Question

On December 31, 2020, Russia Inc. has outstanding the following shares: 5,000, $ 3.20, no par value preferred shares with a carrying value of

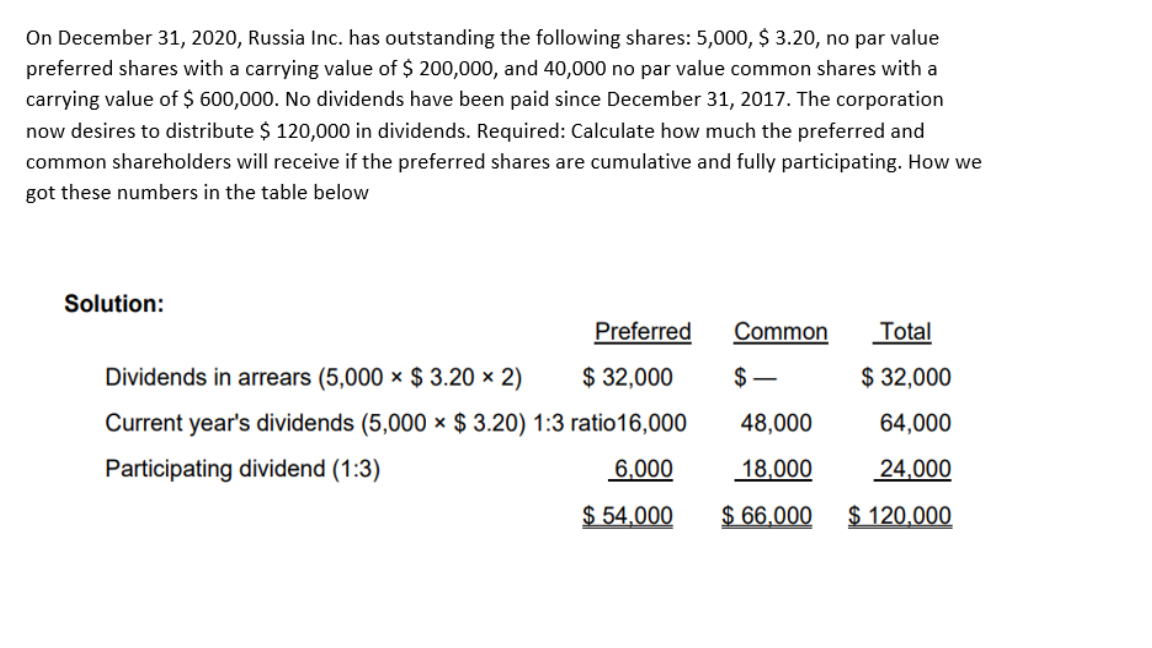

On December 31, 2020, Russia Inc. has outstanding the following shares: 5,000, $ 3.20, no par value preferred shares with a carrying value of $ 200,000, and 40,000 no par value common shares with a carrying value of $ 600,000. No dividends have been paid since December 31, 2017. The corporation now desires to distribute $ 120,000 in dividends. Required: Calculate how much the preferred and common shareholders will receive if the preferred shares are cumulative and fully participating. How we got these numbers in the table below Solution: Preferred Common Total Dividends in arrears (5,000 $ 3.20 2) $ 32,000 $ $ 32,000 Current year's dividends (5,000 $ 3.20) 1:3 ratio16,000 48,000 64,000 Participating dividend (1:3) 6,000 18,000 24,000 $ 54,000 $66,000 $ 120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield.

9th Canadian Edition, Volume 2

470964731, 978-0470964736, 978-0470161012

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App