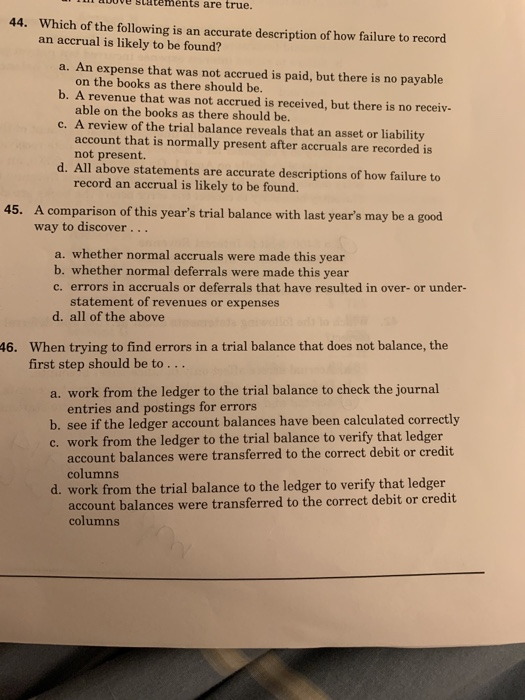

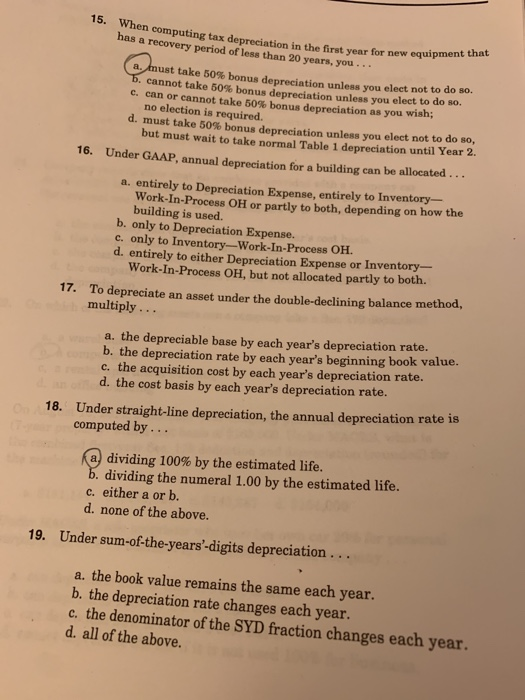

DUVU blatements are true. 44. Which of the following is an accurate description of how failure to record an accrual is likely to be found? a. An expense that was not accrued is paid, but there is no payable on the books as there should be. b. A revenue that was not accrued is received, but there is no receive able on the books as there should be. c. A review of the trial balance reveals that an asset or liability account that is normally present after accruals are recorded is not present. d. All above statements are accurate descriptions of how failure to record an accrual is likely to be found. 45. A comparison of this year's trial balance with last year's may be a good way to discover ... a. whether normal accruals were made this year b. whether normal deferrals were made this year c. errors in accruals or deferrals that have resulted in over- or under- statement of revenues or expenses d. all of the above 46. When trying to find errors in a trial balance that does not balance, the first step should be to... a. work from the ledger to the trial balance to check the journal entries and postings for errors b. see if the ledger account balances have been calculated correctly c. work from the ledger to the trial balance to verify that ledger account balances were transferred to the correct debit or credit columns d. work from the trial balance to the ledger to verify that ledger account balances were transferred to the correct debit or credit columns When computing tax depreciation in the first year for new equip has a recovery period of less than 20 years, you .. he first year for new equipment that a must take 50% bonus depreciation unless you elect not to do so. b. cannot take 50% bonus depreciation unless you elect to do c. can or cannot take 50% bonus depreciation as you wish; no election is required. d. must take 50% bonus depreciation unless you elect not to do so, but must wait to take normal Table 1 depreciation until Year 2 16. Under GAAP, annual depreciation for a building can be allocated ... a. entirely to Depreciation Expense, entirely to Inventory- Work-In-Process OH or partly to both, depending on how the building is used. b. only to Depreciation Expense. c. only to Inventory-Work-In-Process OH. d. entirely to either Depreciation Expense or Inventory- Work-In-Process OH, but not allocated partly to both. To depreciate an asset under the double-declining balance method, multiply.. 17. a. the depreciable base by each year's depreciation rate. b. the depreciation rate by each year's beginning book value. c. the acquisition cost by each year's depreciation rate. d. the cost basis by each year's depreciation rate. 18. Under straight-line depreciation, the annual depreciation rate is computed by... Ka, dividing 100% by the estimated life. b. dividing the numeral 1.00 by the estimated life. c. either a or b. d. none of the above. 19. Under sum-of-the-years'-digits depreciation ... a. the book value remains the same each year. b. the depreciation rate changes each year. c. the denominator of the SYD fraction changes each year. d. all of the above