Question

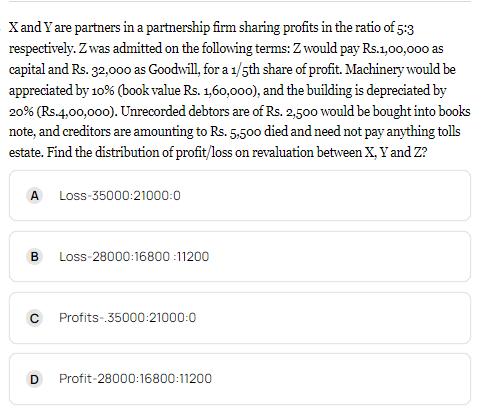

X and Y are partners in a partnership firm sharing profits in the ratio of 5:3 respectively. Z was admitted on the following terms:

X and Y are partners in a partnership firm sharing profits in the ratio of 5:3 respectively. Z was admitted on the following terms: Z would pay Rs.1,00,000 as capital and Rs. 32,000 as Goodwill, for a 1/5th share of profit. Machinery would be appreciated by 10% (book value Rs. 1,60,000), and the building is depreciated by 20% (Rs.4,00,000). Unrecorded debtors are of Rs. 2,500 would be bought into books note, and creditors are amounting to Rs. 5,500 died and need not pay anything tolls estate. Find the distribution of profit/loss on revaluation between X, Y and Z? A Loss-35000:21000:0 B Loss-28000:16800:11200 C Profits-.35000:21000:0 D Profit-28000:16800:11200

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

D Profit280001680011200 The distribution of profitloss on revaluation between X Y and Z is D Profit2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

7th Canadian Edition Volume 2

1119048478, 978-1119048473

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App