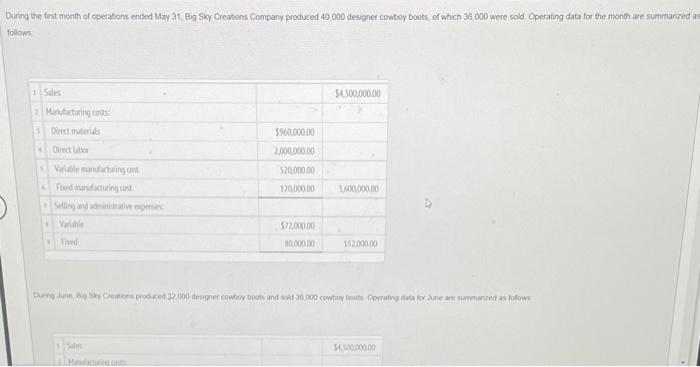

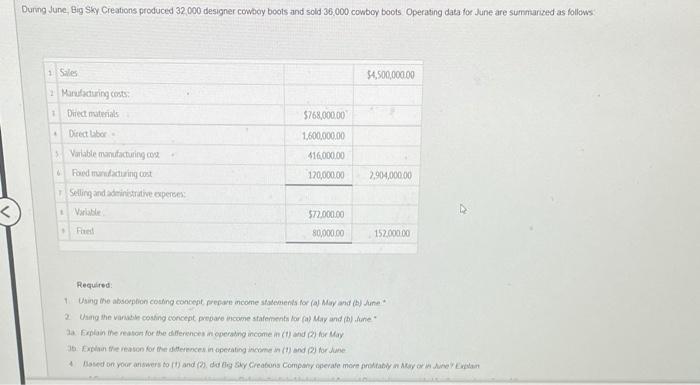

Durng the fast monith of operatons ended May 31, Big Sey Creations Company produced 40,000 designer conboy boots, of which 36, O00 were sold Operating data for the month are surnimarized 7 follown Durng June, Eig S6y Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots Operating data tor dune are suminiarized as follows Required: 1 Using the absorption cosing eoncept precwe income sfacenienta for (a) May and (b) June * 1a. Explain ite reatort for the diferences in operaing income in (I) and 2 f fir May Ta. Using the absorpton costeng concept, prepare income statements for Moy Be sure to complete the statement heading Refer to the fist of Labels and Amotint Descriptons frovided for bee exact wording of the answer choices for text entries. A colon () wil automaticaly oppear if it is requved Enter amounts as positive numbers unless the amount is a citcilation that resutts of a negative amount. For example: Net loss shoald be negative 11. Using the obsorption costing concept, prepare income statements for June. Be sure to complete the statemient he ading flefer to the ist of Labels and Amount Deeschptions provided for the exacd anout For example: Net foss should be nergative 2a Using the parable costang concept, prepare nocome statements for May Be sure to compiefe the stwement heading Reler to the Ast of Labels and Amount Descrighons provided for the exact amount: For erample Net loss should be negative sording of the answer choices for text entres. A colon () wil autiomatcolly oppear if it as requred. Enher amounts as positive numbers unless the amount is a calculation that rasufs ma segative amount. For example Net lass should be negative Durng the fast monith of operatons ended May 31, Big Sey Creations Company produced 40,000 designer conboy boots, of which 36, O00 were sold Operating data for the month are surnimarized 7 follown Durng June, Eig S6y Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots Operating data tor dune are suminiarized as follows Required: 1 Using the absorption cosing eoncept precwe income sfacenienta for (a) May and (b) June * 1a. Explain ite reatort for the diferences in operaing income in (I) and 2 f fir May Ta. Using the absorpton costeng concept, prepare income statements for Moy Be sure to complete the statement heading Refer to the fist of Labels and Amotint Descriptons frovided for bee exact wording of the answer choices for text entries. A colon () wil automaticaly oppear if it is requved Enter amounts as positive numbers unless the amount is a citcilation that resutts of a negative amount. For example: Net loss shoald be negative 11. Using the obsorption costing concept, prepare income statements for June. Be sure to complete the statemient he ading flefer to the ist of Labels and Amount Deeschptions provided for the exacd anout For example: Net foss should be nergative 2a Using the parable costang concept, prepare nocome statements for May Be sure to compiefe the stwement heading Reler to the Ast of Labels and Amount Descrighons provided for the exact amount: For erample Net loss should be negative sording of the answer choices for text entres. A colon () wil autiomatcolly oppear if it as requred. Enher amounts as positive numbers unless the amount is a calculation that rasufs ma segative amount. For example Net lass should be negative