Answered step by step

Verified Expert Solution

Question

1 Approved Answer

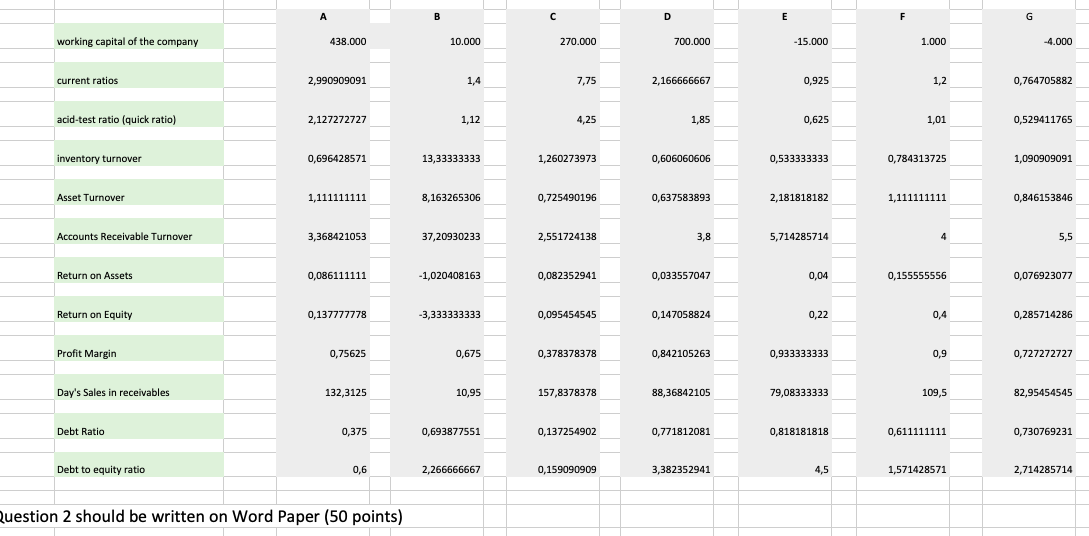

During your analyzes, you asked to interpret the company's situation and industry also. Just writing increases or decreases not enough. You need to write the

During your analyzes, you asked to interpret the company's situation and industry also. Just writing increases or decreases not enough. You need to write the possible reasons behind the increases/decreases.

D E F G working capital of the company 438.000 10.000 270.000 700.000 -15.000 1.000 -4.000 current ratios 2,990909091 1,4 7,75 2,166666667 0,925 1,2 0,764705882 acid-test ratio (quick ratio) 2,127272727 1,12 4,25 1,85 0,625 1,01 0,529411765 inventory turnover 0,696428571 13,33333333 1,260273973 0,606060606 0,533333333 0,784313725 1,090909091 Asset Turnover 1,111111111 8,163265306 0,725490196 0,637583893 2.181818182 1,111111111 0,846153846 Accounts Receivable Turnover 3,368421053 37,20930233 2,551724138 3,8 5,714285714 4 5,5 Return on Assets 0,086111111 -1,020408163 0,082352941 0,033557047 0,04 0,155555556 0,076923077 Return on Equity 0,137777778 -3,333333333 0,095454545 0,147058824 0,22 0.4 0,285714286 Profit Margin 0,75625 0,675 0,378378378 0,842105263 0,933333333 0,9 0,727272727 Day's Sales in receivables 132,3125 10,95 157,8378378 88,36842105 79,08333333 109,5 82,95454545 Debt Ratio 0,375 0,693877551 0,137254902 0,771812081 0,818181818 0,611111111 0,730769231 Debt to equity ratio 0,6 2,266666667 0,159090909 3,382352941 4,5 1,571428571 2,714285714 Question 2 should be written on Word Paper (50 points) D E F G working capital of the company 438.000 10.000 270.000 700.000 -15.000 1.000 -4.000 current ratios 2,990909091 1,4 7,75 2,166666667 0,925 1,2 0,764705882 acid-test ratio (quick ratio) 2,127272727 1,12 4,25 1,85 0,625 1,01 0,529411765 inventory turnover 0,696428571 13,33333333 1,260273973 0,606060606 0,533333333 0,784313725 1,090909091 Asset Turnover 1,111111111 8,163265306 0,725490196 0,637583893 2.181818182 1,111111111 0,846153846 Accounts Receivable Turnover 3,368421053 37,20930233 2,551724138 3,8 5,714285714 4 5,5 Return on Assets 0,086111111 -1,020408163 0,082352941 0,033557047 0,04 0,155555556 0,076923077 Return on Equity 0,137777778 -3,333333333 0,095454545 0,147058824 0,22 0.4 0,285714286 Profit Margin 0,75625 0,675 0,378378378 0,842105263 0,933333333 0,9 0,727272727 Day's Sales in receivables 132,3125 10,95 157,8378378 88,36842105 79,08333333 109,5 82,95454545 Debt Ratio 0,375 0,693877551 0,137254902 0,771812081 0,818181818 0,611111111 0,730769231 Debt to equity ratio 0,6 2,266666667 0,159090909 3,382352941 4,5 1,571428571 2,714285714 Question 2 should be written on Word Paper (50 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started