Answered step by step

Verified Expert Solution

Question

1 Approved Answer

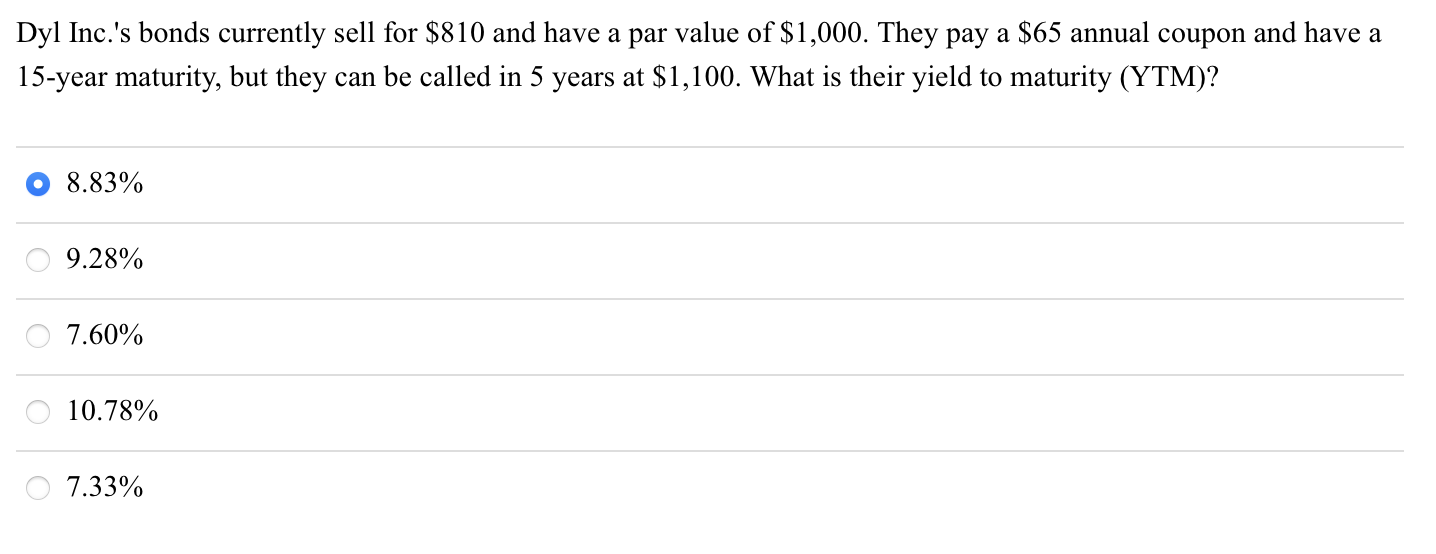

Dyl Inc.'s bonds currently sell for $810 and have a par value of $1,000. They pay a $65 annual coupon and have a 15 -year

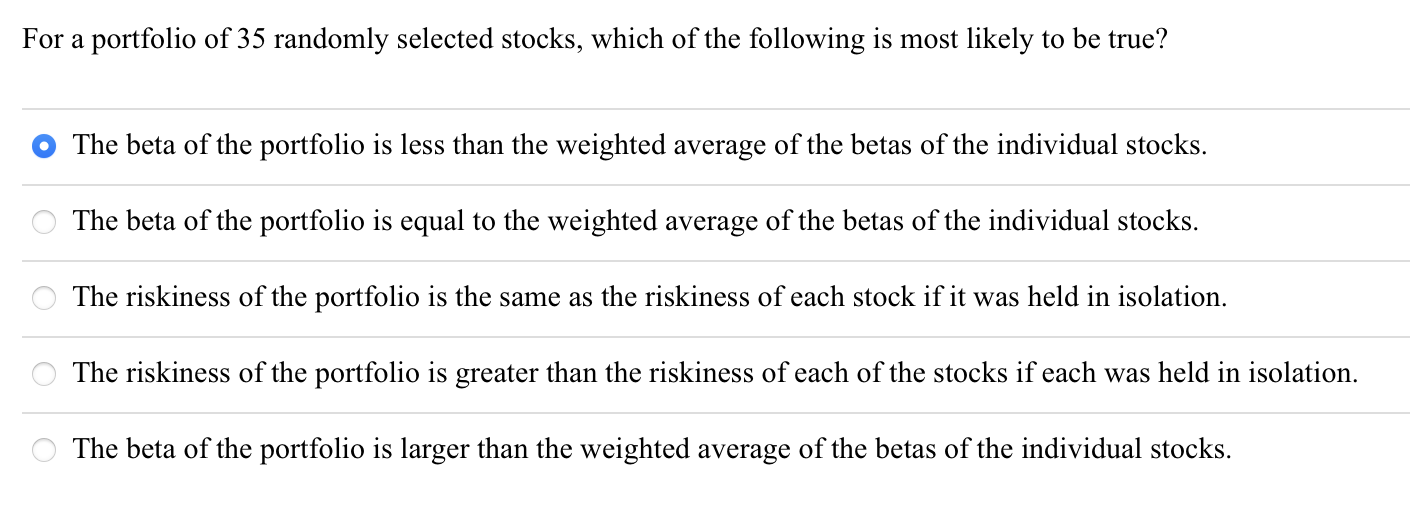

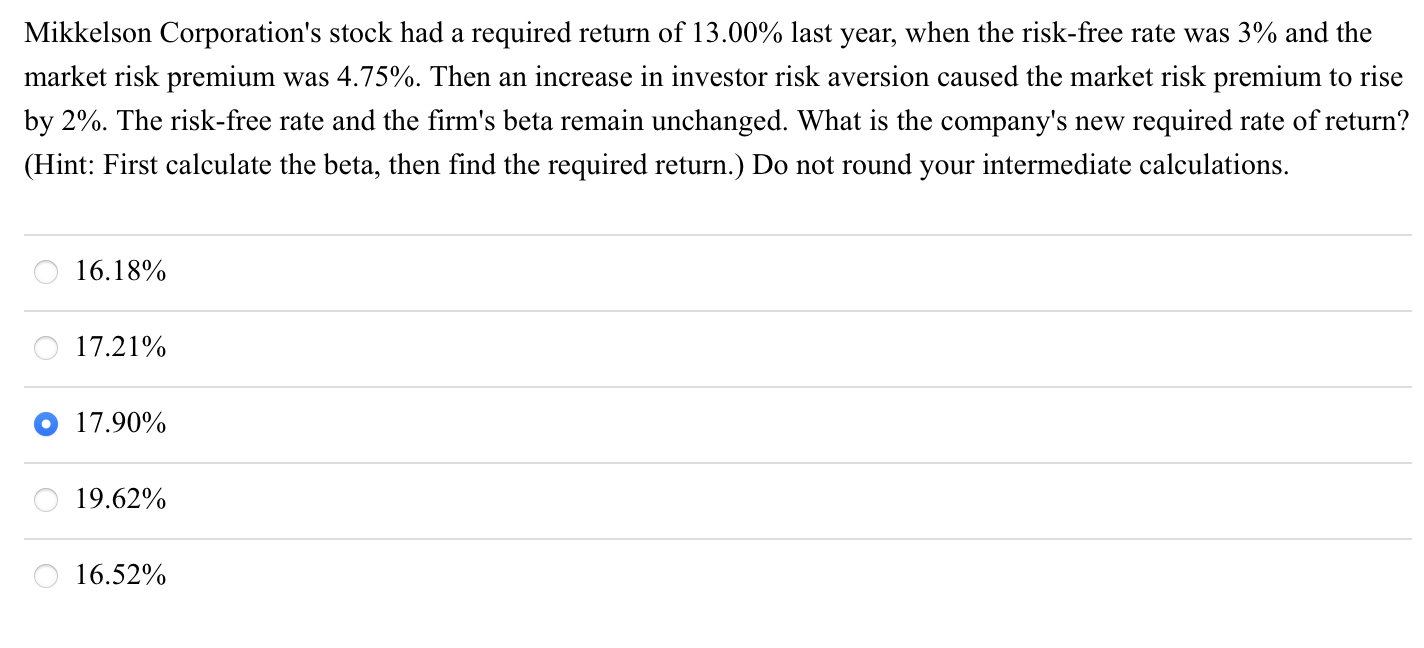

Dyl Inc.'s bonds currently sell for $810 and have a par value of $1,000. They pay a $65 annual coupon and have a 15 -year maturity, but they can be called in 5 years at $1,100. What is their yield to maturity (YTM)? 8.83% 9.28% 7.60% 10.78% 7.33% or a portfolio of 35 randomly selected stocks, which of the following is most likely to be true? The beta of the portfolio is less than the weighted average of the betas of the individual stocks. The beta of the portfolio is equal to the weighted average of the betas of the individual stocks. The riskiness of the portfolio is the same as the riskiness of each stock if it was held in isolation. The riskiness of the portfolio is greater than the riskiness of each of the stocks if each was held i Mikkelson Corporation's stock had a required return of 13.00% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, then find the required return.) Do not round your intermediate calculations. 16.18% 17.21% 17.90% 19.62% 16.52%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started