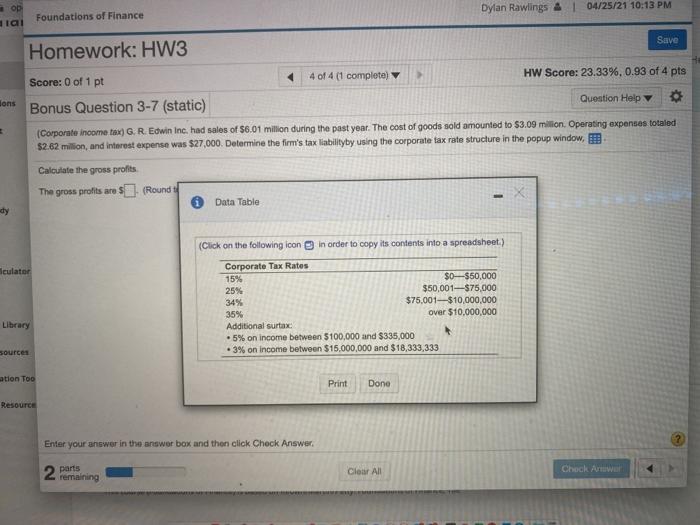

Dylan Rawlings 4 1 04/25/21 10:13 PM Foundations of Finance iai Save Homework: HW3 lons Score: 0 of 1 pt 4 of 4 (1 complete HW Score: 23.33%, 0.93 of 4 pts Bonus Question 3-7 (static) Question Help (Corporate income tax) . R. Edwin Inc. had sales of $6.01 million during the past year. The cost of goods sold amounted to $3.09 million Operating expenses totaled $2.62 million, and interest expense was $27,000. Determine the firm's tax liability by using the corporate tax rate structure in the popup window, Calculate the gross profits The gross profits are $(Round / Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Sculator Corporate Tax Rates 15% $0-$50,000 25% $50,001-$75,000 34% $75.001-$10,000,000 35% over $10,000,000 Additional surtax 5% on income between $100,000 and $335.000 3% on income between $15,000,000 and $18,333,333 Library sources ation Too Print Done Resource Enter your answer in the answer box and then click Chock Answer 2 parts Clear All Chock Arwe remaining Dylan Rawlings 4 1 04/25/21 10:13 PM Foundations of Finance iai Save Homework: HW3 lons Score: 0 of 1 pt 4 of 4 (1 complete HW Score: 23.33%, 0.93 of 4 pts Bonus Question 3-7 (static) Question Help (Corporate income tax) . R. Edwin Inc. had sales of $6.01 million during the past year. The cost of goods sold amounted to $3.09 million Operating expenses totaled $2.62 million, and interest expense was $27,000. Determine the firm's tax liability by using the corporate tax rate structure in the popup window, Calculate the gross profits The gross profits are $(Round / Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Sculator Corporate Tax Rates 15% $0-$50,000 25% $50,001-$75,000 34% $75.001-$10,000,000 35% over $10,000,000 Additional surtax 5% on income between $100,000 and $335.000 3% on income between $15,000,000 and $18,333,333 Library sources ation Too Print Done Resource Enter your answer in the answer box and then click Chock Answer 2 parts Clear All Chock Arwe remaining