Question

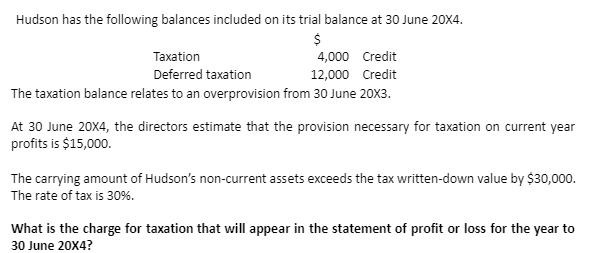

Hudson has the following balances included on its trial balance at 30 June 20X4. $ 4,000 Credit 12,000 Credit Taxation Deferred taxation The taxation

Hudson has the following balances included on its trial balance at 30 June 20X4. $ 4,000 Credit 12,000 Credit Taxation Deferred taxation The taxation balance relates to an overprovision from 30 June 20X3. At 30 June 20X4, the directors estimate that the provision necessary for taxation on current year profits is $15,000. The carrying amount of Hudson's non-current assets exceeds the tax written-down value by $30,000. The rate of tax is 30%. What is the charge for taxation that will appear in the statement of profit or loss for the year to 30 June 20X4?

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The current years provision for Tax is 15000 Less Provision a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Chemistry

Authors: Raymond Chang

10th edition

77274318, 978-0077274313

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App