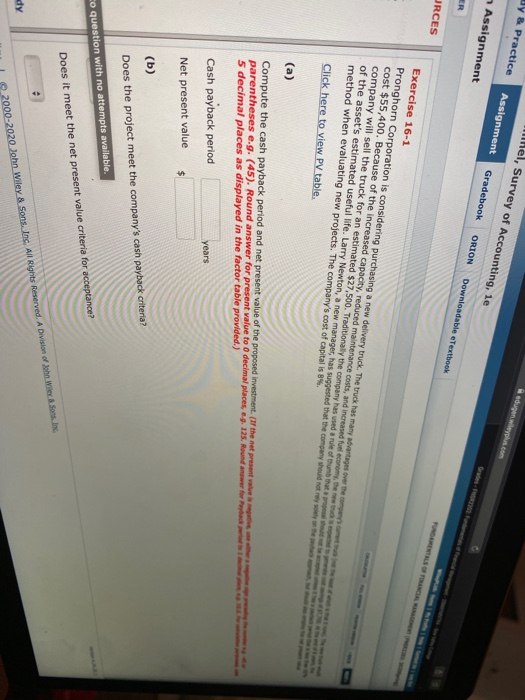

Dy & Practice Mhel, Survey of Accounting, le dueltyplus.com Assignment Assignment Gradebook ORION Downloadable eTextbook JRCES Exercise 16-1 Pronghorn Corporation is considering purchasing a new delivery truck. The truck has many advantages over the man cost $55,400. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, tenemos company will sell the truck for an estimated $27,500. Traditionally the company has used a rule of the of the asset's estimated useful life. Larry Newton, a new manager, has suggested that the company should not rely by method when evaluating new projects. The company's cost of capital is 8%. Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment (of the net presenta parentheses e.g. (45). Round answer for present value to o decimal places, e.g. 125. Round answer for Pack 5 decimal places as displayed in the factor table provided.) Cash payback period years Net present value $ (b) Does the project meet the company's cash payback criteria? co question with no attempts available. Does it meet the net present value criteria for acceptance? dy 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley Sons, Inc Dy & Practice Mhel, Survey of Accounting, le dueltyplus.com Assignment Assignment Gradebook ORION Downloadable eTextbook JRCES Exercise 16-1 Pronghorn Corporation is considering purchasing a new delivery truck. The truck has many advantages over the man cost $55,400. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, tenemos company will sell the truck for an estimated $27,500. Traditionally the company has used a rule of the of the asset's estimated useful life. Larry Newton, a new manager, has suggested that the company should not rely by method when evaluating new projects. The company's cost of capital is 8%. Click here to view PV table. (a) Compute the cash payback period and net present value of the proposed investment (of the net presenta parentheses e.g. (45). Round answer for present value to o decimal places, e.g. 125. Round answer for Pack 5 decimal places as displayed in the factor table provided.) Cash payback period years Net present value $ (b) Does the project meet the company's cash payback criteria? co question with no attempts available. Does it meet the net present value criteria for acceptance? dy 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley Sons, Inc