Answered step by step

Verified Expert Solution

Question

1 Approved Answer

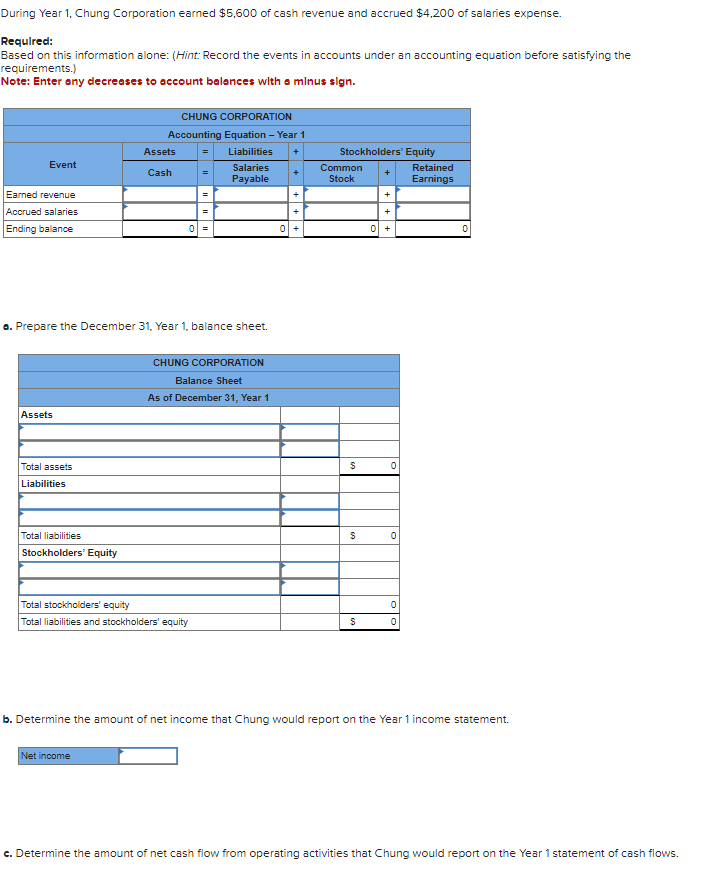

During Year 1, Chung Corporation earned $5,600 of cash revenue and accrued $4,200 of salaries expense. Required: Based on this information alone: (Hint: Record

During Year 1, Chung Corporation earned $5,600 of cash revenue and accrued $4,200 of salaries expense. Required: Based on this information alone: (Hint: Record the events in accounts under an accounting equation before satisfying the requirements.) Note: Enter any decreases to account balances with a minus sign. CHUNG CORPORATION Accounting Equation - Year 1 Assets Event Cash Earned revenue Accrued salaries Ending balance Liabilities + Salaries Payable 0 0+ ++ a. Prepare the December 31, Year 1, balance sheet. Assets CHUNG CORPORATION Balance Sheet As of December 31, Year 1 Total assets Liabilities Total liabilities Stockholders' Equity Stockholders' Equity Common Retained + Stock Earnings +++ + 0 $ 0 $ 0 Total stockholders' equity 0 Total liabilities and stockholders' equity $ 0 b. Determine the amount of net income that Chung would report on the Year 1 income statement. Net income c. Determine the amount of net cash flow from operating activities that Chung would report on the Year 1 statement of cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to record the events in the accounting equation and then use the infor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started