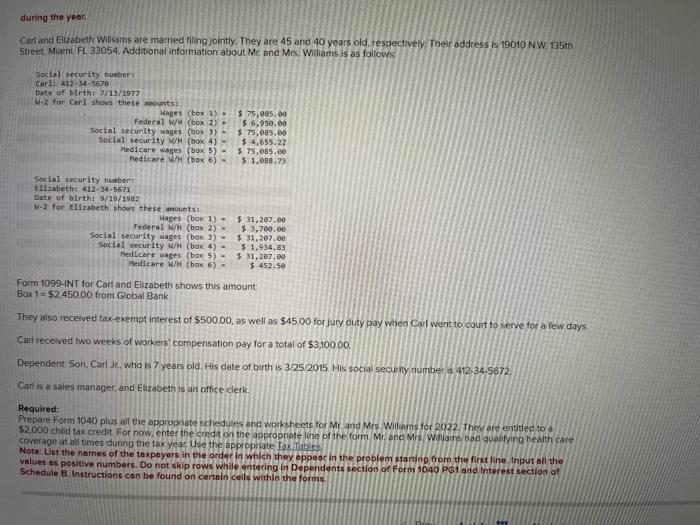

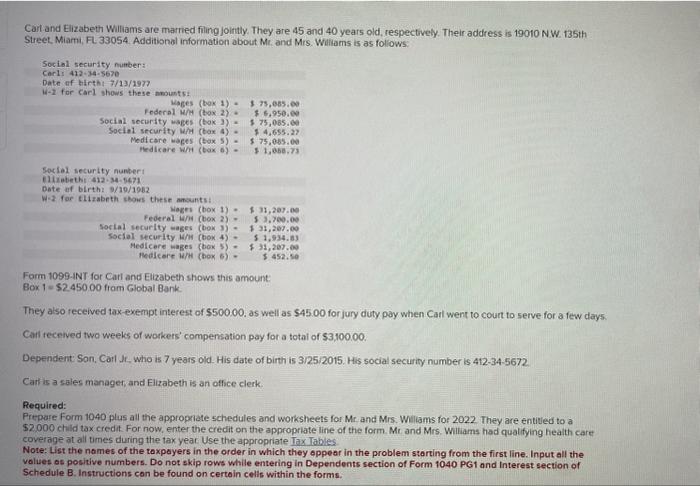

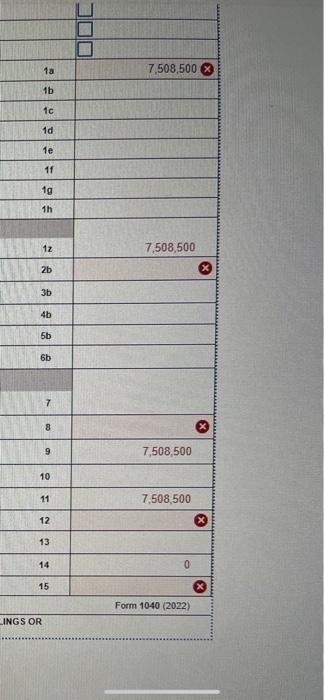

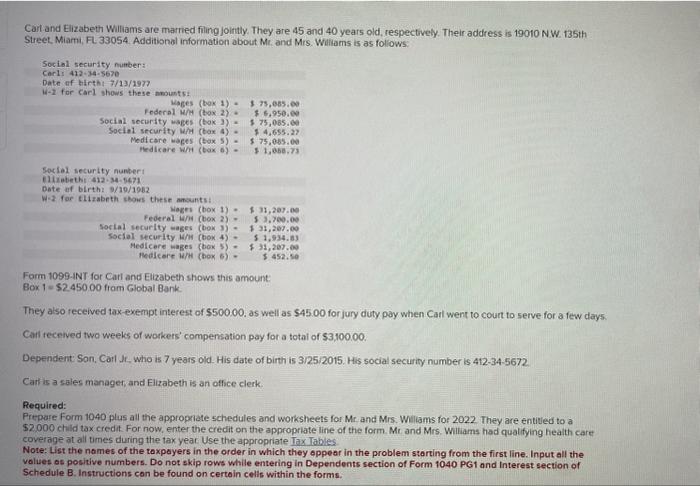

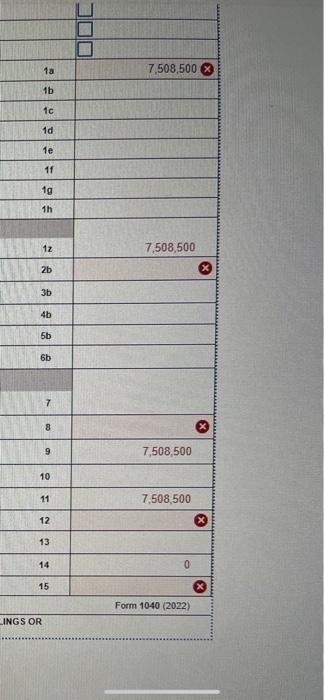

during the yeer. Carl and Elizabeth Wiliams are married fiing jointly. They are 45 and 40 years old, respectively. Their address is i9010 N.W. i35th Street. Miant, FL 33054 . Additional information about Mr and Mrs. Williams is as followis: soclel security namber: carli 412345670 Dotin of birtht 7/23/1977 W-2 for Corl shows these anounts? Sociel security nuaber: ilizabeth: 412-34-5671 Date of birthi 9/10/1982 M-2 fac Ellzabeth shows these arounts: Form 1099-1NT for Cart and Elizabeth shows this amount: Box 1=$2450.00 from Giobal Bank They aiso received tax-exempt interest of $500.00, as well as $45.00 for jury duty pay wheo Carl went to court to serve for a few days Cari tecelved two weeks of warkers compensation pay for a total of $3,100,00. Dependent: Son. Catil Je, who is 7 years old. His date of birth is 3/25/2015. His socla security number is 41234.5672. Cari is a sales manager, and Elizabeth is an office clerk. Required: Prepore Form 1040 plus ali the appropiate scheduses and worksheets for Mr and Mrs. Williams for 2022 . They are entited to a coverage at all times duning the tax yeaz Use the appropriate Tas. abiles. Note: Libt the names of the taxpayers in the arder in which they oppear in the problem startog from the first line. Input oll the values os positive numbers. Do not skip rows while entering in Dependents section of Form 1040 p. 1 and Interest section of Schedule B. Instructions con be found on certoin cells withli the forais. Carl and Elizabeth Willams are married filing jointly. They are 45 and 40 years old, respectively. Their address is 19010 N.W. 135 th Street. Miami, FL33054. Additional information about Mr. and Mrs. Wiliams is as foliows: Sociol secarity number: Carlis 412-34-5670 Date of birthi 7/13/197? W-i for carl shows these anbunts: Soc lal security nunberi E) liabethi 412 -34-5471. Dote af birthz. 8/10/1982 W-2 far tisabeth sbows these ancunts: Form 1099-INT for Carl and Elizabeth shows this amount: B01=$245000 fram Global Bank. They also received tax-exempt interest of $500.00. as well as $45.00 for jury duty pay when Canl went to court to 5 erve for a few days. Call tecerved two weeks of workers' compensation pay for a totai of 53,300.00. Dependent: Son, Carl If. who is 7 years old. His date of birth is 3/2512015. His social security number is 41234.5672. Caff is a sales managet, and Elizabeth is an office clerk. Required: Prepare Form 1040 plus all the appropriate schedules and worksheets for Mr. and Mrs: Wiliams for 2022 . They are entitied to a $2000 child tax credit. For now, enter the credit on the approprlate line of the form. Mr and Mrs. Wiliams had qualifying health care coverage at all times during the tax year Use the appropriate Tax Tables Note: List the names of the taxpayers in the order in which they appear in the problem starting from the first line. Input all the volues os positive numbers. Do not skip rows while entering in Dependents section of Form 1040 PGi and Interest section of Schedule B. Instructions con be found on certoin celis within the forms